Simultaneous Exchange versus Delayed Exchange

Most 1031 Exchanges take place on a delayed basis. That is to say that the Exchanger sells his Relinquished Property to a buyer of choice and acquires Replacement Property from a seller of choice within 180 days thereafter, or by the due date for filing the tax return for the year of the sale, hence a delay in completed the exchange. However, on occasion, there are just two or three parties who wish to directly exchange properties. Because circumstances exist, they are able to exchange properties simultaneously, i.e. at the same exact time, rather than on a delayed basis.

Facing the circumstances of a simultaneous exchange, including the absence of the requirement of holding funds until the close of a transaction to complete the exchange present in a delayed exchange, the parties sometimes consider entering into a 1031 Exchange transaction without involving a Qualified Intermediary. While this can be done, as the use of a

Qualified Intermediary is not a precondition to a valid 1031 Exchange transaction, there are reasons why an Exchanger might want to use the same structure for a simultaneous 1031 Exchange that is customarily used for a delayed 1031 Exchange.

A simultaneous exchange may seem as simple as two parties exchanging deeds to their properties of the same fair market value to complete a valid 1031 Exchange or one party paying in cash to equalize the values. However, there is more to it, much of which being proper processes and documentation are often overlooked. Should an audit occur, the documentation will be relied upon to determine if the 1031 Exchange stands up to IRS scrutiny.

Criteria for a Valid 1031 Exchange

As mentioned above, there are certain requirements that must be met for a valid 1031 Exchange in addition to merely exchanging properties via title transfer and possibly cash from one party to make up for a difference in fair market value.

Intent to Exchange

For a 1031 Exchange to be valid, there has to be an expressed intent to exchange requiring the purchase and sale of the properties to be reciprocal and mutually interdependent. The typical tax deferred exchange agreement contains language covering this requirement. Without more, a standard form Purchase and Sale Agreement would not contain necessary language to this effect. The presence of an “exchange cooperation clause” in a form contract would not suffice for this purpose.

Exchange Requirement

One of the primary drivers of the 1991 exchange regulations was to provide a way to maintain an “exchange event” between the parties while effectively taking the Exchanger’s buyer and seller out of the active participation in the Exchanger’s 1031 Exchange transaction. This was accomplished through the use of a new player, the “Qualified Intermediary” (QI). The idea was that the QI could substitute for the Exchanger’s buyer and seller as the party with whom the Exchanger was exchanging the properties, i.e. an intermediary in the middle of the transaction. The buyer and seller could be just that, they did not have to actively participate in the exchange. However, a simultaneous exchange without the use of a QI requires those other parties to be involved in the exchange and that is not always something they are willing to undertake. The buyer would have to agree to obtain the property from the Seller in lieu of paying the Exchanger and to transfer that property to the Exchanger. Likewise, the Seller would have to agree to sell the property to the buyer in lieu of the Exchanger. Contracts between the parties would have to be consistent with this. Proper conveyances would need to be made, reps and warranties might have to run to parties other than the person to whom the property was being transferred to or from, etc. Certain jurisdictions may seek to impose transfer taxes on some of the conveyances.

Actual or Constructive Receipt of Funds

Further, an Exchanger cannot be in actual or constructive receipt of any sale proceeds during the pendency of a 1031Exchange. When using a QI, including its secondary role of holding the exchange proceeds, even for a transitory moment, the regulations provide that with proper language in the exchange agreement and/or an accompanying “qualified escrow” agreement, the Exchanger will not be deemed to be in actual or constructive receipt. Conversely, with a simultaneous exchange using a routine closing escrow, that document may not have the type of language which insures against actual or constructive receipt.

Inexpensive Insurance

It is often said that a person’s purchase of their home might be the most significant purchase they make during their lifetime. Purchasing an investment or business use property is also a very significant event and so is the certainty of receiving tax deferral via a successful 1031 Exchange.

A buyer of a new home would not consider buying such an important property without the protection of title insurance. The 1031 Exchange regulations provide a “safe harbor” structure for the exchange of properties. The use of a Qualified Intermediary, such as Accruit, assures for a 1031 Exchange within the safe harbor to be preapproved by the IRS, which is equivalent to receiving title insurance. Think of it as Exchange Insurance. The cost of a 1031 Exchange is generally a minor amount, especially when considering the tax deferral at stake, so it is often considered a worthwhile expense to assure the transaction meets with the IRS requirements.

The drafters of the regulations understood while it is possible to do an exchange without using a Qualified Intermediary, Exchangers might like to take advantage of the safe harbor and the assurance it provides. So, they addressed this issue in the Preamble to the 1991 Regulations:

Extension of safe harbor rules to simultaneous exchanges

The rules in the proposed regulations, including the safe harbors, apply only to deferred exchanges. Commentators noted that the concerns relating to actual or constructive receipt and agency also exist in the case of simultaneous exchanges. They requested that the safe harbors be made available for simultaneous exchanges. Upon review, the Service has determined it necessary to make only the qualified intermediary safe harbor available for simultaneous exchanges. The final regulations provide, therefore, that in the case of simultaneous transfers of like-kind properties involving a qualified intermediary, the qualified intermediary will not be considered the agent of the taxpayer for purposes of section 1031 (a). Thus, in such a case the transfer and receipt of property by the taxpayer will be treated as an exchange. This provision is set forth in new §1.1031 (b)-2 of the final regulations and is effective for transfers of property made by taxpayers on or effective for transfers of property made by taxpayers on or after June 10, 1991.

In sum, while it is possible to structure a valid 1031 Exchange without engaging the services of a Qualified Intermediary, but there are some risks that certain required elements might inadvertently be missed invalidating the 1031 Exchange. Tax deferral is a gift, but to receive it, technical adherence is a necessity. The drafters of the regulations understood this and chose to make the rules applicable to simultaneous 1031 Exchanges. The safe harbor structure set forth in the applicable regulations provide “exchange insurance” and the cost is minimal compared to the benefit of knowing the structure is preapproved.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Author: meredithb@accruit.com

-

Can A Simultaneous 1031 Exchange be Done Without the Use of a Qualified Intermediary?

-

Can A Simultaneous 1031 Exchange be Done Without the Use of a Qualified Intermediary?

Simultaneous Exchange versus Delayed Exchange

Most 1031 Exchanges take place on a delayed basis. That is to say that the Exchanger sells his Relinquished Property to a buyer of choice and acquires Replacement Property from a seller of choice within 180 days thereafter, or by the due date for filing the tax return for the year of the sale, hence a delay in completed the exchange. However, on occasion, there are just two or three parties who wish to directly exchange properties. Because circumstances exist, they are able to exchange properties simultaneously, i.e. at the same exact time, rather than on a delayed basis.

Facing the circumstances of a simultaneous exchange, including the absence of the requirement of holding funds until the close of a transaction to complete the exchange present in a delayed exchange, the parties sometimes consider entering into a 1031 Exchange transaction without involving a Qualified Intermediary. While this can be done, as the use of a

Qualified Intermediary is not a precondition to a valid 1031 Exchange transaction, there are reasons why an Exchanger might want to use the same structure for a simultaneous 1031 Exchange that is customarily used for a delayed 1031 Exchange.

A simultaneous exchange may seem as simple as two parties exchanging deeds to their properties of the same fair market value to complete a valid 1031 Exchange or one party paying in cash to equalize the values. However, there is more to it, much of which being proper processes and documentation are often overlooked. Should an audit occur, the documentation will be relied upon to determine if the 1031 Exchange stands up to IRS scrutiny.

Criteria for a Valid 1031 Exchange

As mentioned above, there are certain requirements that must be met for a valid 1031 Exchange in addition to merely exchanging properties via title transfer and possibly cash from one party to make up for a difference in fair market value.

Intent to Exchange

For a 1031 Exchange to be valid, there has to be an expressed intent to exchange requiring the purchase and sale of the properties to be reciprocal and mutually interdependent. The typical tax deferred exchange agreement contains language covering this requirement. Without more, a standard form Purchase and Sale Agreement would not contain necessary language to this effect. The presence of an “exchange cooperation clause” in a form contract would not suffice for this purpose.

Exchange Requirement

One of the primary drivers of the 1991 exchange regulations was to provide a way to maintain an “exchange event” between the parties while effectively taking the Exchanger’s buyer and seller out of the active participation in the Exchanger’s 1031 Exchange transaction. This was accomplished through the use of a new player, the “Qualified Intermediary” (QI). The idea was that the QI could substitute for the Exchanger’s buyer and seller as the party with whom the Exchanger was exchanging the properties, i.e. an intermediary in the middle of the transaction. The buyer and seller could be just that, they did not have to actively participate in the exchange. However, a simultaneous exchange without the use of a QI requires those other parties to be involved in the exchange and that is not always something they are willing to undertake. The buyer would have to agree to obtain the property from the Seller in lieu of paying the Exchanger and to transfer that property to the Exchanger. Likewise, the Seller would have to agree to sell the property to the buyer in lieu of the Exchanger. Contracts between the parties would have to be consistent with this. Proper conveyances would need to be made, reps and warranties might have to run to parties other than the person to whom the property was being transferred to or from, etc. Certain jurisdictions may seek to impose transfer taxes on some of the conveyances.

Actual or Constructive Receipt of Funds

Further, an Exchanger cannot be in actual or constructive receipt of any sale proceeds during the pendency of a 1031Exchange. When using a QI, including its secondary role of holding the exchange proceeds, even for a transitory moment, the regulations provide that with proper language in the exchange agreement and/or an accompanying “qualified escrow” agreement, the Exchanger will not be deemed to be in actual or constructive receipt. Conversely, with a simultaneous exchange using a routine closing escrow, that document may not have the type of language which insures against actual or constructive receipt.

Inexpensive Insurance

It is often said that a person’s purchase of their home might be the most significant purchase they make during their lifetime. Purchasing an investment or business use property is also a very significant event and so is the certainty of receiving tax deferral via a successful 1031 Exchange.

A buyer of a new home would not consider buying such an important property without the protection of title insurance. The 1031 Exchange regulations provide a “safe harbor” structure for the exchange of properties. The use of a Qualified Intermediary, such as Accruit, assures for a 1031 Exchange within the safe harbor to be preapproved by the IRS, which is equivalent to receiving title insurance. Think of it as Exchange Insurance. The cost of a 1031 Exchange is generally a minor amount, especially when considering the tax deferral at stake, so it is often considered a worthwhile expense to assure the transaction meets with the IRS requirements.

The drafters of the regulations understood while it is possible to do an exchange without using a Qualified Intermediary, Exchangers might like to take advantage of the safe harbor and the assurance it provides. So, they addressed this issue in the Preamble to the 1991 Regulations:

Extension of safe harbor rules to simultaneous exchanges

The rules in the proposed regulations, including the safe harbors, apply only to deferred exchanges. Commentators noted that the concerns relating to actual or constructive receipt and agency also exist in the case of simultaneous exchanges. They requested that the safe harbors be made available for simultaneous exchanges. Upon review, the Service has determined it necessary to make only the qualified intermediary safe harbor available for simultaneous exchanges. The final regulations provide, therefore, that in the case of simultaneous transfers of like-kind properties involving a qualified intermediary, the qualified intermediary will not be considered the agent of the taxpayer for purposes of section 1031 (a). Thus, in such a case the transfer and receipt of property by the taxpayer will be treated as an exchange. This provision is set forth in new §1.1031 (b)-2 of the final regulations and is effective for transfers of property made by taxpayers on or effective for transfers of property made by taxpayers on or after June 10, 1991.

In sum, while it is possible to structure a valid 1031 Exchange without engaging the services of a Qualified Intermediary, but there are some risks that certain required elements might inadvertently be missed invalidating the 1031 Exchange. Tax deferral is a gift, but to receive it, technical adherence is a necessity. The drafters of the regulations understood this and chose to make the rules applicable to simultaneous 1031 Exchanges. The safe harbor structure set forth in the applicable regulations provide “exchange insurance” and the cost is minimal compared to the benefit of knowing the structure is preapproved.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Can A Simultaneous 1031 Exchange be Done Without the Use of a Qualified Intermediary?

Simultaneous Exchange versus Delayed Exchange

Most 1031 Exchanges take place on a delayed basis. That is to say that the Exchanger sells his Relinquished Property to a buyer of choice and acquires Replacement Property from a seller of choice within 180 days thereafter, or by the due date for filing the tax return for the year of the sale, hence a delay in completed the exchange. However, on occasion, there are just two or three parties who wish to directly exchange properties. Because circumstances exist, they are able to exchange properties simultaneously, i.e. at the same exact time, rather than on a delayed basis.

Facing the circumstances of a simultaneous exchange, including the absence of the requirement of holding funds until the close of a transaction to complete the exchange present in a delayed exchange, the parties sometimes consider entering into a 1031 Exchange transaction without involving a Qualified Intermediary. While this can be done, as the use of a

Qualified Intermediary is not a precondition to a valid 1031 Exchange transaction, there are reasons why an Exchanger might want to use the same structure for a simultaneous 1031 Exchange that is customarily used for a delayed 1031 Exchange.

A simultaneous exchange may seem as simple as two parties exchanging deeds to their properties of the same fair market value to complete a valid 1031 Exchange or one party paying in cash to equalize the values. However, there is more to it, much of which being proper processes and documentation are often overlooked. Should an audit occur, the documentation will be relied upon to determine if the 1031 Exchange stands up to IRS scrutiny.

Criteria for a Valid 1031 Exchange

As mentioned above, there are certain requirements that must be met for a valid 1031 Exchange in addition to merely exchanging properties via title transfer and possibly cash from one party to make up for a difference in fair market value.

Intent to Exchange

For a 1031 Exchange to be valid, there has to be an expressed intent to exchange requiring the purchase and sale of the properties to be reciprocal and mutually interdependent. The typical tax deferred exchange agreement contains language covering this requirement. Without more, a standard form Purchase and Sale Agreement would not contain necessary language to this effect. The presence of an “exchange cooperation clause” in a form contract would not suffice for this purpose.

Exchange Requirement

One of the primary drivers of the 1991 exchange regulations was to provide a way to maintain an “exchange event” between the parties while effectively taking the Exchanger’s buyer and seller out of the active participation in the Exchanger’s 1031 Exchange transaction. This was accomplished through the use of a new player, the “Qualified Intermediary” (QI). The idea was that the QI could substitute for the Exchanger’s buyer and seller as the party with whom the Exchanger was exchanging the properties, i.e. an intermediary in the middle of the transaction. The buyer and seller could be just that, they did not have to actively participate in the exchange. However, a simultaneous exchange without the use of a QI requires those other parties to be involved in the exchange and that is not always something they are willing to undertake. The buyer would have to agree to obtain the property from the Seller in lieu of paying the Exchanger and to transfer that property to the Exchanger. Likewise, the Seller would have to agree to sell the property to the buyer in lieu of the Exchanger. Contracts between the parties would have to be consistent with this. Proper conveyances would need to be made, reps and warranties might have to run to parties other than the person to whom the property was being transferred to or from, etc. Certain jurisdictions may seek to impose transfer taxes on some of the conveyances.

Actual or Constructive Receipt of Funds

Further, an Exchanger cannot be in actual or constructive receipt of any sale proceeds during the pendency of a 1031Exchange. When using a QI, including its secondary role of holding the exchange proceeds, even for a transitory moment, the regulations provide that with proper language in the exchange agreement and/or an accompanying “qualified escrow” agreement, the Exchanger will not be deemed to be in actual or constructive receipt. Conversely, with a simultaneous exchange using a routine closing escrow, that document may not have the type of language which insures against actual or constructive receipt.

Inexpensive Insurance

It is often said that a person’s purchase of their home might be the most significant purchase they make during their lifetime. Purchasing an investment or business use property is also a very significant event and so is the certainty of receiving tax deferral via a successful 1031 Exchange.

A buyer of a new home would not consider buying such an important property without the protection of title insurance. The 1031 Exchange regulations provide a “safe harbor” structure for the exchange of properties. The use of a Qualified Intermediary, such as Accruit, assures for a 1031 Exchange within the safe harbor to be preapproved by the IRS, which is equivalent to receiving title insurance. Think of it as Exchange Insurance. The cost of a 1031 Exchange is generally a minor amount, especially when considering the tax deferral at stake, so it is often considered a worthwhile expense to assure the transaction meets with the IRS requirements.

The drafters of the regulations understood while it is possible to do an exchange without using a Qualified Intermediary, Exchangers might like to take advantage of the safe harbor and the assurance it provides. So, they addressed this issue in the Preamble to the 1991 Regulations:

Extension of safe harbor rules to simultaneous exchanges

The rules in the proposed regulations, including the safe harbors, apply only to deferred exchanges. Commentators noted that the concerns relating to actual or constructive receipt and agency also exist in the case of simultaneous exchanges. They requested that the safe harbors be made available for simultaneous exchanges. Upon review, the Service has determined it necessary to make only the qualified intermediary safe harbor available for simultaneous exchanges. The final regulations provide, therefore, that in the case of simultaneous transfers of like-kind properties involving a qualified intermediary, the qualified intermediary will not be considered the agent of the taxpayer for purposes of section 1031 (a). Thus, in such a case the transfer and receipt of property by the taxpayer will be treated as an exchange. This provision is set forth in new §1.1031 (b)-2 of the final regulations and is effective for transfers of property made by taxpayers on or effective for transfers of property made by taxpayers on or after June 10, 1991.

In sum, while it is possible to structure a valid 1031 Exchange without engaging the services of a Qualified Intermediary, but there are some risks that certain required elements might inadvertently be missed invalidating the 1031 Exchange. Tax deferral is a gift, but to receive it, technical adherence is a necessity. The drafters of the regulations understood this and chose to make the rules applicable to simultaneous 1031 Exchanges. The safe harbor structure set forth in the applicable regulations provide “exchange insurance” and the cost is minimal compared to the benefit of knowing the structure is preapproved.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

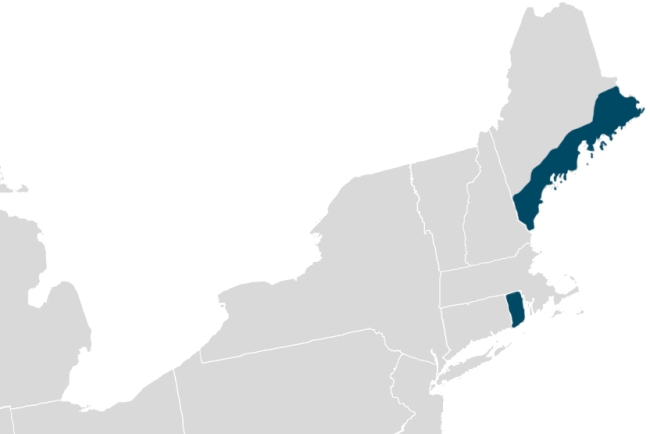

IRS Announces Tax Relief for Areas in Rhode Island and Maine due to Recent Severe Storms

Due to the severe storms and flooding of December 17th and January 9th, the IRS has issued tax relief for parts of Maine and Rhode Island.

The General postponement date is July 15th, 2024.

In Maine, individuals that reside or have businesses within Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington, and York counties qualify for tax relief as this time.

In Rhode Island, individuals that reside or have businesses within Kent, Providence, and Washington counties qualify for tax relief as this time.

An “Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers who do not meet the definition of Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The “Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers).

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Maine tax relief from the IRS.

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Rhode Island January 9th Storms tax relief from the IRS.