Selling foreign real estate and reinvesting in other foreign real estate through a 1031 Exchange presents unique challenges beyond those of a 1031 Exchange with domestic property. While tax deferral benefits can still apply, factors such as differing tax codes and fluctuations in currency and markets require careful planning. In this blog, we explore important considerations for Exchangers contemplating a 1031 Exchange involving foreign property.

Foreign Property Is Not Like-Kind to U.S. Property

In a 1031 Exchange, both Relinquished and Replacement Properties must be like-kind, meaning real estate held for business or investment can be exchanged for another, regardless of type (ex. a multi-family property for an office building). For U.S. exchanges, properties must be within the continental U.S. Puerto Rico is excluded, but the U.S. Virgin Islands may qualify. In the context of 1031, https://www.accruit.com/blog/1031-exchanges-involving-foreign-property”… properties can only be exchanged for other foreign properties, regardless of location. Domestic and foreign properties cannot be exchanged with each other.

Tax Treatment in Foreign Jurisdictions

When conducting a 1031 Exchange with foreign property, it’s crucial to understand how the tax laws of the foreign country may impact the transaction. While the U.S. allows tax deferral under IRC §1031, most other countries do not recognize this provision, potentially resulting in immediate tax liabilities. In some cases, foreign countries impose higher capital gains tax rates than the U.S. (as high as 50%), reducing the benefits of deferral.

Another consideration is how foreign taxes interact with U.S. tax rules. If you pay capital gains tax in another country, you might be able to claim a foreign tax credit (FTC) or a deduction on your U.S. tax return. However, timing differences can create problems. If the foreign country taxes the gain right away but the U.S. delays recognition, you may not be able to fully use the FTC, which could lead to double taxation. Some tax treaties help by providing credits, but they don’t override the basic rules of §1031.

Besides capital gains taxes, Exchangers may face extra costs like stamp duties, value-added tax (VAT), or other transaction fees, making exchanges more complicated and expensive. These taxes usually can’t be recovered or deducted on a U.S. tax return, so it’s important to consider their impact. Another factor is estate and inheritance taxes, as some countries impose high taxes on property owned by non-residents. Using a foreign entity or trust to hold real estate might help reduce these risks, but it’s critical to properly structure a 1031 Exchange to follow both U.S. and foreign tax laws.

Foreign Currency Factors

Investing in foreign real estate comes with financial risks due to currency fluctuations, local market conditions, and regulatory factors. For a 1031 Exchange of foreign property, the Exchanger has two potential options for exchange funds to be held with the Qualified Intermediary (QI) in a United States bank. The first option is for the exchange funds to be held in the foreign currency within a foreign currency bank account; however not all banks can accommodate these types of accounts and there is additional documentation and security measures in place for holders of these accounts to reduce the banks associated risk with foreign money movements. The second option is to exchange the foreign currency into U.S. dollars. In this situation, the funds from the sale of the Relinquished Property are sent to the QI in the U.S. where they are converted to U.S. dollars prior to being converted back to the foreign currency to be wired internationally for the purchase of the Replacement Property(ies). During this process, exchange rates and additional transaction fees come into play, as the sale proceeds must be converted from U.S. dollars to the local currency for Replacement Property acquisition, requiring additional work for the QI to coordinate with banks.

Since property values are based on the local currency, changes in exchange rates can significantly impact both the purchase and sale price when converted to U.S. dollars at the time of the Relinquished Property sale. If said foreign currency weakens against the U.S. dollar, the investment’s value may decline upon conversion. Currency shifts can also have tax consequences, as the IRS may treat significant exchange rate differences between sale and purchase as a foreign exchange gain or loss, potentially leading to extra tax liabilities.

Market Risks

In addition to currency fluctuations, inflation and interest rates in other countries can affect property values and loan costs. High inflation can reduce buying power, while changes in interest rates can make mortgages more expensive and impact demand for real estate. Additionally, some countries impose foreign exchange restrictions that limit the transfer of money across borders. If these restrictions tighten, it could become difficult for funds to be sent to the QI upon the sale of the Relinquished Property.

Political and economic instability is another factor to consider. Changes in government policies, real estate regulations, or foreign ownership laws can lower property values and limit an Exchanger’s ability to buy, sell, or manage properties. In uncertain regulatory climates, unexpected restrictions on foreign real estate transactions can add even more unpredictability.

Given the complexities of 1031 Exchanges involving foreign property, Exchangers should carefully evaluate any risks before proceeding and understand that due to the increased complexities involving foreign currency and the additional steps and scrutiny involved, the cost for a 1031 Exchange involving foreign property is significantly higher than a 1031 Exchange with domestic property. Working with experienced legal and tax professionals, as well as a Qualified Intermediary such as Accruit, can help navigate the challenges and maximize the benefits of a foreign property exchange.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Author: meredithb@accruit.com

-

Considerations for 1031 Exchanges Involving Foreign Property

-

Considerations for 1031 Exchanges Involving Foreign Property

Selling foreign real estate and reinvesting in other foreign real estate through a 1031 Exchange presents unique challenges beyond those of a 1031 Exchange with domestic property. While tax deferral benefits can still apply, factors such as differing tax codes and fluctuations in currency and markets require careful planning. In this blog, we explore important considerations for Exchangers contemplating a 1031 Exchange involving foreign property.

Foreign Property Is Not Like-Kind to U.S. Property

In a 1031 Exchange, both Relinquished and Replacement Properties must be like-kind, meaning real estate held for business or investment can be exchanged for another, regardless of type (ex. a multi-family property for an office building). For U.S. exchanges, properties must be within the continental U.S. Puerto Rico is excluded, but the U.S. Virgin Islands may qualify. In the context of 1031, https://www.accruit.com/blog/1031-exchanges-involving-foreign-property”… properties can only be exchanged for other foreign properties, regardless of location. Domestic and foreign properties cannot be exchanged with each other.

Tax Treatment in Foreign Jurisdictions

When conducting a 1031 Exchange with foreign property, it’s crucial to understand how the tax laws of the foreign country may impact the transaction. While the U.S. allows tax deferral under IRC §1031, most other countries do not recognize this provision, potentially resulting in immediate tax liabilities. In some cases, foreign countries impose higher capital gains tax rates than the U.S. (as high as 50%), reducing the benefits of deferral.

Another consideration is how foreign taxes interact with U.S. tax rules. If you pay capital gains tax in another country, you might be able to claim a foreign tax credit (FTC) or a deduction on your U.S. tax return. However, timing differences can create problems. If the foreign country taxes the gain right away but the U.S. delays recognition, you may not be able to fully use the FTC, which could lead to double taxation. Some tax treaties help by providing credits, but they don’t override the basic rules of §1031.

Besides capital gains taxes, Exchangers may face extra costs like stamp duties, value-added tax (VAT), or other transaction fees, making exchanges more complicated and expensive. These taxes usually can’t be recovered or deducted on a U.S. tax return, so it’s important to consider their impact. Another factor is estate and inheritance taxes, as some countries impose high taxes on property owned by non-residents. Using a foreign entity or trust to hold real estate might help reduce these risks, but it’s critical to properly structure a 1031 Exchange to follow both U.S. and foreign tax laws.

Foreign Currency Factors

Investing in foreign real estate comes with financial risks due to currency fluctuations, local market conditions, and regulatory factors. For a 1031 Exchange of foreign property, the Exchanger has two potential options for exchange funds to be held with the Qualified Intermediary (QI) in a United States bank. The first option is for the exchange funds to be held in the foreign currency within a foreign currency bank account; however not all banks can accommodate these types of accounts and there is additional documentation and security measures in place for holders of these accounts to reduce the banks associated risk with foreign money movements. The second option is to exchange the foreign currency into U.S. dollars. In this situation, the funds from the sale of the Relinquished Property are sent to the QI in the U.S. where they are converted to U.S. dollars prior to being converted back to the foreign currency to be wired internationally for the purchase of the Replacement Property(ies). During this process, exchange rates and additional transaction fees come into play, as the sale proceeds must be converted from U.S. dollars to the local currency for Replacement Property acquisition, requiring additional work for the QI to coordinate with banks.

Since property values are based on the local currency, changes in exchange rates can significantly impact both the purchase and sale price when converted to U.S. dollars at the time of the Relinquished Property sale. If said foreign currency weakens against the U.S. dollar, the investment’s value may decline upon conversion. Currency shifts can also have tax consequences, as the IRS may treat significant exchange rate differences between sale and purchase as a foreign exchange gain or loss, potentially leading to extra tax liabilities.

Market Risks

In addition to currency fluctuations, inflation and interest rates in other countries can affect property values and loan costs. High inflation can reduce buying power, while changes in interest rates can make mortgages more expensive and impact demand for real estate. Additionally, some countries impose foreign exchange restrictions that limit the transfer of money across borders. If these restrictions tighten, it could become difficult for funds to be sent to the QI upon the sale of the Relinquished Property.

Political and economic instability is another factor to consider. Changes in government policies, real estate regulations, or foreign ownership laws can lower property values and limit an Exchanger’s ability to buy, sell, or manage properties. In uncertain regulatory climates, unexpected restrictions on foreign real estate transactions can add even more unpredictability.

Given the complexities of 1031 Exchanges involving foreign property, Exchangers should carefully evaluate any risks before proceeding and understand that due to the increased complexities involving foreign currency and the additional steps and scrutiny involved, the cost for a 1031 Exchange involving foreign property is significantly higher than a 1031 Exchange with domestic property. Working with experienced legal and tax professionals, as well as a Qualified Intermediary such as Accruit, can help navigate the challenges and maximize the benefits of a foreign property exchange.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

-

Considerations for 1031 Exchanges Involving Foreign Property

Selling foreign real estate and reinvesting in other foreign real estate through a 1031 Exchange presents unique challenges beyond those of a 1031 Exchange with domestic property. While tax deferral benefits can still apply, factors such as differing tax codes and fluctuations in currency and markets require careful planning. In this blog, we explore important considerations for Exchangers contemplating a 1031 Exchange involving foreign property.

Foreign Property Is Not Like-Kind to U.S. Property

In a 1031 Exchange, both Relinquished and Replacement Properties must be like-kind, meaning real estate held for business or investment can be exchanged for another, regardless of type (ex. a multi-family property for an office building). For U.S. exchanges, properties must be within the continental U.S. Puerto Rico is excluded, but the U.S. Virgin Islands may qualify. In the context of 1031, https://www.accruit.com/blog/1031-exchanges-involving-foreign-property”… properties can only be exchanged for other foreign properties, regardless of location. Domestic and foreign properties cannot be exchanged with each other.

Tax Treatment in Foreign Jurisdictions

When conducting a 1031 Exchange with foreign property, it’s crucial to understand how the tax laws of the foreign country may impact the transaction. While the U.S. allows tax deferral under IRC §1031, most other countries do not recognize this provision, potentially resulting in immediate tax liabilities. In some cases, foreign countries impose higher capital gains tax rates than the U.S. (as high as 50%), reducing the benefits of deferral.

Another consideration is how foreign taxes interact with U.S. tax rules. If you pay capital gains tax in another country, you might be able to claim a foreign tax credit (FTC) or a deduction on your U.S. tax return. However, timing differences can create problems. If the foreign country taxes the gain right away but the U.S. delays recognition, you may not be able to fully use the FTC, which could lead to double taxation. Some tax treaties help by providing credits, but they don’t override the basic rules of §1031.

Besides capital gains taxes, Exchangers may face extra costs like stamp duties, value-added tax (VAT), or other transaction fees, making exchanges more complicated and expensive. These taxes usually can’t be recovered or deducted on a U.S. tax return, so it’s important to consider their impact. Another factor is estate and inheritance taxes, as some countries impose high taxes on property owned by non-residents. Using a foreign entity or trust to hold real estate might help reduce these risks, but it’s critical to properly structure a 1031 Exchange to follow both U.S. and foreign tax laws.

Foreign Currency Factors

Investing in foreign real estate comes with financial risks due to currency fluctuations, local market conditions, and regulatory factors. For a 1031 Exchange of foreign property, the Exchanger has two potential options for exchange funds to be held with the Qualified Intermediary (QI) in a United States bank. The first option is for the exchange funds to be held in the foreign currency within a foreign currency bank account; however not all banks can accommodate these types of accounts and there is additional documentation and security measures in place for holders of these accounts to reduce the banks associated risk with foreign money movements. The second option is to exchange the foreign currency into U.S. dollars. In this situation, the funds from the sale of the Relinquished Property are sent to the QI in the U.S. where they are converted to U.S. dollars prior to being converted back to the foreign currency to be wired internationally for the purchase of the Replacement Property(ies). During this process, exchange rates and additional transaction fees come into play, as the sale proceeds must be converted from U.S. dollars to the local currency for Replacement Property acquisition, requiring additional work for the QI to coordinate with banks.

Since property values are based on the local currency, changes in exchange rates can significantly impact both the purchase and sale price when converted to U.S. dollars at the time of the Relinquished Property sale. If said foreign currency weakens against the U.S. dollar, the investment’s value may decline upon conversion. Currency shifts can also have tax consequences, as the IRS may treat significant exchange rate differences between sale and purchase as a foreign exchange gain or loss, potentially leading to extra tax liabilities.

Market Risks

In addition to currency fluctuations, inflation and interest rates in other countries can affect property values and loan costs. High inflation can reduce buying power, while changes in interest rates can make mortgages more expensive and impact demand for real estate. Additionally, some countries impose foreign exchange restrictions that limit the transfer of money across borders. If these restrictions tighten, it could become difficult for funds to be sent to the QI upon the sale of the Relinquished Property.

Political and economic instability is another factor to consider. Changes in government policies, real estate regulations, or foreign ownership laws can lower property values and limit an Exchanger’s ability to buy, sell, or manage properties. In uncertain regulatory climates, unexpected restrictions on foreign real estate transactions can add even more unpredictability.

Given the complexities of 1031 Exchanges involving foreign property, Exchangers should carefully evaluate any risks before proceeding and understand that due to the increased complexities involving foreign currency and the additional steps and scrutiny involved, the cost for a 1031 Exchange involving foreign property is significantly higher than a 1031 Exchange with domestic property. Working with experienced legal and tax professionals, as well as a Qualified Intermediary such as Accruit, can help navigate the challenges and maximize the benefits of a foreign property exchange.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

-

IRS Announces Tax Relief for West Virginia Taxpayers Impacted by Severe Storms

Due to severe storms, straight-line winds, flooding, landslides and mudslides, the IRS has issued Tax Relief for counties within West Virginia.

Affected Taxpayers have until November 3, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Logan, McDowell, Mercer, Mingo, Wayne and Wyoming counties in West Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

Who is an “Affected Taxpayer”?

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the Relinquished Property or Replacement Property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Relief Specific to 1031 Exchanges for Affected Taxpayers

General Postponement under Section 6 of Rev. Proc. 2018-58 under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Relief for Taxpayers with Related Difficulties

Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the Relinquished Property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the Relinquished Property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-west-virginia-storm-victims-qualify-fo… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

-

IRS Announces Tax Relief for West Virginia Taxpayers Impacted by Severe Storms

Due to severe storms, straight-line winds, flooding, landslides and mudslides, the IRS has issued Tax Relief for counties within West Virginia.

Affected Taxpayers have until November 3, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Logan, McDowell, Mercer, Mingo, Wayne and Wyoming counties in West Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

Who is an “Affected Taxpayer”?

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the Relinquished Property or Replacement Property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Relief Specific to 1031 Exchanges for Affected Taxpayers

General Postponement under Section 6 of Rev. Proc. 2018-58 under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Relief for Taxpayers with Related Difficulties

Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the Relinquished Property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the Relinquished Property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-west-virginia-storm-victims-qualify-fo… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

-

IRS Announces Tax Relief for West Virginia Taxpayers Impacted by Severe Storms

Due to severe storms, straight-line winds, flooding, landslides and mudslides, the IRS has issued Tax Relief for counties within West Virginia.

Affected Taxpayers have until November 3, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Logan, McDowell, Mercer, Mingo, Wayne and Wyoming counties in West Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

Who is an “Affected Taxpayer”?

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the Relinquished Property or Replacement Property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Relief Specific to 1031 Exchanges for Affected Taxpayers

General Postponement under Section 6 of Rev. Proc. 2018-58 under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Relief for Taxpayers with Related Difficulties

Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the Relinquished Property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the Relinquished Property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-west-virginia-storm-victims-qualify-fo… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

-

Disaster Extensions and 1031 Exchanges

Large scale disasters caused by wildfires, tornadoes, tropical storms, flooding, and other natural events impacted Exchangers in more than two dozen states in 2024.1 For those impacted, various forms of assistance were available from a variety of government and non-government organizations including Federal Emergency Management Agency, Small Business Administration, United States Department of Agriculture, and others. The Internal Revenue Service provided relief by allowing those defined as “Affected Taxpayers” to deduct casualty losses and extend certain time sensitive deadlines. But how do declared disasters impact IRC Section 1031 Tax Deferred Exchanges specifically?

Section 1031 Background

Under IRC Section 1031(a)(1), “no gain or loss is recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchange solely for property of like kind that is to be held for productive use in a trade or business or for investment.” The Code section goes on to provide the Replacement Property is deemed to be not like-kind property if it is not identified on or before the 45th day after the transfer of the Relinquished Property, or if the property isn’t acquired by the earlier of (i) the 180th day after the transfer of the Relinquished Property, or (ii) the due date for the Taxpayer’s return for the tax year in which the transfer of the Relinquished Property occurs, including extensions.2

For example, in a forward exchange, if the Exchanger transferred the Relinquished Property on November 1, 2024, the 45-day identification deadline would be December 16, 2024, and the 180-day exchange deadline would be April 30, 2025. However, the Exchanger’s tax return deadline is April 15, 2025, which effectively shortens their exchange period unless they file Form 4868 to extend the deadline. Note, these deadlines and Form 4868 apply to individuals and married couples. Other deadlines and forms are to be used for other Exchangers including Farmers and Ranchers, Corporations, and Partnerships.

In a parking exchange, or “reverse” exchange/and or property improvement exchanges, the same calculations would apply. If, through a properly structured parking exchange, the exchange company, technically referred to as the Exchange Accommodation Titleholder, acquired the Exchanger’s Replacement Property on November 1, 2024, the Exchanger would have until December 16, 2024 to identify which property (or properties) in their existing portfolio would be the target for disposition, and until April 15, 2025 to complete that disposition (unless they file Form 4868 for an extension on their tax return).

IRS Disaster Extensions

The Robert T. Stafford Disaster Relief and Emergency Assistance Act (“Stafford Act”) of 19883 amended the Disaster Relief Act of 1974. Section 401(a) of the Stafford Act provides that the Governor of an affected state must request that the President declare that a ‘major disaster’ exists. Major Disaster is defined as:

“any natural catastrophe (including any hurricane, tornado, storm, high water, wind-driven [sic] water, tidal wave, tsunami, earthquake, volcanic eruption, landslide, mudslide, snowstorm, or drought), or, regardless of cause, any fire, flood, or explosion, in any part of the United States, which in the determination of the President causes damage of sufficient severity and magnitude to warrant major disaster assistance under this Act to supplement the efforts and available resources of States, local governments, and disaster relief organizations in alleviating the damage, loss, hardship, or suffering caused thereby.”4

Further, the Secretary of the Treasury may extend certain time sensitive acts for up to one year for Exchangers affected by a federally declared natural disaster.5 Under IRC §7508A(d)(2), “Qualified Taxpayers” are

(A) Any individual whose principal residence (for purposes of section 1033(h)(4)) is located in a disaster area,

(B) Any taxpayer if the taxpayer’s principal place of business (other than the business of performing services as an employee) is located in a disaster area,

(C) Any individual who is a relief worker affiliated with a recognized government or philanthropic organization and who is assisting in a disaster area,

(D) Any taxpayer whose records necessary to meet a deadline for an act described in section 7508(a)(1) are maintained in a disaster area,

(E) Any individual visiting a disaster are who was killed or injured as a result of the disaster, and

(F) Solely with respect to a joint return, any spouse of an individual described in any preceding subparagraph of this paragraph.6

Exchangers may determine if an event was designated by the President as a federally declared disaster area by searching on https://www.fema.gov/disaster/declarations”>FEMA’s Disaster & Declarations page. Many, but not all, of these disasters will also be posted to the www.irs.gov/newsroom/tax-relief-in-disaster-situations”>IRS Newsroom. FEMA can provide assistance in one of three forms – public assistance, individual assistance, or a combination of public and individual assistance. Public assistance is when FEMA provides grants to state and local governments for items like debris removal, repairing roads and bridges, public buildings, and public utilities. Compare this to individual assistance, which is when FEMA provides grants to individuals for items like temporary housing, housing repair and replacement, as well as funeral expenses, just to name a few.

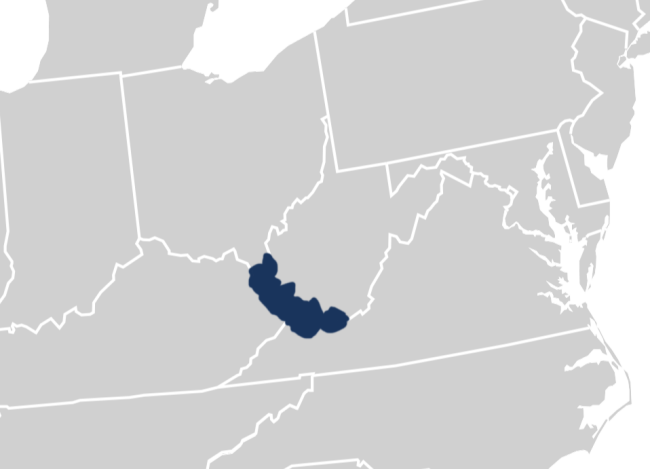

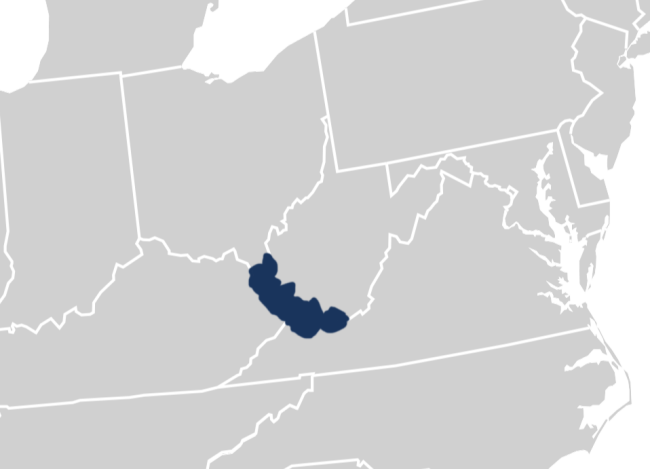

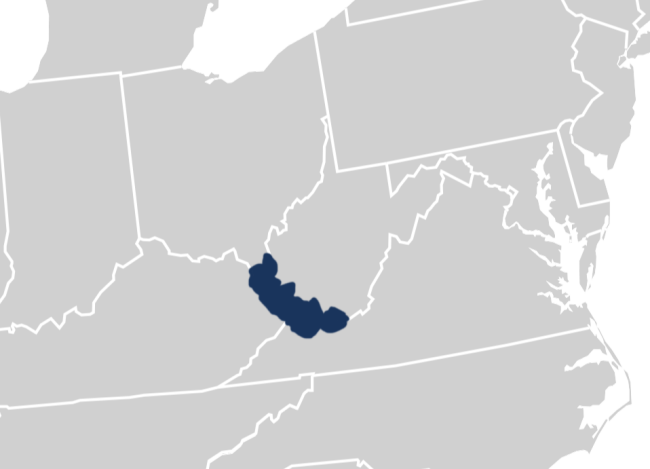

When the President declares a federal disaster, FEMA will designate what counties, or parishes, are entitled to relief and what types of relief. This information is shared with the public and a map is generated to facilitate the sharing of this information. As an example, below is the map that was published in the wake of severe storms, straight-line winds, flooding and tornadoes affecting Kentucky in 2022.

After the President declared that a major disaster existed in Kentucky, FEMA determined the geographical areas covered by the Declaration. Note that the map is color coded, and that there are five potential designations, by county. The counties indicated in white were not entitled to any FEMA relief. The counties highlighted in gold were entitled to public assistance only, and the counties in pink were entitled to receive both individual and public assistance. Only counties entitled to individual assistance, or public and individual assistance will receive disaster extensions.

Revenue Procedure 2018-58

Revenue Procedure 2018-58 updates Revenue Procedure 2007-56 with the purpose of providing an updated list of time sensitive acts that may be postponed under Sections 7508 and 7508A of the IRC.

Further, Rev. Proc. 2007-56 and 2018-58 extend the definition of Affected Taxpayer to include individuals serving in the Armed Forces of the United States in a combat zone, or serving in support of such Armed Forces, individuals serving with respect to contingency operations, Affected Taxpayers by reason of federally declared disasters within the meaning of § 301.7508A-1(d)(1), or Taxpayers whom the IRS determines are affected by a terroristic7 or military action.8

The Revenue Procedures also include special rules for Section 1031 Like-Kind Exchanges.9 The last day of the 45-day identification period, the last day of the 180-day exchange period, and the last day of any deadlines set forth under Rev. Proc. 2000-37 for parking exchanges, specifically those “that fall on or after the date of a federally declared disaster, are postponed by 120 days or to the last day of the general disaster extension period authorized by an IRS News Release or other guidance announcing tax relief for victims of the specific federally declared disaster, whichever is later.”10

Affected Taxpayers who meet the terms of the Disaster Relief Notice must choose the relief provided in Section 6 or Section 17 of Rev. Proc. 2018-58. Section 6 applies only to Affected Taxpayers as defined in the Disaster Relief Notice and postpones deadlines falling between the Disaster Date in the Disaster Relief Notice and the last day of the Postponement Period to the last day of the Postponement Period.

Example A: Disaster Date is May 15, and the last day of the Postponement Period is September 15. The Taxpayer is an Affected Taxpayer as defined in the Disaster Relief Notice and disposes of their Relinquished Property on May 16 (after the Disaster Date), the 45th day is June 30, and the 180th day is November 12. Under Section 6, the ID deadline is postponed to September 15, the last day of the Postponement Period. The exchange period deadline is not postponed because it did not fall between the disaster date and the last day of the Postponement Period.

Section 17 applies to both Affected Taxpayers and Non-Affected Taxpayers who otherwise qualify for the disaster relief. It is important to note that for Section 17 to apply, the Relinquished Property must have been transferred (or the parked property must have been parked), on or before the Disaster Date. Section 17 permits both 1031 Exchange deadlines to be postponed for 120 days or until the last day of the Postponement Period, whichever is later. However, under no circumstances may the postponement go beyond (a) the due date, including extensions, of the Exchanger’s tax return for the year of the transfer, or (b) one year.11

Example B: Same basic facts as Example A. The Affected Taxpayer cannot benefit from Section 17 postponements because the transfer of the Relinquished Property occurred after the Disaster Date. This Taxpayer does not obtain the 120-day postponement.

Example C: Same basic facts as Example A, however, the Affected Taxpayer sold the Relinquished Property on May 1, before the May 15 Disaster Date, and has a 45-day deadline of June 15 and a 180-day deadline of October 28. If this Affected Taxpayer chooses Section 17 relief, then they may extend both their 45-day and 180-day deadlines by 120 days or until the last day of the Disaster Period, whichever is later.

How to Obtain Disaster Relief

For Exchangers located in the disaster area, the IRS maintains a list of the ZIP codes located within the disaster area and administratively tags the accounts of those Exchangers. The IRS automatically provides filing relief to these Exchangers, and they do not need to do anything further.

As discussed above, there are categories of Affected Taxpayer who are not physically located within the disaster area. Individuals who qualify for relief but who are not physically located within the disaster area must inform the IRS that they have been impacted by the disaster. These individuals must contact the IRS by calling 866-562-5227. It is important to remember that Affected Taxpayers also includes workers affiliated with recognized government of philanthropic agencies assisting the relief activities.

To qualify for an extension on 1031 Exchange deadlines, the Exchanger must qualify for relief under both the specific Disaster Relief Notice and the terms of Rev. Proc. 2018-58.12

Exchangers who believe that they may qualify for disaster related extensions on the 1031 Exchanges must consult with their tax and legal advisors. Upon determining that they qualify for such extensions, they must then promptly notify their Qualified Intermediary so that the Intermediary may properly notate the exchange files.

The material in this blog is presented for informational purposes only. The information presented is not intended as investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Sources:

1. Wildfires in California, Hawaii, and Washington. Tornadoes in Arkansas, Florida, Illinois, Iowa, Kentucky, Missouri, Mississippi, and West Virginia. Tropical storms in Florida, Louisiana, North Carolina, Pennsylvania, Puerto Rico, Tennessee, the U.S. Virgin Islands. Flooding in Alaska, Arizona, Arkansas, California, Connecticut, Illinois, Iowa, Maine, Massachusetts, Minnesota, Mississippi, Missouri, New Mexico, New York, Rhode Island, South Dakota, Texas, and West Virginia.

2. IRC §1031(a)(3).

3. 42 USC 5121, et seq.

4. Strafford Act Section 102(2); 42 USC 5122.

5. 26 USC §7508A.

6. 26 USC §7508A(d)(2).

7. Notice 2023-71 provided relief to taxpayers who were unable to meet filing or payment deadlines due to the terrorist attacks in Israel in October 2023.

8. Rev. Proc. 2007-56, Section 3; Rev. Proc. 2018-58, Section 3.

9. Rev. Proc. 2007-56, Section 17; Rev. Proc. 2018-58, Section 17.

10. Rev. Proc. 2018-58, Section 17.02(1).

11. Rev. Proc. 2018-58, Section 17.02.

12. Rev. Proc. 2018-58, Section 17.02(2)(b) -

Disaster Extensions and 1031 Exchanges

Large scale disasters caused by wildfires, tornadoes, tropical storms, flooding, and other natural events impacted Exchangers in more than two dozen states in 2024.1 For those impacted, various forms of assistance were available from a variety of government and non-government organizations including Federal Emergency Management Agency, Small Business Administration, United States Department of Agriculture, and others. The Internal Revenue Service provided relief by allowing those defined as “Affected Taxpayers” to deduct casualty losses and extend certain time sensitive deadlines. But how do declared disasters impact IRC Section 1031 Tax Deferred Exchanges specifically?

Section 1031 Background

Under IRC Section 1031(a)(1), “no gain or loss is recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchange solely for property of like kind that is to be held for productive use in a trade or business or for investment.” The Code section goes on to provide the Replacement Property is deemed to be not like-kind property if it is not identified on or before the 45th day after the transfer of the Relinquished Property, or if the property isn’t acquired by the earlier of (i) the 180th day after the transfer of the Relinquished Property, or (ii) the due date for the Taxpayer’s return for the tax year in which the transfer of the Relinquished Property occurs, including extensions.2

For example, in a forward exchange, if the Exchanger transferred the Relinquished Property on November 1, 2024, the 45-day identification deadline would be December 16, 2024, and the 180-day exchange deadline would be April 30, 2025. However, the Exchanger’s tax return deadline is April 15, 2025, which effectively shortens their exchange period unless they file Form 4868 to extend the deadline. Note, these deadlines and Form 4868 apply to individuals and married couples. Other deadlines and forms are to be used for other Exchangers including Farmers and Ranchers, Corporations, and Partnerships.

In a parking exchange, or “reverse” exchange/and or property improvement exchanges, the same calculations would apply. If, through a properly structured parking exchange, the exchange company, technically referred to as the Exchange Accommodation Titleholder, acquired the Exchanger’s Replacement Property on November 1, 2024, the Exchanger would have until December 16, 2024 to identify which property (or properties) in their existing portfolio would be the target for disposition, and until April 15, 2025 to complete that disposition (unless they file Form 4868 for an extension on their tax return).

IRS Disaster Extensions

The Robert T. Stafford Disaster Relief and Emergency Assistance Act (“Stafford Act”) of 19883 amended the Disaster Relief Act of 1974. Section 401(a) of the Stafford Act provides that the Governor of an affected state must request that the President declare that a ‘major disaster’ exists. Major Disaster is defined as:

“any natural catastrophe (including any hurricane, tornado, storm, high water, wind-driven [sic] water, tidal wave, tsunami, earthquake, volcanic eruption, landslide, mudslide, snowstorm, or drought), or, regardless of cause, any fire, flood, or explosion, in any part of the United States, which in the determination of the President causes damage of sufficient severity and magnitude to warrant major disaster assistance under this Act to supplement the efforts and available resources of States, local governments, and disaster relief organizations in alleviating the damage, loss, hardship, or suffering caused thereby.”4

Further, the Secretary of the Treasury may extend certain time sensitive acts for up to one year for Exchangers affected by a federally declared natural disaster.5 Under IRC §7508A(d)(2), “Qualified Taxpayers” are

(A) Any individual whose principal residence (for purposes of section 1033(h)(4)) is located in a disaster area,

(B) Any taxpayer if the taxpayer’s principal place of business (other than the business of performing services as an employee) is located in a disaster area,

(C) Any individual who is a relief worker affiliated with a recognized government or philanthropic organization and who is assisting in a disaster area,

(D) Any taxpayer whose records necessary to meet a deadline for an act described in section 7508(a)(1) are maintained in a disaster area,

(E) Any individual visiting a disaster are who was killed or injured as a result of the disaster, and

(F) Solely with respect to a joint return, any spouse of an individual described in any preceding subparagraph of this paragraph.6

Exchangers may determine if an event was designated by the President as a federally declared disaster area by searching on https://www.fema.gov/disaster/declarations”>FEMA’s Disaster & Declarations page. Many, but not all, of these disasters will also be posted to the www.irs.gov/newsroom/tax-relief-in-disaster-situations”>IRS Newsroom. FEMA can provide assistance in one of three forms – public assistance, individual assistance, or a combination of public and individual assistance. Public assistance is when FEMA provides grants to state and local governments for items like debris removal, repairing roads and bridges, public buildings, and public utilities. Compare this to individual assistance, which is when FEMA provides grants to individuals for items like temporary housing, housing repair and replacement, as well as funeral expenses, just to name a few.

When the President declares a federal disaster, FEMA will designate what counties, or parishes, are entitled to relief and what types of relief. This information is shared with the public and a map is generated to facilitate the sharing of this information. As an example, below is the map that was published in the wake of severe storms, straight-line winds, flooding and tornadoes affecting Kentucky in 2022.

After the President declared that a major disaster existed in Kentucky, FEMA determined the geographical areas covered by the Declaration. Note that the map is color coded, and that there are five potential designations, by county. The counties indicated in white were not entitled to any FEMA relief. The counties highlighted in gold were entitled to public assistance only, and the counties in pink were entitled to receive both individual and public assistance. Only counties entitled to individual assistance, or public and individual assistance will receive disaster extensions.

Revenue Procedure 2018-58

Revenue Procedure 2018-58 updates Revenue Procedure 2007-56 with the purpose of providing an updated list of time sensitive acts that may be postponed under Sections 7508 and 7508A of the IRC.

Further, Rev. Proc. 2007-56 and 2018-58 extend the definition of Affected Taxpayer to include individuals serving in the Armed Forces of the United States in a combat zone, or serving in support of such Armed Forces, individuals serving with respect to contingency operations, Affected Taxpayers by reason of federally declared disasters within the meaning of § 301.7508A-1(d)(1), or Taxpayers whom the IRS determines are affected by a terroristic7 or military action.8

The Revenue Procedures also include special rules for Section 1031 Like-Kind Exchanges.9 The last day of the 45-day identification period, the last day of the 180-day exchange period, and the last day of any deadlines set forth under Rev. Proc. 2000-37 for parking exchanges, specifically those “that fall on or after the date of a federally declared disaster, are postponed by 120 days or to the last day of the general disaster extension period authorized by an IRS News Release or other guidance announcing tax relief for victims of the specific federally declared disaster, whichever is later.”10

Affected Taxpayers who meet the terms of the Disaster Relief Notice must choose the relief provided in Section 6 or Section 17 of Rev. Proc. 2018-58. Section 6 applies only to Affected Taxpayers as defined in the Disaster Relief Notice and postpones deadlines falling between the Disaster Date in the Disaster Relief Notice and the last day of the Postponement Period to the last day of the Postponement Period.

Example A: Disaster Date is May 15, and the last day of the Postponement Period is September 15. The Taxpayer is an Affected Taxpayer as defined in the Disaster Relief Notice and disposes of their Relinquished Property on May 16 (after the Disaster Date), the 45th day is June 30, and the 180th day is November 12. Under Section 6, the ID deadline is postponed to September 15, the last day of the Postponement Period. The exchange period deadline is not postponed because it did not fall between the disaster date and the last day of the Postponement Period.

Section 17 applies to both Affected Taxpayers and Non-Affected Taxpayers who otherwise qualify for the disaster relief. It is important to note that for Section 17 to apply, the Relinquished Property must have been transferred (or the parked property must have been parked), on or before the Disaster Date. Section 17 permits both 1031 Exchange deadlines to be postponed for 120 days or until the last day of the Postponement Period, whichever is later. However, under no circumstances may the postponement go beyond (a) the due date, including extensions, of the Exchanger’s tax return for the year of the transfer, or (b) one year.11

Example B: Same basic facts as Example A. The Affected Taxpayer cannot benefit from Section 17 postponements because the transfer of the Relinquished Property occurred after the Disaster Date. This Taxpayer does not obtain the 120-day postponement.

Example C: Same basic facts as Example A, however, the Affected Taxpayer sold the Relinquished Property on May 1, before the May 15 Disaster Date, and has a 45-day deadline of June 15 and a 180-day deadline of October 28. If this Affected Taxpayer chooses Section 17 relief, then they may extend both their 45-day and 180-day deadlines by 120 days or until the last day of the Disaster Period, whichever is later.

How to Obtain Disaster Relief

For Exchangers located in the disaster area, the IRS maintains a list of the ZIP codes located within the disaster area and administratively tags the accounts of those Exchangers. The IRS automatically provides filing relief to these Exchangers, and they do not need to do anything further.

As discussed above, there are categories of Affected Taxpayer who are not physically located within the disaster area. Individuals who qualify for relief but who are not physically located within the disaster area must inform the IRS that they have been impacted by the disaster. These individuals must contact the IRS by calling 866-562-5227. It is important to remember that Affected Taxpayers also includes workers affiliated with recognized government of philanthropic agencies assisting the relief activities.

To qualify for an extension on 1031 Exchange deadlines, the Exchanger must qualify for relief under both the specific Disaster Relief Notice and the terms of Rev. Proc. 2018-58.12

Exchangers who believe that they may qualify for disaster related extensions on the 1031 Exchanges must consult with their tax and legal advisors. Upon determining that they qualify for such extensions, they must then promptly notify their Qualified Intermediary so that the Intermediary may properly notate the exchange files.

The material in this blog is presented for informational purposes only. The information presented is not intended as investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Sources:

1. Wildfires in California, Hawaii, and Washington. Tornadoes in Arkansas, Florida, Illinois, Iowa, Kentucky, Missouri, Mississippi, and West Virginia. Tropical storms in Florida, Louisiana, North Carolina, Pennsylvania, Puerto Rico, Tennessee, the U.S. Virgin Islands. Flooding in Alaska, Arizona, Arkansas, California, Connecticut, Illinois, Iowa, Maine, Massachusetts, Minnesota, Mississippi, Missouri, New Mexico, New York, Rhode Island, South Dakota, Texas, and West Virginia.

2. IRC §1031(a)(3).

3. 42 USC 5121, et seq.

4. Strafford Act Section 102(2); 42 USC 5122.

5. 26 USC §7508A.

6. 26 USC §7508A(d)(2).

7. Notice 2023-71 provided relief to taxpayers who were unable to meet filing or payment deadlines due to the terrorist attacks in Israel in October 2023.

8. Rev. Proc. 2007-56, Section 3; Rev. Proc. 2018-58, Section 3.

9. Rev. Proc. 2007-56, Section 17; Rev. Proc. 2018-58, Section 17.

10. Rev. Proc. 2018-58, Section 17.02(1).

11. Rev. Proc. 2018-58, Section 17.02.

12. Rev. Proc. 2018-58, Section 17.02(2)(b) -

Disaster Extensions and 1031 Exchanges

Large scale disasters caused by wildfires, tornadoes, tropical storms, flooding, and other natural events impacted Exchangers in more than two dozen states in 2024.1 For those impacted, various forms of assistance were available from a variety of government and non-government organizations including Federal Emergency Management Agency, Small Business Administration, United States Department of Agriculture, and others. The Internal Revenue Service provided relief by allowing those defined as “Affected Taxpayers” to deduct casualty losses and extend certain time sensitive deadlines. But how do declared disasters impact IRC Section 1031 Tax Deferred Exchanges specifically?

Section 1031 Background

Under IRC Section 1031(a)(1), “no gain or loss is recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchange solely for property of like kind that is to be held for productive use in a trade or business or for investment.” The Code section goes on to provide the Replacement Property is deemed to be not like-kind property if it is not identified on or before the 45th day after the transfer of the Relinquished Property, or if the property isn’t acquired by the earlier of (i) the 180th day after the transfer of the Relinquished Property, or (ii) the due date for the Taxpayer’s return for the tax year in which the transfer of the Relinquished Property occurs, including extensions.2

For example, in a forward exchange, if the Exchanger transferred the Relinquished Property on November 1, 2024, the 45-day identification deadline would be December 16, 2024, and the 180-day exchange deadline would be April 30, 2025. However, the Exchanger’s tax return deadline is April 15, 2025, which effectively shortens their exchange period unless they file Form 4868 to extend the deadline. Note, these deadlines and Form 4868 apply to individuals and married couples. Other deadlines and forms are to be used for other Exchangers including Farmers and Ranchers, Corporations, and Partnerships.

In a parking exchange, or “reverse” exchange/and or property improvement exchanges, the same calculations would apply. If, through a properly structured parking exchange, the exchange company, technically referred to as the Exchange Accommodation Titleholder, acquired the Exchanger’s Replacement Property on November 1, 2024, the Exchanger would have until December 16, 2024 to identify which property (or properties) in their existing portfolio would be the target for disposition, and until April 15, 2025 to complete that disposition (unless they file Form 4868 for an extension on their tax return).

IRS Disaster Extensions

The Robert T. Stafford Disaster Relief and Emergency Assistance Act (“Stafford Act”) of 19883 amended the Disaster Relief Act of 1974. Section 401(a) of the Stafford Act provides that the Governor of an affected state must request that the President declare that a ‘major disaster’ exists. Major Disaster is defined as:

“any natural catastrophe (including any hurricane, tornado, storm, high water, wind-driven [sic] water, tidal wave, tsunami, earthquake, volcanic eruption, landslide, mudslide, snowstorm, or drought), or, regardless of cause, any fire, flood, or explosion, in any part of the United States, which in the determination of the President causes damage of sufficient severity and magnitude to warrant major disaster assistance under this Act to supplement the efforts and available resources of States, local governments, and disaster relief organizations in alleviating the damage, loss, hardship, or suffering caused thereby.”4

Further, the Secretary of the Treasury may extend certain time sensitive acts for up to one year for Exchangers affected by a federally declared natural disaster.5 Under IRC §7508A(d)(2), “Qualified Taxpayers” are

(A) Any individual whose principal residence (for purposes of section 1033(h)(4)) is located in a disaster area,

(B) Any taxpayer if the taxpayer’s principal place of business (other than the business of performing services as an employee) is located in a disaster area,

(C) Any individual who is a relief worker affiliated with a recognized government or philanthropic organization and who is assisting in a disaster area,

(D) Any taxpayer whose records necessary to meet a deadline for an act described in section 7508(a)(1) are maintained in a disaster area,

(E) Any individual visiting a disaster are who was killed or injured as a result of the disaster, and

(F) Solely with respect to a joint return, any spouse of an individual described in any preceding subparagraph of this paragraph.6

Exchangers may determine if an event was designated by the President as a federally declared disaster area by searching on https://www.fema.gov/disaster/declarations”>FEMA’s Disaster & Declarations page. Many, but not all, of these disasters will also be posted to the www.irs.gov/newsroom/tax-relief-in-disaster-situations”>IRS Newsroom. FEMA can provide assistance in one of three forms – public assistance, individual assistance, or a combination of public and individual assistance. Public assistance is when FEMA provides grants to state and local governments for items like debris removal, repairing roads and bridges, public buildings, and public utilities. Compare this to individual assistance, which is when FEMA provides grants to individuals for items like temporary housing, housing repair and replacement, as well as funeral expenses, just to name a few.

When the President declares a federal disaster, FEMA will designate what counties, or parishes, are entitled to relief and what types of relief. This information is shared with the public and a map is generated to facilitate the sharing of this information. As an example, below is the map that was published in the wake of severe storms, straight-line winds, flooding and tornadoes affecting Kentucky in 2022.

After the President declared that a major disaster existed in Kentucky, FEMA determined the geographical areas covered by the Declaration. Note that the map is color coded, and that there are five potential designations, by county. The counties indicated in white were not entitled to any FEMA relief. The counties highlighted in gold were entitled to public assistance only, and the counties in pink were entitled to receive both individual and public assistance. Only counties entitled to individual assistance, or public and individual assistance will receive disaster extensions.

Revenue Procedure 2018-58

Revenue Procedure 2018-58 updates Revenue Procedure 2007-56 with the purpose of providing an updated list of time sensitive acts that may be postponed under Sections 7508 and 7508A of the IRC.

Further, Rev. Proc. 2007-56 and 2018-58 extend the definition of Affected Taxpayer to include individuals serving in the Armed Forces of the United States in a combat zone, or serving in support of such Armed Forces, individuals serving with respect to contingency operations, Affected Taxpayers by reason of federally declared disasters within the meaning of § 301.7508A-1(d)(1), or Taxpayers whom the IRS determines are affected by a terroristic7 or military action.8

The Revenue Procedures also include special rules for Section 1031 Like-Kind Exchanges.9 The last day of the 45-day identification period, the last day of the 180-day exchange period, and the last day of any deadlines set forth under Rev. Proc. 2000-37 for parking exchanges, specifically those “that fall on or after the date of a federally declared disaster, are postponed by 120 days or to the last day of the general disaster extension period authorized by an IRS News Release or other guidance announcing tax relief for victims of the specific federally declared disaster, whichever is later.”10

Affected Taxpayers who meet the terms of the Disaster Relief Notice must choose the relief provided in Section 6 or Section 17 of Rev. Proc. 2018-58. Section 6 applies only to Affected Taxpayers as defined in the Disaster Relief Notice and postpones deadlines falling between the Disaster Date in the Disaster Relief Notice and the last day of the Postponement Period to the last day of the Postponement Period.

Example A: Disaster Date is May 15, and the last day of the Postponement Period is September 15. The Taxpayer is an Affected Taxpayer as defined in the Disaster Relief Notice and disposes of their Relinquished Property on May 16 (after the Disaster Date), the 45th day is June 30, and the 180th day is November 12. Under Section 6, the ID deadline is postponed to September 15, the last day of the Postponement Period. The exchange period deadline is not postponed because it did not fall between the disaster date and the last day of the Postponement Period.

Section 17 applies to both Affected Taxpayers and Non-Affected Taxpayers who otherwise qualify for the disaster relief. It is important to note that for Section 17 to apply, the Relinquished Property must have been transferred (or the parked property must have been parked), on or before the Disaster Date. Section 17 permits both 1031 Exchange deadlines to be postponed for 120 days or until the last day of the Postponement Period, whichever is later. However, under no circumstances may the postponement go beyond (a) the due date, including extensions, of the Exchanger’s tax return for the year of the transfer, or (b) one year.11

Example B: Same basic facts as Example A. The Affected Taxpayer cannot benefit from Section 17 postponements because the transfer of the Relinquished Property occurred after the Disaster Date. This Taxpayer does not obtain the 120-day postponement.

Example C: Same basic facts as Example A, however, the Affected Taxpayer sold the Relinquished Property on May 1, before the May 15 Disaster Date, and has a 45-day deadline of June 15 and a 180-day deadline of October 28. If this Affected Taxpayer chooses Section 17 relief, then they may extend both their 45-day and 180-day deadlines by 120 days or until the last day of the Disaster Period, whichever is later.

How to Obtain Disaster Relief

For Exchangers located in the disaster area, the IRS maintains a list of the ZIP codes located within the disaster area and administratively tags the accounts of those Exchangers. The IRS automatically provides filing relief to these Exchangers, and they do not need to do anything further.

As discussed above, there are categories of Affected Taxpayer who are not physically located within the disaster area. Individuals who qualify for relief but who are not physically located within the disaster area must inform the IRS that they have been impacted by the disaster. These individuals must contact the IRS by calling 866-562-5227. It is important to remember that Affected Taxpayers also includes workers affiliated with recognized government of philanthropic agencies assisting the relief activities.

To qualify for an extension on 1031 Exchange deadlines, the Exchanger must qualify for relief under both the specific Disaster Relief Notice and the terms of Rev. Proc. 2018-58.12

Exchangers who believe that they may qualify for disaster related extensions on the 1031 Exchanges must consult with their tax and legal advisors. Upon determining that they qualify for such extensions, they must then promptly notify their Qualified Intermediary so that the Intermediary may properly notate the exchange files.

The material in this blog is presented for informational purposes only. The information presented is not intended as investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Sources:

1. Wildfires in California, Hawaii, and Washington. Tornadoes in Arkansas, Florida, Illinois, Iowa, Kentucky, Missouri, Mississippi, and West Virginia. Tropical storms in Florida, Louisiana, North Carolina, Pennsylvania, Puerto Rico, Tennessee, the U.S. Virgin Islands. Flooding in Alaska, Arizona, Arkansas, California, Connecticut, Illinois, Iowa, Maine, Massachusetts, Minnesota, Mississippi, Missouri, New Mexico, New York, Rhode Island, South Dakota, Texas, and West Virginia.

2. IRC §1031(a)(3).

3. 42 USC 5121, et seq.

4. Strafford Act Section 102(2); 42 USC 5122.

5. 26 USC §7508A.

6. 26 USC §7508A(d)(2).

7. Notice 2023-71 provided relief to taxpayers who were unable to meet filing or payment deadlines due to the terrorist attacks in Israel in October 2023.

8. Rev. Proc. 2007-56, Section 3; Rev. Proc. 2018-58, Section 3.

9. Rev. Proc. 2007-56, Section 17; Rev. Proc. 2018-58, Section 17.

10. Rev. Proc. 2018-58, Section 17.02(1).

11. Rev. Proc. 2018-58, Section 17.02.

12. Rev. Proc. 2018-58, Section 17.02(2)(b) -

The Future of Sustainable Real Estate: Leveraging 1031 Exchanges for Green Investments

With buildings responsible for over 1/3 of global CO2 emissions, the shift toward sustainable real estate is growing. Government incentives, stricter regulations, and rising demand make green properties a smart investment. 1031 Exchanges offer investors a tax-efficient way to transition into eco-friendly properties or fund sustainability upgrades, aligning financial growth with green practices. In this blog, we explore key sustainability trends, investment opportunities, and how 1031 Exchanges can support the transition to green real estate.

The Rise of Sustainable Buildings

Cities and companies around the world are setting strong carbon neutrality goals, driving innovation in sustainable building practices. The World Green Building Council estimates that green buildings can cut carbon emissions by up to 50% compared to traditional structures, and hundreds of cities globally have committed to achieving carbon neutrality by 2050. Additionally, green building certifications like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are becoming more important to new construction projects, as organizations place greater emphasis on sustainable decisions.

Investment Potential

Sustainable properties not only contribute positively to the environment, but also present significant investment opportunities. Opportunities include:Market Stability: Green buildings tend to be more resilient to market fluctuations, due to their lower operational costs and long-term value, offering a more stable income stream.

Higher ROI: Sustainable properties often command higher property values and premium rental rates, leading to a higher return on investment.

Institutional Support: Environmentally conscious investors, including many https://www.accruit.com/blog/passive-real-estate-investments-reits-and-… Estate Investment Trusts (REITs) are increasingly drawn to green real estate, recognizing its potential for long-term growth.

Government Regulations and Incentives

In the United States, federal, state, and local governments actively promote sustainable real estate through various policies, regulations, and financial incentives designed to encourage green development.

Key PoliciesStricter Building Codes: Regulations now require higher energy efficiency, water conservation, and use of sustainable materials in construction. For example, the International Green Construction Code (IgCC) provides a comprehensive approach to building design, construction, and operation, establishing mandatory green standards for buildings.

Carbon Emission Regulations and Incentives: Policies are being introduced that penalize high carbon emissions, encouraging businesses and builders to adopt greener practices. The Inflation Reduction Act (IRA) supports these efforts by offering tax credits and rebates to incentivize energy-efficient and renewable energy improvements.

Green Certification Programs: Certifications like LEED provide incentives for meeting sustainability standards, promoting green construction. These certifications provide clear guidelines for sustainable building practices.

Incentives for Builders and Buyers

Tax Credits: Builders and property owners can benefit from tax credits for investing in energy-efficient systems and materials. For example, the 45L Tax Credit offers up to $5,000 per unit for energy-efficient homes, promoting sustainable housing while lowering energy costs for both owners and tenants.

Subsidies: Government subsidies are available to support the installation of renewable energy systems and retrofitting of existing buildings. The IRA allocates funds to clean energy production, including support for renewable energy installations.

Financing: Green construction projects can benefit from financing options, making it easier to invest in sustainable building practices. Various programs are available to assist with energy-efficient purchases and improvements, such as green loans. Green loans are a dedicated type of financing designed for eco-friendly projects, such as solar loans, energy-efficiency loans, and green mortgages. They often require proof that the funds were used for sustainable projects and may offer lower interest rates to encourage sustainable practices.

These policies and incentives are designed to reduce the cost of adopting sustainable real estate, encouraging wider participation and fostering continued growth in the sector.

Green Housing

“Green housing” refers to homes built with energy-efficient resources and environmentally sustainable practices. The goal is to create homes that are not only environmentally responsible but also cost-effective, offering long-term financial benefits to homeowners.

Key Benefits of Green HousingPreserving the Environment: Green housing minimizes carbon footprints, conserves energy, and uses recyclable materials while reducing costs for homeowners.

Sustainable Upgrades: Upgrades such as solar panels, energy-efficient appliances, and recycled materials make green homes both eco-friendly and more cost-effective for the tenants. In California, sustainability is further prioritized through the state’s solar mandate, which requires all new homes and low-rise multifamily properties to have solar panels installed during construction, ensuring that renewable energy is integrated from the start.

Green Real Estate and 1031 Exchanges

Green real estate represents a shift in how properties are designed, renovated, and managed. As eco-friendly materials and energy-efficient technologies like solar panels and wind energy become more widely adopted, green properties are becoming highly desirable investments.

While tax incentives, such as the 30% federal tax credit for installing solar panels, don’t directly impact 1031 Exchanges, they can play a role in influencing investor decisions. Investors seeking to maximize returns on green properties can benefit from these incentives, as they help offset the costs of installing energy-efficient systems, making the property more financially viable. In some cases, tax credits and rebates can even improve ROI by reducing the upfront costs of making green upgrades and yielding higher rents from tenants.

For example, consider a residential property worth $270,000 generating $2,250/month in rent. Operating costs, such as maintenance and insurance, amount to 3.08% of the gross rental income. After accounting for these expenses, the property has an expected Net Operating Income (NOI) of 5.25%. Operating costs, such as maintenance and insurance, consume 3.08% of that income. If the investor decides to install solar panels at an estimated cost of $15,000, the total investment increases to $285,000. While rental rates might not immediately increase as a result of the solar installation, the 30% tax credit could offset up to $4,500 of the expense, significantly reducing the effective cost of the upgrade. Studies show that LEED-certified multifamily properties command a 9% rental premium, double that of non-certified properties. In the office sector, LEED-certified office buildings achieve an average rent 31% higher than non-certified buildings. For class A, green-certified office properties, there is an average 7.1% rental premium. Studies conducted across 20 major global office markets found that only 34% of the future demand for low-carbon workspace will be met in the coming years. In other words, for every 9 square feet of demand, only 3 square feet is currently in the pipeline. Over time, the combination of energy savings and increasing demand for sustainable properties could further enhance a property’s profitability.

Using 1031 Exchanges for Green Investments

A 1031 Exchange is a powerful tax-deferral strategy that allows real estate investors to reinvest proceeds from the sale of one property into another like-kind property, deferring associated taxes in the process. For investors focused on sustainability, this creates an opportunity to transition into green real estate without the immediate tax burden, while simultaneously benefiting from long-term energy savings and enhanced property value.

An https://www.accruit.com/blog/1031-exchanges-involving-construction-and-… exchange can also be valuable strategy, allowing investors to use a portion of their reinvestment funds to upgrade the Replacement Property(ies). If properly structured, sustainability improvements such as solar panel installations or water-saving fixtures can be included as part of the Replacement Property value. This means investors can reinvest in green real estate while still deferring taxes, effectively combining the benefits of both tax deferral and sustainable property improvements. Additionally, Exchangers installing solar panels as part of a 1031 Exchange can still take advantage of the 30% tax incentive, as this incentive is separate from the exchange and allows the Exchanger to deduct 30% of the cost from their Adjust Gross Income, regardless of the source of the funds.

By leveraging a 1031 Exchange for sustainability upgrades, investors not only maximize tax benefits, but enhance the long-term value and efficiency of their properties.

The future of real estate is going green. Sustainable building practices, government incentives, and growing investor interest are shaping the industry. While tax incentives for environmentally friendly building upgrades don’t directly affect 1031 Exchanges, they make green investments more attractive by reducing upfront costs. Investors seeking strong returns and sustainability should consider green properties, whether through upgrades, improvement exchanges, or utilizing incentives, ensuring both financial growth and positive environmental impact.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Sources:

Green Real Estate: The Key Sustainability Trends for 2025 | GEP Blog

Sustainability reporting in construction and real estate sector: A conceptualization and a review of existing literature – ScienceDirect

Why Bother with Certification? LEED-Certified Apartments Earn Higher Rents :: GBIG Insight

Green Loans and Eco-Friendly Lending | Axelrad Capital