Accruit has been named a finalist in the Professional Service Company category.

REjournals has announced the finalists for their 2024 Commercial Real Estate Awards. The REJournals CRE Awards celebrate the achievements, successes and highlights from all sectors of the commercial real estate industry.

Accruit, a national 1031 Exchange Qualified Intermediary and Exchange Accommodate Titleholder, boasts a considerable foothold in the greater Chicago, Illinois market with an office and two staff attorneys located in Chicago, Illinois.

In 2023, Accruit supported over $15+ Billion in real estate transactions through our patented 1031 Exchange software, Exchange Manager Pro℠. Accruit alone as a Qualified Intermediary and Exchange Accommodation Titleholder facilitated $4.12 Billion in real estate transactions.

Specific to Illinois, Accruit facilitated over $218 million in Relinquished Property transactions and over $122 million in Replacement Property transactions, totaling a combined $340+ million of RE closings in Illinois in 2023.

In addition, Accruit presented two real estate continuing education courses for Illinois brokers and agents, as well as two continuing legal education courses to through collaborations with Advocus, formerly ATGF, and Illinois Real Estate Lawyers Association (IRELA). Accruit has participated as panelist speaker for four consecutive years, including 2023, at the RE Journals National Net Lease Summit in Chicago, IL.

Accruit is active in providing 1031 Exchange education and resources to many Illinois associations including NICAR, IRELA, and Advocus.

Lastly, in 2023, Accruit’s specialized services, as an Exchange Accommodation Titleholder, was part of the largest sale of a multi-tenant suburban office building in the past 18 months in Illinois, the Illinois CRE Awards and full list of finalists.

Category: Company and Industry News

-

Accruit Named Finalist in Illinois Real Estate Journals’ CRE Awards

-

Accruit Named Finalist in Illinois Real Estate Journals’ CRE Awards

Accruit has been named a finalist in the Professional Service Company category.

REjournals has announced the finalists for their 2024 Commercial Real Estate Awards. The REJournals CRE Awards celebrate the achievements, successes and highlights from all sectors of the commercial real estate industry.

Accruit, a national 1031 Exchange Qualified Intermediary and Exchange Accommodate Titleholder, boasts a considerable foothold in the greater Chicago, Illinois market with an office and two staff attorneys located in Chicago, Illinois.

In 2023, Accruit supported over $15+ Billion in real estate transactions through our patented 1031 Exchange software, Exchange Manager Pro℠. Accruit alone as a Qualified Intermediary and Exchange Accommodation Titleholder facilitated $4.12 Billion in real estate transactions.

Specific to Illinois, Accruit facilitated over $218 million in Relinquished Property transactions and over $122 million in Replacement Property transactions, totaling a combined $340+ million of RE closings in Illinois in 2023.

In addition, Accruit presented two real estate continuing education courses for Illinois brokers and agents, as well as two continuing legal education courses to through collaborations with Advocus, formerly ATGF, and Illinois Real Estate Lawyers Association (IRELA). Accruit has participated as panelist speaker for four consecutive years, including 2023, at the RE Journals National Net Lease Summit in Chicago, IL.

Accruit is active in providing 1031 Exchange education and resources to many Illinois associations including NICAR, IRELA, and Advocus.

Lastly, in 2023, Accruit’s specialized services, as an Exchange Accommodation Titleholder, was part of the largest sale of a multi-tenant suburban office building in the past 18 months in Illinois, the Illinois CRE Awards and full list of finalists. -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

1031 Exchange: Solution for Short-term Rental Property Owners Faced with Legislative Changes

Short-term Rental Market Overview

Over the past 15 years, short-term rentals, such as Airbnb and VRBO, have become an increasingly popular investments for property owners. In 2020, the COVID-19 pandemic led to an explosive need for short-term rentals, which led many investors to turn their sights and funds toward short-term rentals. As of 2024, Airbnb has over four million hosts, or property owners, and seven million global listings, as many hosts own more than one rental property. In recent years, the short-term rental market has exploded. The average number of short-term rentals in the US in 2022 was 1,278,254, a 20.5% increase from 2021 and 2023 saw an additional 11% increase up to 1,424,441 total rentals. In 2022, the average monthly rental income from Airbnb in Denver was $3,540, for a combined annual rental income of $42,480.

It was reported in 2023 that 30% of vacation property owners and 32% of investment property owners have expressed interest in renting their homes as short-term rentals. While interest and inventory for short-term rentals has drastically increased over recent years, residents of high-interest areas are voicing concerns over the impact they feel short-term rentals may have on their neighborhoods. As a result, many cities and counties have begun to institute restrictions and even bans in specific high-tourism and urban areas which affect the return-on-investment potential for short-term rental property owners.

Proposed Limits to Short-Term Rentals in Colorado

County Specific

Increased restrictions and bans on short-term rentals can be seen across the country, but below are some specific examples of proposed legislation that would impact Colorado short-term rental property owners.

Park County, Colorado, which includes popular towns such as Alma and Fairplay, has experienced an increase in short-term rentals. In 2021, the county passed an ordinance that property owners must obtain an annual license. Additionally, the tourist-filled ski region is considering limiting or eliminating short-term rental properties as issues of housing scarcity, increased pricing, and neighborhood disturbance have been called into question. While Park County faces decisions regarding this industry, many towns and counties across Colorado, as well as other parts of the country, are also weighing the decision between allowing a strong rental market to continue or impose hard limits.

Another Colorado county dealing with proposed regulations is Summit County, home to many iconic and popular ski towns such as Breckenridge, Frisco, and Keystone. In terms of Summit County’s property tax rates, it was proposed earlier this year to increase tax rates based on classifications between lodging and residential properties. If short-term rental properties are classified as lodging properties, due to being booked as a short-term rental for more than 90 days per year, then the tax would be four times the residential rate. This large discrepancy would make it difficult for these property owners to cover their operating expenses or receive any meaningful return on investment, hence reducing property being used in this way.Colorado Senate Bills 33 & 2:

In Colorado, two proposed bills are set to address and revise guidelines regarding short-term rental properties. Senate Bill 2 proposes amendments to current law, allowing counties to offer property tax credits or rebates to promote specific uses of real property addressing local concerns to the use of real property. These concerns may include issues affecting residents’ health, safety, welfare, equity, housing access, and education. The bill would allow counties and cities to give tax breaks to properties that are used for mental health, childcare, and other areas of “specific local concern.” The bill defines an “area of specific local concern” as real property use that is diminishing or unavailable or deemed necessary for residents’ well-being.

While these bills are in review, the property owners of -

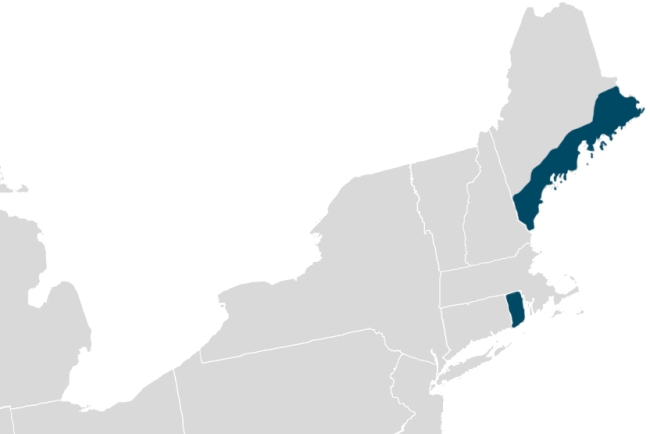

IRS Announces Tax Relief for Areas in Rhode Island and Maine due to Recent Severe Storms

Due to the severe storms and flooding of December 17th and January 9th, the IRS has issued tax relief for parts of Maine and Rhode Island.

The General postponement date is July 15th, 2024.

In Maine, individuals that reside or have businesses within Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington, and York counties qualify for tax relief as this time.

In Rhode Island, individuals that reside or have businesses within Kent, Providence, and Washington counties qualify for tax relief as this time.

An “Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers who do not meet the definition of Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The “Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers).

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Maine tax relief from the IRS.

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Rhode Island January 9th Storms tax relief from the IRS. -

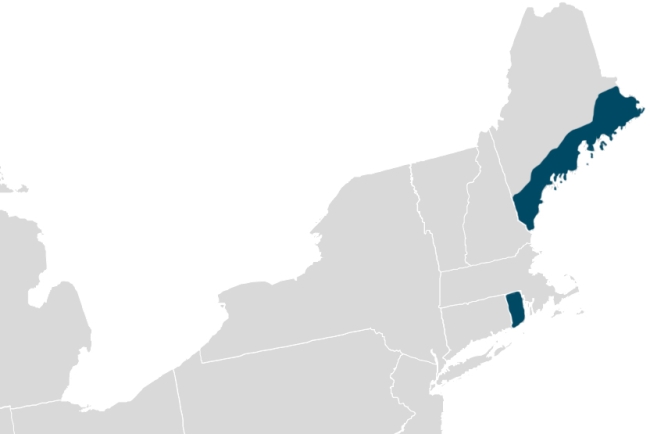

IRS Announces Tax Relief for Areas in Rhode Island and Maine due to Recent Severe Storms

Due to the severe storms and flooding of December 17th and January 9th, the IRS has issued tax relief for parts of Maine and Rhode Island.

The General postponement date is July 15th, 2024.

In Maine, individuals that reside or have businesses within Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington, and York counties qualify for tax relief as this time.

In Rhode Island, individuals that reside or have businesses within Kent, Providence, and Washington counties qualify for tax relief as this time.

An “Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers who do not meet the definition of Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The “Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers).

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Maine tax relief from the IRS.

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Rhode Island January 9th Storms tax relief from the IRS. -

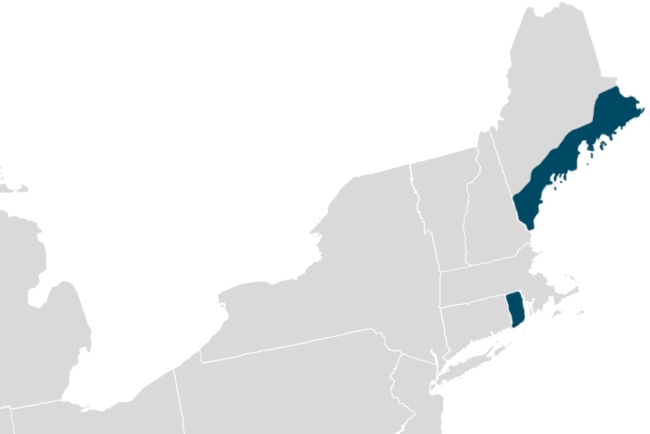

IRS Announces Tax Relief for Areas in Rhode Island and Maine due to Recent Severe Storms

Due to the severe storms and flooding of December 17th and January 9th, the IRS has issued tax relief for parts of Maine and Rhode Island.

The General postponement date is July 15th, 2024.

In Maine, individuals that reside or have businesses within Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington, and York counties qualify for tax relief as this time.

In Rhode Island, individuals that reside or have businesses within Kent, Providence, and Washington counties qualify for tax relief as this time.

An “Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers who do not meet the definition of Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Those certain items of real and/or personal property described in the relinquished property contract and qualifying as “relinquished property” within the meaning of Treasury Regulations Section 1.1031(k)-1(a); The “Old Asset”, property or properties given up or conveyed by a taxpayer as part of a 1031 exchange. Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected (“Exchangor” or “Exchanger”) Individual or entity desiring an exchange. Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers).

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Maine tax relief from the IRS.

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-imp… for full details on the Rhode Island January 9th Storms tax relief from the IRS. -

Understanding How Biden’s Proposed Budget Impacts 1031 Exchanges

Biden’s Budget on 1031 Exchanges

The US Department of Treasury released their General Explanations of President Biden’s FY 2025 Budget, also referred to as the “Green Book”, which proposes hard limits be set on IRC Section 1031. The proposed budget suggests that 1031 Exchanges are a loophole, as they delay the payment of tax on real estate transactions as long as the Exchanger continues reinvesting in real estate. It is believed that this equates to an interest-free loan from the government, potentially indefinitely, and real estate is the only asset that gets this “sweetheart deal.” The proposal would permit deferrals of gain up to an aggregate amount of $500,000 for individuals ($1 million for married couples filing jointly) annually for similar real estate exchanges. Any gains from 1031 Exchanges above $500,000 (or $1 million for married couples filing jointly) in a year would be recognized in the year the Exchanger transfers the real property and subject to tax.

Effect on 1031 Exchanges

If a $500,000 cap on 1031 Exchanges were to be implemented, research shows it would have negative economic consequences. Below are a few of the many reasons why a $500,000 limit on 1031 Exchanges would be harmful to the economy:

Impact on Real Estate Investment and Liquidity: In real estate transactions, 1031 Exchanges are often utilized to defer capital gains taxes, motivating property owners to reinvest in other properties. However, setting a cap of $500,000 on these exchanges might hinder investors’ ability to engage in larger and more complex transactions, potentially reducing liquidity in the real estate market.

Reduced Property Transactions: A limit might dissuade property owners from engaging in 1031 Exchanges due to the potential of increased tax burdens. Consequently, this could lead to a decrease in property transactions, in turn, slowing economic activity within the real estate sector.

Potential Negative Effect on Small Businesses: Setting a limit on 1031 Exchanges could have a negative, disproportionate impact on small businesses, as well as investors who depend on 1031 Exchanges in managing their property portfolios. Biden’s cap could hinder investors’ means to expand, relocate, or optimize their property holdings.

Impact on Economic Growth: 1031 Exchange research shows that they stimulate economic growth by promoting investment, job creation, and improvements to properties, thus improvements to neighborhoods, cities, etc. Setting a hard cap on 1031 Exchanges would impede these economic accelerators.

A -

Understanding How Biden’s Proposed Budget Impacts 1031 Exchanges

Biden’s Budget on 1031 Exchanges

The US Department of Treasury released their General Explanations of President Biden’s FY 2025 Budget, also referred to as the “Green Book”, which proposes hard limits be set on IRC Section 1031. The proposed budget suggests that 1031 Exchanges are a loophole, as they delay the payment of tax on real estate transactions as long as the Exchanger continues reinvesting in real estate. It is believed that this equates to an interest-free loan from the government, potentially indefinitely, and real estate is the only asset that gets this “sweetheart deal.” The proposal would permit deferrals of gain up to an aggregate amount of $500,000 for individuals ($1 million for married couples filing jointly) annually for similar real estate exchanges. Any gains from 1031 Exchanges above $500,000 (or $1 million for married couples filing jointly) in a year would be recognized in the year the Exchanger transfers the real property and subject to tax.

Effect on 1031 Exchanges

If a $500,000 cap on 1031 Exchanges were to be implemented, research shows it would have negative economic consequences. Below are a few of the many reasons why a $500,000 limit on 1031 Exchanges would be harmful to the economy:

Impact on Real Estate Investment and Liquidity: In real estate transactions, 1031 Exchanges are often utilized to defer capital gains taxes, motivating property owners to reinvest in other properties. However, setting a cap of $500,000 on these exchanges might hinder investors’ ability to engage in larger and more complex transactions, potentially reducing liquidity in the real estate market.

Reduced Property Transactions: A limit might dissuade property owners from engaging in 1031 Exchanges due to the potential of increased tax burdens. Consequently, this could lead to a decrease in property transactions, in turn, slowing economic activity within the real estate sector.

Potential Negative Effect on Small Businesses: Setting a limit on 1031 Exchanges could have a negative, disproportionate impact on small businesses, as well as investors who depend on 1031 Exchanges in managing their property portfolios. Biden’s cap could hinder investors’ means to expand, relocate, or optimize their property holdings.

Impact on Economic Growth: 1031 Exchange research shows that they stimulate economic growth by promoting investment, job creation, and improvements to properties, thus improvements to neighborhoods, cities, etc. Setting a hard cap on 1031 Exchanges would impede these economic accelerators.

A