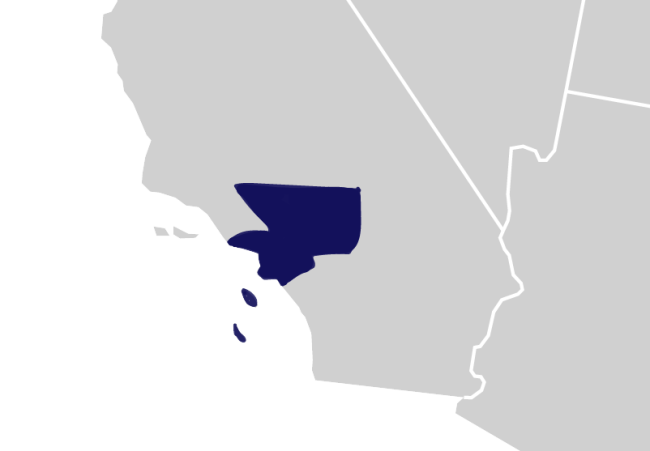

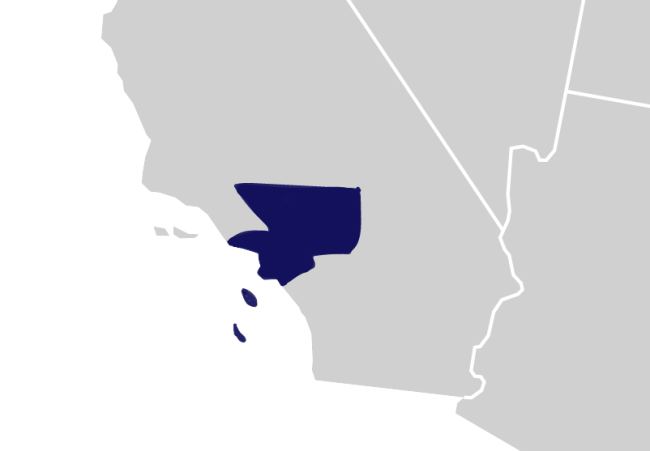

Due to California wildfires, the IRS has issued Tax Relief for Los Angeles County.

Affected Taxpayers have until October 15, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Los Angeles County qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

Who is an “Affected Taxpayer”?

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the Relinquished Property or Replacement Property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Relief Specific to 1031 Exchanges for Affected Taxpayers

General Postponement under Section 6 of Rev. Proc. 2018-58 under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Relief for Taxpayers with Related Difficulties

Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the Relinquished Property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the Relinquished Property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-california-wildfire-victims-qualify-fo… style=”font-size:12.0pt”>Visit for full details on the tax relief for Los Angeles wildfires.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Category: Company and Industry News

-

The IRS Announces Tax Relief for California Taxpayers Impacted by Wildfires

-

The IRS Announces Tax Relief for California Taxpayers Impacted by Wildfires

Due to California wildfires, the IRS has issued Tax Relief for Los Angeles County.

Affected Taxpayers have until October 15, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Los Angeles County qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

Who is an “Affected Taxpayer”?

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the Relinquished Property or Replacement Property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Relief Specific to 1031 Exchanges for Affected Taxpayers

General Postponement under Section 6 of Rev. Proc. 2018-58 under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Relief for Taxpayers with Related Difficulties

Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the Relinquished Property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the Relinquished Property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-california-wildfire-victims-qualify-fo… style=”font-size:12.0pt”>Visit for full details on the tax relief for Los Angeles wildfires.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

-

2024 A Year in Review

It is with great excitement that Accruit presents our 2024 Year in Review infographic, a vibrant encapsulation of our remarkable achievements over the past year. This visually engaging infographic highlights the substantial growth across all of our product lines, underscoring our unwavering commitment to innovation and market responsiveness.

Moreover, the infographic emphasizes our active involvement in the industry and our dedication to educating various audiences on 1031 exchanges. Through participation in various events, conferences, and workshops, we have shared our expertise and fostered a deeper understanding of tax deferred exchanges, helping clients navigate their complexities with confidence.

2024 was a tremendous success. We look forward to another great year ahead, our team will continue to revolutionize the 1031 industry through our innovative solutions and exceptional customer service.

-

2024 A Year in Review

It is with great excitement that Accruit presents our 2024 Year in Review infographic, a vibrant encapsulation of our remarkable achievements over the past year. This visually engaging infographic highlights the substantial growth across all of our product lines, underscoring our unwavering commitment to innovation and market responsiveness.

Moreover, the infographic emphasizes our active involvement in the industry and our dedication to educating various audiences on 1031 exchanges. Through participation in various events, conferences, and workshops, we have shared our expertise and fostered a deeper understanding of tax deferred exchanges, helping clients navigate their complexities with confidence.

2024 was a tremendous success. We look forward to another great year ahead, our team will continue to revolutionize the 1031 industry through our innovative solutions and exceptional customer service.

-

2024 A Year in Review

It is with great excitement that Accruit presents our 2024 Year in Review infographic, a vibrant encapsulation of our remarkable achievements over the past year. This visually engaging infographic highlights the substantial growth across all of our product lines, underscoring our unwavering commitment to innovation and market responsiveness.

Moreover, the infographic emphasizes our active involvement in the industry and our dedication to educating various audiences on 1031 exchanges. Through participation in various events, conferences, and workshops, we have shared our expertise and fostered a deeper understanding of tax deferred exchanges, helping clients navigate their complexities with confidence.

2024 was a tremendous success. We look forward to another great year ahead, our team will continue to revolutionize the 1031 industry through our innovative solutions and exceptional customer service.

-

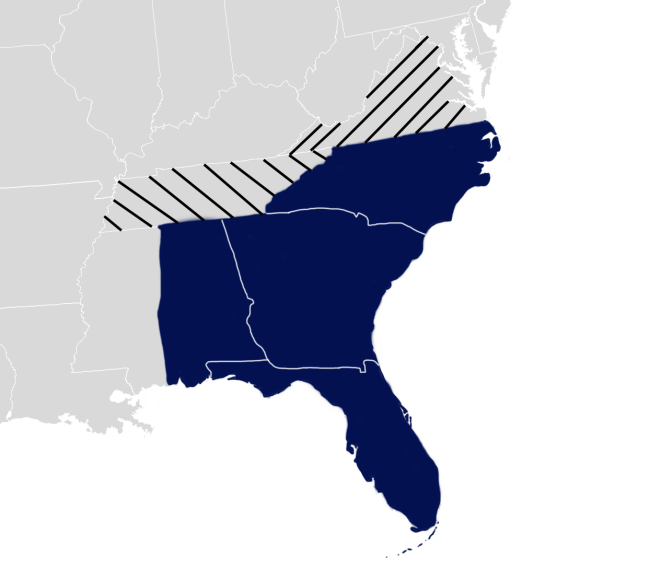

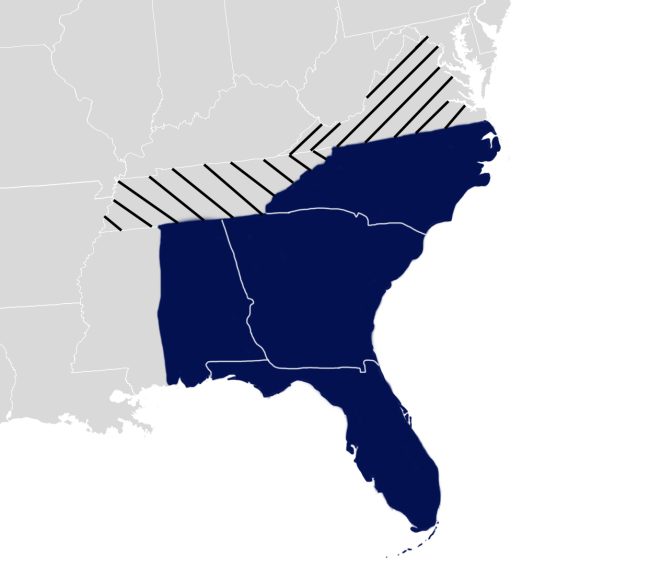

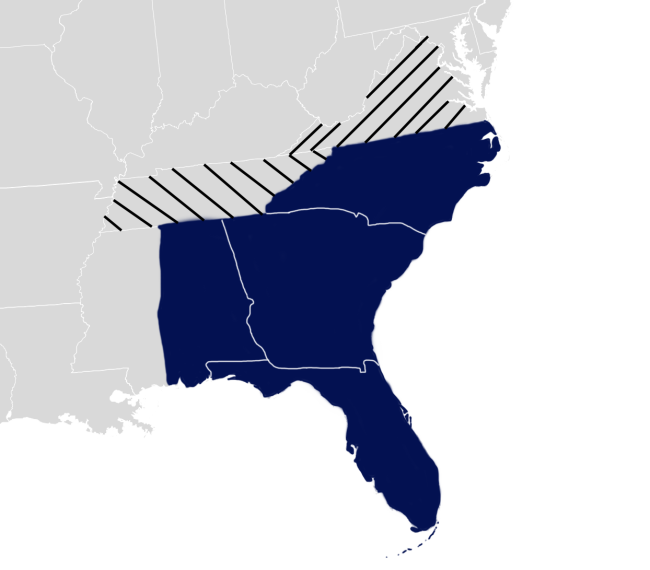

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Accruit Recap of FEA Annual Conference 2024

1031 Exchange Industry Education and Involvement

Accruit continued its deep-rooted involvement in educating peers within the 1031 Exchange industry with David Gorenberg co-presenting the 1031 Exchange Bootcamp, which covered topics such as the role of Qualified Intermediaries, intricacies of identification rules, mixed-use properties, and safe harbors. David also led a General Session discussion, A Frank Discussion on Ethics, where the relationship between ethics and 1031 Exchanges was analyzed. As a past co-chair of the FEA Ethics Committee, David’s insights were essential to the conversation.

Brent Abrahm, President and CEO of Accruit, was involved in a panel discussion regarding the FEA Political Action Committee (PAC). The panel underscored the importance of funding the PAC through individual FEA members to help support the work being done in Washington D.C. to protect IRC Section 1031. Brent is proud to point out that, “Accruit was recognized as the only company in the FEA that had 100% participation to the FEA PAC in 2023 and our goal is to do it again in 2024.”

Steve Holtkamp, Senior Managing Director and Chief Revenue Officer, was also present at the conference, attending the Board of Directors meeting to which he is a member. “Steve’s thoughtful approach and meaningful participation on the Board have been recognized and appreciated by his fellow Board members,” said Max Hansen, Managing Director at Accruit.

Michele Smith and Asher joined the rest of the Accruit team at the conference to attend the educational presentations to stay up to date on the latest concepts, receive CE credit, and uphold their status as Certified Exchange Specialists®. Additionally, Ellie Trovato was recognized for being the newest member of the CES® Certification council.

First-time attendees Darcy Yeldell and Noah Doran were delighted to join Accruit’s veteran attendees at the conference.

Darcy shared that, “Having the opportunity to surround myself with other industry professionals and colleagues was amazing. The wealth of knowledge was cool to see and even though a lot of us are competitors, you could feel that we all came together to support each other and our love for 1031’s!”

Noah noted that the FEA Annual Conference was, “An excellent opportunity to meet others new to the FEA, and the speakers emphasized the importance of getting involved. Their encouragement inspired me to join the Membership Committee, which I’m excited about!”

1031 Achievements and Recognition

We are thrilled to announce that at the FEA Annual Conference David Gorenberg, Educational and Technical Director, was recognized for his involvement in the 1031 Exchange industry as a recipient of the prestigious Margo McDonnell Certified Exchange Specialist® Perpetual Award. This award is based on peer nominations and given to an individual who has demonstrated outstanding dedication and made exceptional contributions to the 1031 Exchange industry. “In his usual humble way, David was very surprised when he received the richly deserved award. Aside from being a great human being and serving as a past President of the FEA, it really is the pinnacle of David’s career,” said Max Hansen.

David has over 30 years’ experience involved in the 1031 industry, he is a current member and past president of the FEA and co-chair of the FEA Ethics Committee. His contributions include lecturing at the Real Estate Investment Securities Association, National Association of REALTORS®, and multiple FEA Conferences amongst many others.

David wasn’t the only member of Accruit to be recognized for his contributions and commitment to the 1031 Exchange industry at the Annual Conference. Steve Holtkamp was elected to a 2nd term on the FEA Board of Directors and was also asked to serve as the FEA’s incoming Treasurer and Secretary. Reflecting on his involvement, Steve shared, “I was on the Finance Committee and really enjoyed participating and was able to provide a lot of value on that front given my background, so it was my pleasure to step into the role of Treasurer.” He hopes to further his leadership journey, adding, “Hopefully I get the opportunity to serve as President in two years.”

Exchange Manager ProSM, Patented 1031 Exchange Workflow Software

At the FEA Conference Exhibit Hall, Accruit Technologies, led by Marita Kazos and Dave Tornell, proudly showcased Exchange Manager Pro℠, patented 1031 Exchange workflow software, to fellow 1031 industry peers and Qualified Intermediaries. The conference provided the Accruit team an opportunity to connect with Exchange Manager ProSM clients, as well as some clients of Managed Service, integrated 1031 Exchange program. The Business Development team discussed success stories, plans for the future of the technology and strengthened partnerships. According to Marita, there was a lot of buzz surrounding Exchange Manager Pro℠, as she had multiple current clients come to the booth to say that they love the software, as well as prospective interest from other QIs. The Accruit team deeply values recognition received from fellow 1031 industry professionals and the positive feedback from our clients and peers regarding our software solutions and dedication to outstanding service. This motivates us to continue striving for excellence, be a leader in the industry and continue to revolutionize 1031 at every step.

Business First, Fun Included

The FEA Annual Conference was not only an incredible event for 1031 education, industry discussions, and business development, but also a fantastic opportunity to connect with fellow 1031 professionals, foster relationships, and enjoy some fun together.

Our very own CEO, Brent Abrahm, coordinated the 2nd annual charity bike ride in support of the https://johnlockhartfoundation.com/index.html”>John Lockhart Foundation, a local charity that supports vulnerable children in the Austin area as well as raises awareness for colon cancer. The 20-mile ride in the Southern Walnut Creek area included riders from Chicago Deferred Exchange Corp, Clark Wealth Management, HUB 1031, Hogan Land Title Company, First American Exchange, National Realty Exchange, and Encore Bank. The ride resulted in the group raising just under $1,000 for the cause. A highlight of this bike ride was Lance Armstrong cycling past the group – sighting confirmed by Strava, an exercise tracking app.

The 2024 FEA Annual Conference was an outstanding event for not only Accruit, but the entire 1031 Exchange industry. It was filled with insightful discussions, meaningful recognition, and valuable networking opportunities. Beyond the professional achievements, the conference was a reminder of the strength and camaraderie within the 1031 community. We look forward to building on this momentum and seeing everyone again at next year’s conference! -

Accruit Recap of FEA Annual Conference 2024

1031 Exchange Industry Education and Involvement

Accruit continued its deep-rooted involvement in educating peers within the 1031 Exchange industry with David Gorenberg co-presenting the 1031 Exchange Bootcamp, which covered topics such as the role of Qualified Intermediaries, intricacies of identification rules, mixed-use properties, and safe harbors. David also led a General Session discussion, A Frank Discussion on Ethics, where the relationship between ethics and 1031 Exchanges was analyzed. As a past co-chair of the FEA Ethics Committee, David’s insights were essential to the conversation.

Brent Abrahm, President and CEO of Accruit, was involved in a panel discussion regarding the FEA Political Action Committee (PAC). The panel underscored the importance of funding the PAC through individual FEA members to help support the work being done in Washington D.C. to protect IRC Section 1031. Brent is proud to point out that, “Accruit was recognized as the only company in the FEA that had 100% participation to the FEA PAC in 2023 and our goal is to do it again in 2024.”

Steve Holtkamp, Senior Managing Director and Chief Revenue Officer, was also present at the conference, attending the Board of Directors meeting to which he is a member. “Steve’s thoughtful approach and meaningful participation on the Board have been recognized and appreciated by his fellow Board members,” said Max Hansen, Managing Director at Accruit.

Michele Smith and Asher joined the rest of the Accruit team at the conference to attend the educational presentations to stay up to date on the latest concepts, receive CE credit, and uphold their status as Certified Exchange Specialists®. Additionally, Ellie Trovato was recognized for being the newest member of the CES® Certification council.

First-time attendees Darcy Yeldell and Noah Doran were delighted to join Accruit’s veteran attendees at the conference.

Darcy shared that, “Having the opportunity to surround myself with other industry professionals and colleagues was amazing. The wealth of knowledge was cool to see and even though a lot of us are competitors, you could feel that we all came together to support each other and our love for 1031’s!”

Noah noted that the FEA Annual Conference was, “An excellent opportunity to meet others new to the FEA, and the speakers emphasized the importance of getting involved. Their encouragement inspired me to join the Membership Committee, which I’m excited about!”

1031 Achievements and Recognition

We are thrilled to announce that at the FEA Annual Conference David Gorenberg, Educational and Technical Director, was recognized for his involvement in the 1031 Exchange industry as a recipient of the prestigious Margo McDonnell Certified Exchange Specialist® Perpetual Award. This award is based on peer nominations and given to an individual who has demonstrated outstanding dedication and made exceptional contributions to the 1031 Exchange industry. “In his usual humble way, David was very surprised when he received the richly deserved award. Aside from being a great human being and serving as a past President of the FEA, it really is the pinnacle of David’s career,” said Max Hansen.

David has over 30 years’ experience involved in the 1031 industry, he is a current member and past president of the FEA and co-chair of the FEA Ethics Committee. His contributions include lecturing at the Real Estate Investment Securities Association, National Association of REALTORS®, and multiple FEA Conferences amongst many others.

David wasn’t the only member of Accruit to be recognized for his contributions and commitment to the 1031 Exchange industry at the Annual Conference. Steve Holtkamp was elected to a 2nd term on the FEA Board of Directors and was also asked to serve as the FEA’s incoming Treasurer and Secretary. Reflecting on his involvement, Steve shared, “I was on the Finance Committee and really enjoyed participating and was able to provide a lot of value on that front given my background, so it was my pleasure to step into the role of Treasurer.” He hopes to further his leadership journey, adding, “Hopefully I get the opportunity to serve as President in two years.”

Exchange Manager ProSM, Patented 1031 Exchange Workflow Software

At the FEA Conference Exhibit Hall, Accruit Technologies, led by Marita Kazos and Dave Tornell, proudly showcased Exchange Manager Pro℠, patented 1031 Exchange workflow software, to fellow 1031 industry peers and Qualified Intermediaries. The conference provided the Accruit team an opportunity to connect with Exchange Manager ProSM clients, as well as some clients of Managed Service, integrated 1031 Exchange program. The Business Development team discussed success stories, plans for the future of the technology and strengthened partnerships. According to Marita, there was a lot of buzz surrounding Exchange Manager Pro℠, as she had multiple current clients come to the booth to say that they love the software, as well as prospective interest from other QIs. The Accruit team deeply values recognition received from fellow 1031 industry professionals and the positive feedback from our clients and peers regarding our software solutions and dedication to outstanding service. This motivates us to continue striving for excellence, be a leader in the industry and continue to revolutionize 1031 at every step.

Business First, Fun Included

The FEA Annual Conference was not only an incredible event for 1031 education, industry discussions, and business development, but also a fantastic opportunity to connect with fellow 1031 professionals, foster relationships, and enjoy some fun together.

Our very own CEO, Brent Abrahm, coordinated the 2nd annual charity bike ride in support of the https://johnlockhartfoundation.com/index.html”>John Lockhart Foundation, a local charity that supports vulnerable children in the Austin area as well as raises awareness for colon cancer. The 20-mile ride in the Southern Walnut Creek area included riders from Chicago Deferred Exchange Corp, Clark Wealth Management, HUB 1031, Hogan Land Title Company, First American Exchange, National Realty Exchange, and Encore Bank. The ride resulted in the group raising just under $1,000 for the cause. A highlight of this bike ride was Lance Armstrong cycling past the group – sighting confirmed by Strava, an exercise tracking app.

The 2024 FEA Annual Conference was an outstanding event for not only Accruit, but the entire 1031 Exchange industry. It was filled with insightful discussions, meaningful recognition, and valuable networking opportunities. Beyond the professional achievements, the conference was a reminder of the strength and camaraderie within the 1031 community. We look forward to building on this momentum and seeing everyone again at next year’s conference!