Common questions we receive from Exchangers include, “Is it possible to 1031 Exchange into a REIT”, “Do QIs facilitate a 721 Exchange?”, and “What is the process if I ultimately want to reinvest my 1031 exchange funds into a REIT?”

This educational video breaks down the steps involved when an Exchanger’s end goal is to invest their 1031 exchange funds into a REIT. Steps include utilizing a Delaware Statutory Trust (DST) as Replacement Property in a 1031 Exchange, a holding period of the DST interest, then using a 721 UPREIT to swap the interest in the DST for Operating Partnership (OP) units in a REIT.

Watch this video below to better understand the process, as well as this this article,

Author: meredithb@accruit.com

-

Video: Can You 1031 Into a REIT?

-

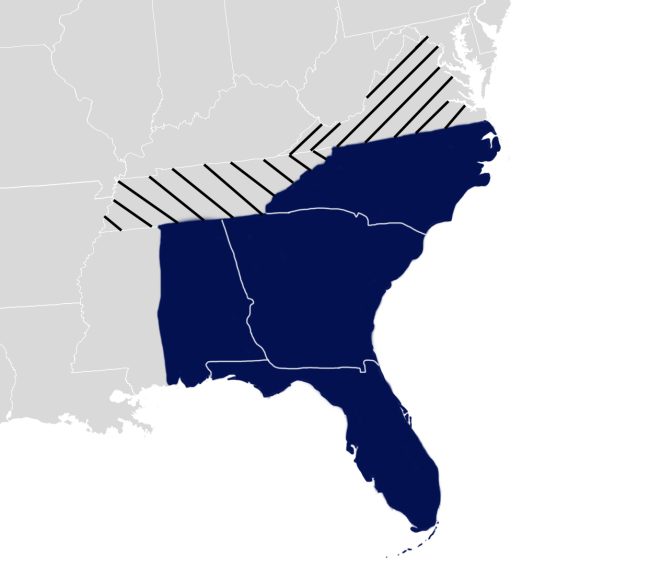

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

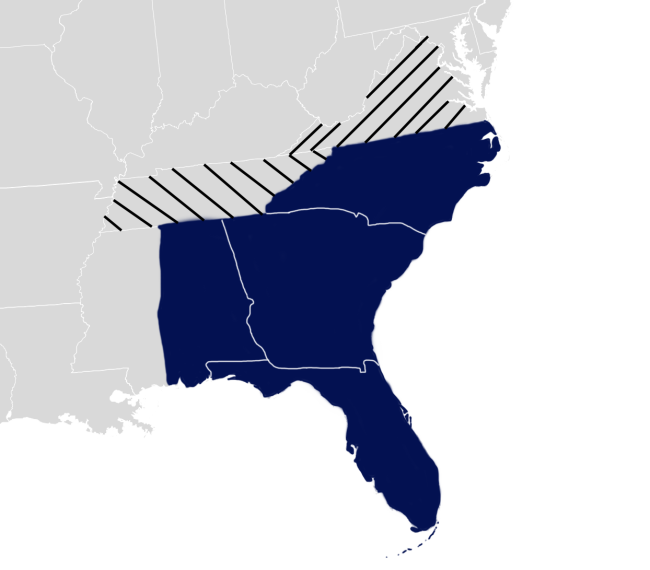

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

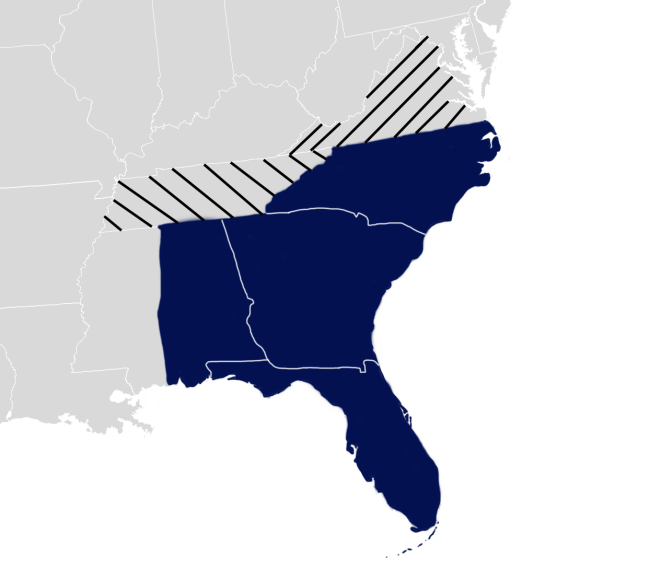

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Accruit, National 1031 Exchange Qualified Intermediary, Team Members Achieve Prestigious CES® Certification

Accruit is proud to announce that two of our esteemed team members, Maritza Castillo and Dina Bardakh, have successfully earned their Certified Exchange Specialist® (CES®) designations. This significant achievement underscores their expertise and dedication to the field of 1031 exchanges.

To receive the CES® designation, Maritza and Dina had to meet specific work experience criteria and pass a rigorous exam covering 1031 exchange rules, critical activities of an exchange facilitator, and ethical issues that may arise during a 1031 exchange. Their success in attaining this certification demonstrates their high level of knowledge and competency, reinforcing their ability to provide exceptional service to our clients.

The CES® Certification Council within the Federation of Exchange Accommodators (FEA) administers the CES® exam, which was first conducted in May 2003. Since then, the CES® designation has become a mark of excellence within the industry, signifying that the holder possesses extensive knowledge and experience in 1031 exchanges.

“We are thrilled to celebrate Maritza’s and Dina’s accomplishment and proud to have them as part of the Accruit team,” said Brent Abrahm, President and CEO of Accruit. “Their dedication to professional development and excellence reflects our company’s commitment to providing the highest quality service to our clients.”

Maritza and Dina join a distinguished group of professionals who have earned the CES® designation, showcasing their commitment to upholding the highest standards in the industry. Accruit is proud to now boast eight total CES® on staff, in addition to the rest of highly qualified team.

About Accruit

Accruit, an Inspira Financial Solution, is a leading full service Qualified Intermediary and developer of the industry’s only patented 1031 Exchange technology. Founded in 2000 and acquired by Inspira Financial in 2023, Accruit has gained the trust of thousands of clients and become a leader in the industry through its highly credentialed experts, consistent delivery of service, innovative technologies, robust security protocols and financial strength. -

Accruit, National 1031 Exchange Qualified Intermediary, Team Members Achieve Prestigious CES® Certification

Accruit is proud to announce that two of our esteemed team members, Maritza Castillo and Dina Bardakh, have successfully earned their Certified Exchange Specialist® (CES®) designations. This significant achievement underscores their expertise and dedication to the field of 1031 exchanges.

To receive the CES® designation, Maritza and Dina had to meet specific work experience criteria and pass a rigorous exam covering 1031 exchange rules, critical activities of an exchange facilitator, and ethical issues that may arise during a 1031 exchange. Their success in attaining this certification demonstrates their high level of knowledge and competency, reinforcing their ability to provide exceptional service to our clients.

The CES® Certification Council within the Federation of Exchange Accommodators (FEA) administers the CES® exam, which was first conducted in May 2003. Since then, the CES® designation has become a mark of excellence within the industry, signifying that the holder possesses extensive knowledge and experience in 1031 exchanges.

“We are thrilled to celebrate Maritza’s and Dina’s accomplishment and proud to have them as part of the Accruit team,” said Brent Abrahm, President and CEO of Accruit. “Their dedication to professional development and excellence reflects our company’s commitment to providing the highest quality service to our clients.”

Maritza and Dina join a distinguished group of professionals who have earned the CES® designation, showcasing their commitment to upholding the highest standards in the industry. Accruit is proud to now boast eight total CES® on staff, in addition to the rest of highly qualified team.

About Accruit

Accruit, an Inspira Financial Solution, is a leading full service Qualified Intermediary and developer of the industry’s only patented 1031 Exchange technology. Founded in 2000 and acquired by Inspira Financial in 2023, Accruit has gained the trust of thousands of clients and become a leader in the industry through its highly credentialed experts, consistent delivery of service, innovative technologies, robust security protocols and financial strength. -

Accruit, National 1031 Exchange Qualified Intermediary, Team Members Achieve Prestigious CES® Certification

Accruit is proud to announce that two of our esteemed team members, Maritza Castillo and Dina Bardakh, have successfully earned their Certified Exchange Specialist® (CES®) designations. This significant achievement underscores their expertise and dedication to the field of 1031 exchanges.

To receive the CES® designation, Maritza and Dina had to meet specific work experience criteria and pass a rigorous exam covering 1031 exchange rules, critical activities of an exchange facilitator, and ethical issues that may arise during a 1031 exchange. Their success in attaining this certification demonstrates their high level of knowledge and competency, reinforcing their ability to provide exceptional service to our clients.

The CES® Certification Council within the Federation of Exchange Accommodators (FEA) administers the CES® exam, which was first conducted in May 2003. Since then, the CES® designation has become a mark of excellence within the industry, signifying that the holder possesses extensive knowledge and experience in 1031 exchanges.

“We are thrilled to celebrate Maritza’s and Dina’s accomplishment and proud to have them as part of the Accruit team,” said Brent Abrahm, President and CEO of Accruit. “Their dedication to professional development and excellence reflects our company’s commitment to providing the highest quality service to our clients.”

Maritza and Dina join a distinguished group of professionals who have earned the CES® designation, showcasing their commitment to upholding the highest standards in the industry. Accruit is proud to now boast eight total CES® on staff, in addition to the rest of highly qualified team.

About Accruit

Accruit, an Inspira Financial Solution, is a leading full service Qualified Intermediary and developer of the industry’s only patented 1031 Exchange technology. Founded in 2000 and acquired by Inspira Financial in 2023, Accruit has gained the trust of thousands of clients and become a leader in the industry through its highly credentialed experts, consistent delivery of service, innovative technologies, robust security protocols and financial strength. -

Commercial Real Estate Transactions and 1031 Exchanges in California

Current Landscape of Commercial Real Estate Transactions in California

In recent years, California has seen a significant rise in commercial real estate transactions, driven by a diversified economy. In 2023, commercial real estate transactions in California totaled over $60 billion, a 15% increase from the previous year. Multifamily and industrial properties have led the market, with multifamily properties comprising approximately 40% of all transactions. This can be attributed to persistent housing shortages in the face of high demand, particularly in urban areas. A large factor contributing to the success of these properties is the pandemic and the subsequent post-pandemic recovery period, which heightened the need for stable and affordable housing. The multifamily sector continues to remain strong due to California’s ongoing housing crisis, where demand is outpacing supply. With the state’s population growth and urbanization trends, these properties offer promising returns and long-term value appreciation. The pandemic and post-pandemic market trends have also shown a skyrocketing growth in e-commerce, which has resulted in an immense need for distribution and fulfillment centers. As businesses adapted to these changes, investors recognized the potential of industrial properties, such as warehouses and distribution centers, which have become increasingly vital in the supply chain. As the market evolves, understanding these dynamics will be crucial for making informed investment decisions that maximize returns in California’s competitive real estate environment.

Statistical Trends Favoring 1031 Exchanges

With high property values and significant transaction volumes, the potential for 1031 Exchanges in California is immense. The state is notorious for commanding some of the highest real estate prices in the country, with the average sales price for commercial properties in California hovering at approximately $1.5 million, with urban centers like San Francisco and Los Angeles often seeing even higher prices. For example, in San Francisco, commercial properties can easily surpass the $2 million mark, driven by the city’s tech boom and limited space for expansion. Similarly, in Los Angeles, prime commercial properties in sectors such as entertainment and media are securing premium prices due to their central locations and increasing demand.

As California’s economy continues to diversify, the demand for commercial real estate is expected to grow even further. Emerging sectors like technology, biotech, and renewable energy are driving new real estate development and acquisitions. The tech sector alone is projected to add over 200,000 jobs in the state by 2025, a surge that will undoubtedly drive greater demand for office space, research facilities, and other commercial properties. Additionally, the push for sustainability and renewable energy is driving the need for industrial spaces and manufacturing facilities. As these industries grow, investors can use 1031 Exchanges to transition their assets into high-growth sectors, staying ahead of market trends while deferring taxes and maximizing returns.

Tax Liabilities Specific to California

Utilizing a 1031 Exchange can help mitigate significant tax liabilities that an investor would face in the high-cost market of California. But while considering a 1031 Exchange, it is important to understand exactly what tax liabilities Californian transactions could be subject to, as well as recognizing the regulating bodies in charge.

California Franchise Tax Board (FTB)

The California Franchise Tax Board (FTB) is the taxing authority for the State of California that collects corporate and state income taxes. The FTB plays a key role in administering taxes related to commercial properties, including capital gains taxes on real estate sales. For 1031 Exchanges, the FTB follows federal guidelines allowing property owners to defer capital gains taxes when they reinvest proceeds into like-kind properties. However, state-specific rules may apply, such as the need to report exchanges and potentially pay deferred taxes if the Replacement Property(ies) is outside California. Compliance with both federal and state tax laws is crucial for commercial property investors using 1031 Exchanges.

Deferral of State Taxes:

While federal tax law allows for the deferral of capital gains taxes, California has its own tax implications. Investors must understand that while the federal government allows deferral, the California Franchise Tax Board (FTB) imposes additional state taxes on the gains when the property is sold and not replaced with another California property. The capital gains from the sale of the Relinquished Property will be subject to California’s state income tax rates, which can be as high as 13.3%, depending on the Seller’s income bracket. High earners, especially those selling investment properties, are subject to the upper end of this tax rate. California treats capital gains as regular income, so any gain from the sale of the Relinquished Property will be taxed according to the individual’s income tax bracket. For high-income individuals, California imposes an additional 1% surtax on income exceeding $1 million. This tax is known as the “Mental Health Services Act” tax and applies to capital gains from the sale of property if the Seller’s total income surpasses $1 million. Lastly, there is withholding tax on sales by nonresidents. If the property Seller is a nonresident of California, the FTB generally requires withholding 3.33% of the total sale price, or the Seller can choose to have the withholding based on the gain from the sale instead.

California Clawback Rule:

The California Clawback Rule refers to the state’s requirement that taxes deferred under a 1031 Exchange must eventually be paid on any gains that originated from a California property, even if the property has been exchanged for one located in another state. This rule is where the state of California “claws back” any deferred taxes once the Exchanger cashes out. Key points about this rule include:

Gain from California Property: If California property is exchanged for out-of-state property, any gain realized from the California property remains subject to California state taxes. The state tracks the deferred capital gains on the California property.

Filing a California Tax Return: California law requires that investors continue to file a California tax return each year, reporting the deferred gain on the Californian Relinquished Property, even if the Replacement Property(ies) is in another state.

Tax Due Upon “Cashing Out”: If the investor eventually sells the out-of-state Replacement Property(ies) and “cashes out” (does not do another 1031 Exchange), they will owe California taxes on the deferred gains from the original California Relinquished Property, in addition to any taxes due in the state where the Replacement Property(ies) is sold.

Continuous Deferral: If the investor continues to do 1031 Exchanges, they can keep deferring both federal capital gains taxes and California state taxes, but the deferred gain from the California Relinquished Property will still be tracked by California.

Choosing the Right Qualified Intermediary

To successfully complete a 1031 Exchange, it’s critical to use a knowledgeable and experienced national Qualified Intermediary (QI). Given California’s specific tax rules, including the state’s “Clawback Rule” and the importance of properly adhering to the like-kind property requirements, using a QI that understands the complexities and nuances of California’s real estate and tax landscape is essential. Failing to work with an experienced, accredited QI can lead to significant financial risks, including the loss of your tax deferral benefits. As one of the nation’s leading providers of 1031 Exchange services, our experienced Accruit team and seamless processes is what investors need to ensure compliance with federal and state tax regulations.

California’s growing commercial real estate market, paired with the potential of 1031 Exchanges, presents a significant opportunity for investors seeking to expand their portfolios while achieving tax deferral. By staying informed about the state’s tax implications, market trends, and the nuances of 1031 Exchanges, investors can better navigate the challenges and opportunities that California offers. Whether you’re investing in multifamily housing, industrial properties, or exploring emerging sectors, utilizing a 1031 Exchange and an experienced QI, such as Accruit, could be essential in optimizing your investment strategy and achieving long-term success in this dynamic commercial market.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Commercial Real Estate Transactions and 1031 Exchanges in California

Current Landscape of Commercial Real Estate Transactions in California

In recent years, California has seen a significant rise in commercial real estate transactions, driven by a diversified economy. In 2023, commercial real estate transactions in California totaled over $60 billion, a 15% increase from the previous year. Multifamily and industrial properties have led the market, with multifamily properties comprising approximately 40% of all transactions. This can be attributed to persistent housing shortages in the face of high demand, particularly in urban areas. A large factor contributing to the success of these properties is the pandemic and the subsequent post-pandemic recovery period, which heightened the need for stable and affordable housing. The multifamily sector continues to remain strong due to California’s ongoing housing crisis, where demand is outpacing supply. With the state’s population growth and urbanization trends, these properties offer promising returns and long-term value appreciation. The pandemic and post-pandemic market trends have also shown a skyrocketing growth in e-commerce, which has resulted in an immense need for distribution and fulfillment centers. As businesses adapted to these changes, investors recognized the potential of industrial properties, such as warehouses and distribution centers, which have become increasingly vital in the supply chain. As the market evolves, understanding these dynamics will be crucial for making informed investment decisions that maximize returns in California’s competitive real estate environment.

Statistical Trends Favoring 1031 Exchanges

With high property values and significant transaction volumes, the potential for 1031 Exchanges in California is immense. The state is notorious for commanding some of the highest real estate prices in the country, with the average sales price for commercial properties in California hovering at approximately $1.5 million, with urban centers like San Francisco and Los Angeles often seeing even higher prices. For example, in San Francisco, commercial properties can easily surpass the $2 million mark, driven by the city’s tech boom and limited space for expansion. Similarly, in Los Angeles, prime commercial properties in sectors such as entertainment and media are securing premium prices due to their central locations and increasing demand.

As California’s economy continues to diversify, the demand for commercial real estate is expected to grow even further. Emerging sectors like technology, biotech, and renewable energy are driving new real estate development and acquisitions. The tech sector alone is projected to add over 200,000 jobs in the state by 2025, a surge that will undoubtedly drive greater demand for office space, research facilities, and other commercial properties. Additionally, the push for sustainability and renewable energy is driving the need for industrial spaces and manufacturing facilities. As these industries grow, investors can use 1031 Exchanges to transition their assets into high-growth sectors, staying ahead of market trends while deferring taxes and maximizing returns.

Tax Liabilities Specific to California

Utilizing a 1031 Exchange can help mitigate significant tax liabilities that an investor would face in the high-cost market of California. But while considering a 1031 Exchange, it is important to understand exactly what tax liabilities Californian transactions could be subject to, as well as recognizing the regulating bodies in charge.

California Franchise Tax Board (FTB)

The California Franchise Tax Board (FTB) is the taxing authority for the State of California that collects corporate and state income taxes. The FTB plays a key role in administering taxes related to commercial properties, including capital gains taxes on real estate sales. For 1031 Exchanges, the FTB follows federal guidelines allowing property owners to defer capital gains taxes when they reinvest proceeds into like-kind properties. However, state-specific rules may apply, such as the need to report exchanges and potentially pay deferred taxes if the Replacement Property(ies) is outside California. Compliance with both federal and state tax laws is crucial for commercial property investors using 1031 Exchanges.

Deferral of State Taxes:

While federal tax law allows for the deferral of capital gains taxes, California has its own tax implications. Investors must understand that while the federal government allows deferral, the California Franchise Tax Board (FTB) imposes additional state taxes on the gains when the property is sold and not replaced with another California property. The capital gains from the sale of the Relinquished Property will be subject to California’s state income tax rates, which can be as high as 13.3%, depending on the Seller’s income bracket. High earners, especially those selling investment properties, are subject to the upper end of this tax rate. California treats capital gains as regular income, so any gain from the sale of the Relinquished Property will be taxed according to the individual’s income tax bracket. For high-income individuals, California imposes an additional 1% surtax on income exceeding $1 million. This tax is known as the “Mental Health Services Act” tax and applies to capital gains from the sale of property if the Seller’s total income surpasses $1 million. Lastly, there is withholding tax on sales by nonresidents. If the property Seller is a nonresident of California, the FTB generally requires withholding 3.33% of the total sale price, or the Seller can choose to have the withholding based on the gain from the sale instead.

California Clawback Rule:

The California Clawback Rule refers to the state’s requirement that taxes deferred under a 1031 Exchange must eventually be paid on any gains that originated from a California property, even if the property has been exchanged for one located in another state. This rule is where the state of California “claws back” any deferred taxes once the Exchanger cashes out. Key points about this rule include:

Gain from California Property: If California property is exchanged for out-of-state property, any gain realized from the California property remains subject to California state taxes. The state tracks the deferred capital gains on the California property.

Filing a California Tax Return: California law requires that investors continue to file a California tax return each year, reporting the deferred gain on the Californian Relinquished Property, even if the Replacement Property(ies) is in another state.

Tax Due Upon “Cashing Out”: If the investor eventually sells the out-of-state Replacement Property(ies) and “cashes out” (does not do another 1031 Exchange), they will owe California taxes on the deferred gains from the original California Relinquished Property, in addition to any taxes due in the state where the Replacement Property(ies) is sold.

Continuous Deferral: If the investor continues to do 1031 Exchanges, they can keep deferring both federal capital gains taxes and California state taxes, but the deferred gain from the California Relinquished Property will still be tracked by California.

Choosing the Right Qualified Intermediary

To successfully complete a 1031 Exchange, it’s critical to use a knowledgeable and experienced national Qualified Intermediary (QI). Given California’s specific tax rules, including the state’s “Clawback Rule” and the importance of properly adhering to the like-kind property requirements, using a QI that understands the complexities and nuances of California’s real estate and tax landscape is essential. Failing to work with an experienced, accredited QI can lead to significant financial risks, including the loss of your tax deferral benefits. As one of the nation’s leading providers of 1031 Exchange services, our experienced Accruit team and seamless processes is what investors need to ensure compliance with federal and state tax regulations.

California’s growing commercial real estate market, paired with the potential of 1031 Exchanges, presents a significant opportunity for investors seeking to expand their portfolios while achieving tax deferral. By staying informed about the state’s tax implications, market trends, and the nuances of 1031 Exchanges, investors can better navigate the challenges and opportunities that California offers. Whether you’re investing in multifamily housing, industrial properties, or exploring emerging sectors, utilizing a 1031 Exchange and an experienced QI, such as Accruit, could be essential in optimizing your investment strategy and achieving long-term success in this dynamic commercial market.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Commercial Real Estate Transactions and 1031 Exchanges in California

Current Landscape of Commercial Real Estate Transactions in California

In recent years, California has seen a significant rise in commercial real estate transactions, driven by a diversified economy. In 2023, commercial real estate transactions in California totaled over $60 billion, a 15% increase from the previous year. Multifamily and industrial properties have led the market, with multifamily properties comprising approximately 40% of all transactions. This can be attributed to persistent housing shortages in the face of high demand, particularly in urban areas. A large factor contributing to the success of these properties is the pandemic and the subsequent post-pandemic recovery period, which heightened the need for stable and affordable housing. The multifamily sector continues to remain strong due to California’s ongoing housing crisis, where demand is outpacing supply. With the state’s population growth and urbanization trends, these properties offer promising returns and long-term value appreciation. The pandemic and post-pandemic market trends have also shown a skyrocketing growth in e-commerce, which has resulted in an immense need for distribution and fulfillment centers. As businesses adapted to these changes, investors recognized the potential of industrial properties, such as warehouses and distribution centers, which have become increasingly vital in the supply chain. As the market evolves, understanding these dynamics will be crucial for making informed investment decisions that maximize returns in California’s competitive real estate environment.

Statistical Trends Favoring 1031 Exchanges

With high property values and significant transaction volumes, the potential for 1031 Exchanges in California is immense. The state is notorious for commanding some of the highest real estate prices in the country, with the average sales price for commercial properties in California hovering at approximately $1.5 million, with urban centers like San Francisco and Los Angeles often seeing even higher prices. For example, in San Francisco, commercial properties can easily surpass the $2 million mark, driven by the city’s tech boom and limited space for expansion. Similarly, in Los Angeles, prime commercial properties in sectors such as entertainment and media are securing premium prices due to their central locations and increasing demand.

As California’s economy continues to diversify, the demand for commercial real estate is expected to grow even further. Emerging sectors like technology, biotech, and renewable energy are driving new real estate development and acquisitions. The tech sector alone is projected to add over 200,000 jobs in the state by 2025, a surge that will undoubtedly drive greater demand for office space, research facilities, and other commercial properties. Additionally, the push for sustainability and renewable energy is driving the need for industrial spaces and manufacturing facilities. As these industries grow, investors can use 1031 Exchanges to transition their assets into high-growth sectors, staying ahead of market trends while deferring taxes and maximizing returns.

Tax Liabilities Specific to California

Utilizing a 1031 Exchange can help mitigate significant tax liabilities that an investor would face in the high-cost market of California. But while considering a 1031 Exchange, it is important to understand exactly what tax liabilities Californian transactions could be subject to, as well as recognizing the regulating bodies in charge.

California Franchise Tax Board (FTB)

The California Franchise Tax Board (FTB) is the taxing authority for the State of California that collects corporate and state income taxes. The FTB plays a key role in administering taxes related to commercial properties, including capital gains taxes on real estate sales. For 1031 Exchanges, the FTB follows federal guidelines allowing property owners to defer capital gains taxes when they reinvest proceeds into like-kind properties. However, state-specific rules may apply, such as the need to report exchanges and potentially pay deferred taxes if the Replacement Property(ies) is outside California. Compliance with both federal and state tax laws is crucial for commercial property investors using 1031 Exchanges.

Deferral of State Taxes:

While federal tax law allows for the deferral of capital gains taxes, California has its own tax implications. Investors must understand that while the federal government allows deferral, the California Franchise Tax Board (FTB) imposes additional state taxes on the gains when the property is sold and not replaced with another California property. The capital gains from the sale of the Relinquished Property will be subject to California’s state income tax rates, which can be as high as 13.3%, depending on the Seller’s income bracket. High earners, especially those selling investment properties, are subject to the upper end of this tax rate. California treats capital gains as regular income, so any gain from the sale of the Relinquished Property will be taxed according to the individual’s income tax bracket. For high-income individuals, California imposes an additional 1% surtax on income exceeding $1 million. This tax is known as the “Mental Health Services Act” tax and applies to capital gains from the sale of property if the Seller’s total income surpasses $1 million. Lastly, there is withholding tax on sales by nonresidents. If the property Seller is a nonresident of California, the FTB generally requires withholding 3.33% of the total sale price, or the Seller can choose to have the withholding based on the gain from the sale instead.

California Clawback Rule:

The California Clawback Rule refers to the state’s requirement that taxes deferred under a 1031 Exchange must eventually be paid on any gains that originated from a California property, even if the property has been exchanged for one located in another state. This rule is where the state of California “claws back” any deferred taxes once the Exchanger cashes out. Key points about this rule include:

Gain from California Property: If California property is exchanged for out-of-state property, any gain realized from the California property remains subject to California state taxes. The state tracks the deferred capital gains on the California property.

Filing a California Tax Return: California law requires that investors continue to file a California tax return each year, reporting the deferred gain on the Californian Relinquished Property, even if the Replacement Property(ies) is in another state.

Tax Due Upon “Cashing Out”: If the investor eventually sells the out-of-state Replacement Property(ies) and “cashes out” (does not do another 1031 Exchange), they will owe California taxes on the deferred gains from the original California Relinquished Property, in addition to any taxes due in the state where the Replacement Property(ies) is sold.

Continuous Deferral: If the investor continues to do 1031 Exchanges, they can keep deferring both federal capital gains taxes and California state taxes, but the deferred gain from the California Relinquished Property will still be tracked by California.

Choosing the Right Qualified Intermediary

To successfully complete a 1031 Exchange, it’s critical to use a knowledgeable and experienced national Qualified Intermediary (QI). Given California’s specific tax rules, including the state’s “Clawback Rule” and the importance of properly adhering to the like-kind property requirements, using a QI that understands the complexities and nuances of California’s real estate and tax landscape is essential. Failing to work with an experienced, accredited QI can lead to significant financial risks, including the loss of your tax deferral benefits. As one of the nation’s leading providers of 1031 Exchange services, our experienced Accruit team and seamless processes is what investors need to ensure compliance with federal and state tax regulations.

California’s growing commercial real estate market, paired with the potential of 1031 Exchanges, presents a significant opportunity for investors seeking to expand their portfolios while achieving tax deferral. By staying informed about the state’s tax implications, market trends, and the nuances of 1031 Exchanges, investors can better navigate the challenges and opportunities that California offers. Whether you’re investing in multifamily housing, industrial properties, or exploring emerging sectors, utilizing a 1031 Exchange and an experienced QI, such as Accruit, could be essential in optimizing your investment strategy and achieving long-term success in this dynamic commercial market.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.