Where Did the Term “1031 Exchange” Come From?

The term “1031 Exchange” originates from Section 1031 of the Internal Revenue Code, established in 1954 as an amendment to the Federal Tax Code. This section codified the definition and rules for tax-deferred exchanges of like-kind properties, allowing investors to defer capital gains taxes when exchanging real estate or certain other property held for business or investment. Initially part of Section 112(b)(1) in the Revenue Act of 1921 (later renumbered in the Revenue Act of 1928), this section ultimately became known as Section 1031, leading to the term “1031 Exchange”.

The Origins of Section 1031: The Revenue Act of 1921

https://www.accruit.com/blog/history-1031-exchanges”>The Revenue Act of 1921 was pivotal in establishing tax-deferred exchanges, allowing investors to exchange properties without immediate capital gains tax. Section 202 of the Act required exchanged properties to be of similar use, or “like-kind,” to prevent investors from avoiding taxation by exchanging real estate for non-real estate assets. Congress noted that if no cash exchanged hands, the “continuity of an investment” should not trigger a taxable event. In 1954, an amendment to the Federal Tax Code clarified and strengthened the definition of a tax-deferred, like-kind exchange, establishing a clearer structure for real estate exchanges that shaped how 1031 Exchanges are conducted today.

How 1031 Exchanges Benefit Investors and the Economy

The https://www.accruit.com/blog/how-1031-exchanges-stimulate-economy”>bene… of 1031 Exchanges not only impact property owners, but also significantly contribute to economic growth.

Encourages Real Estate Transactions and Ensures Investment Continuity

By deferring capital gains taxes through a 1031 Exchange, investors are allowed to retain more of their profits for reinvestment and encouraged to move forward with real estate transactions that might otherwise be delayed or abandoned. This not only promotes the free flow of property transactions but also provides continuity for income-generating investment. Engaging in a 1031 Exchange can support portfolio growth, diversification, and the acquisition of higher-value properties. By moving from a lower-performing asset to one that generates greater income or appreciation potential, investors can enhance their long-term financial prospects. Additionally, 1031 Exchanges provide a strategic exit plan for property owners. For instance, farmers and ranchers approaching retirement can sell their properties without incurring immediate tax liabilities, allowing them to reinvest 100% of their proceeds into passive-income properties, such as multifamily residences or commercial real estate. This strategy not only secures their financial future but also encourages ongoing investment in their communities.

Promoting Regional Investment and Development

1031 Exchanges are a powerful tool in broadening investment opportunities. Investors are not limited to their local markets, as they can exchange properties across different states or regions. This flexibility enables them to diversify their holdings, reinvest in emerging markets with high growth potential, and acquire more productive like-kind properties. 1031 Exchanges also promote the efficient use of real estate. By encouraging property owners to sell underperforming assets and reinvest in more productive ones, the overall quality and productivity of properties within a market can improve. This can lead to revitalization in certain areas, driving further economic development and community growth. The resulting improvements can enhance property values, increase tax revenues for local governments, and contribute to a more dynamic economy.

Job Creation

Each individual 1031 Exchange transaction stimulates employment and business growth by engaging various industries. By allowing investors to defer capital gains taxes, 1031 Exchanges activate higher transaction volumes in the real estate market, increasing demand for services from agents, brokers, and appraisers. For example, when an investor upgrades to a more productive property, it often requires renovations or improvements, generating job opportunities in the construction industry for contractors, laborers, and related services. The changing of hands of property also boosts the need for property management services, creating jobs for leasing agents and maintenance staff. Additionally, executing a 1031 Exchange often requires legal and financial expertise, resulting in increased demand for attorneys, tax advisors, and Qualified Intermediaries. Ultimately, each 1031 Exchange employs many individuals across different fields, benefitting individuals, families, and the community at large.

As we celebrate National 1031 Day, it’s important to acknowledge the lasting benefits that 1031 Exchanges offer to individuals, communities, and the overall US economy.

Happy 1031 Day!

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Blog

-

Celebrating National 1031 Exchange Day

-

End-of-Year Tax Considerations for 2024

Maximize Retirement Contributions

One of the easiest ways to lower taxable income is by contributing to retirement accounts like a 401(k) or IRA. For 2024, the contribution limits for 401(k)s are $23,000, with an additional $7,500 catch-up contribution allowed for those 50 or older. Maxing out 401(k) contributions not only boosts retirement savings but also reduces taxable income, as contributions are made pre-tax. Contributions to traditional IRAs are also tax-deductible, with a maximum limit of $7,000, with an additional $1,000 catch-up contribution for individuals 50 or older. Contributions to a Roth IRA are not tax-deductible, but they grow tax-free and allow for qualified withdrawals in retirement. Individuals who are self-employed can contribute to a SEP IRA or Solo 401(k), with limits based on earnings. For SEP IRAs, you can contribute up to 25% of your income, with a maximum of $69,000 for 2024. These contributions can reduce your taxable income and grow tax-deferred until retirement. Maxing out retirement contributions before the year closes out can save you current or long-term taxes as well as ensure long-term financial security.

Harvest Investment Losses

Tax-loss harvesting is another useful strategy to consider before year-end. Tax-loss harvesting is the strategic sale of assets at a loss to offset capital gains taxes owed from selling profitable assets. It’s often used to reduce short-term capital gains, which are taxed at higher rates than long-term gains. Investors typically employ this tactic at the end of the year to minimize taxes by selling investments that have decreased in value to claim a credit against their gains. For 2024, up to $3,000 of net losses can be used to offset ordinary income, with any remaining losses carried over to future years. With this, it is important to not only be aware that selling an asset at a loss disrupts the balance of a portfolio, but to avoid a wash-sale scenario.

The Wash-Sale Rule

The wash-sale rule is an IRS regulation that disallows a tax deduction on an asset sold at a loss if the same or a “substantially identical” asset is repurchased within 30 days before or after the sale. This rule prevents investors from selling assets just to claim a tax benefit and quickly buying them back. In a wash sale, the loss is not deductible but added to the cost basis of the new purchase. Violating the rule can lead to fines or trading restrictions.

Take Advantage of Expiring Tax Provisions

Certain tax provisions are set to expire at the end of 2024 and could provide one-time benefits that won’t be available in future tax years, possibly yielding significant savings. For example, the temporary provision for bonus depreciation for businesses is set to change in 2025. In 2024, eligible businesses can deduct up to 80% of the cost of qualified assets, like equipment and machinery, in the year they are put into use. However, this rate will decrease to 60% next year, so it’s important to make purchases or invest in qualifying assets before December 31 to benefit from the higher deduction. Additionally, the expanded Child Tax Credit, which was temporarily raised to $3,600 per child under 6 and $3,000 for children aged 6 to 17 under previous COVID-19 relief laws, may return to lower amounts unless extended by Congress. Eligible families should make sure they claim the full credit available for 2024. Other expiring tax benefits may involve temporary deductions, credits, or incentives introduced through recent legislation, such as tax credits for energy-efficient home improvements, including solar panel installations. Some of these provisions are specific to certain years or projects, so reviewing any applicable expiring credits, such as those for residential energy efficiency upgrades, can help you maximize savings before the end of year.

Review Your Tax Withholding and Estimated Payments

Lastly, it’s important to review your tax withholding or estimated tax payments to avoid underpayment penalties. If you’ve experienced significant income changes in 2024, adjusting your withholding now can prevent surprises when you file your return.

Start by checking your paycheck and W-4 form to ensure your withholding aligns with your tax obligations. If you’ve had too much withheld, adjusting your W-4 now can increase your take-home pay. If you’ve withheld too little, you may owe taxes when filing and face penalties. For self-employed individuals or those with additional income, review your estimated tax payments. Ensure you’ve made sufficient quarterly payments, especially if your income has fluctuated. Adjusting your remaining estimated payments can help avoid underpayment penalties.

1031 Exchanges and Real Estate Tax Considerations

If you’re in the real estate sector or thinking about selling investment property, consider using a 1031 Exchange to defer capital gains taxes. A 1031 Exchange allows you to reinvest proceeds from the sale of real estate into a new property without immediately paying taxes associated with the real estate transaction. This is particularly useful if you’re selling at year-end but don’t want to realize the gain in 2024. For more on how to structure a 1031 Exchange, consult a Qualified Intermediary like Accruit.

For investors who are on the fence about selling property in Q4 or delaying listing the property until Q1 2025, https://www.accruit.com/blog/1031-exchange-tax-straddling-2023″>1031 tax straddling could be a compelling reason to list the property now rather than waiting until 2025. If a 1031 Exchange spans multiple tax years, i.e. is started in 2024, but the 180-day exchange period extends into 2025, and the Exchanger fails to identify or acquire Replacement Property, the Exchanger may still be able to defer capital gains taxes until the 2025 tax due date under IRS Installment Sale rules (Section 453). This provides flexibility in managing tax obligations, even in failed exchanges.

Conducting a 1031 Exchange in Q4 can provide flexibility. If the exchange fails due to missed deadlines, any returned funds become taxable in 2024. However, the default reporting allows for the deferral of capital gains payment on the sale of the Relinquished Property until the 2025 taxes are due, which coincides with the deadline for filing individual 2025 tax returns. By combining Section 1031 with Section 453, Exchangers can report exchange funds as income in the year received rather than the year of the sale, which provides a potential benefit for those considering a Q4 sale.

An additional consideration for 1031 Exchanges started in Q4 of 2024 is to ensure you get the full 180-day exchange period. Specifically for 1031 Exchanges started after October 18th, it is important to plan your tax filing accordingly. The exchange deadline would be the individuals tax return due date, which is April 15th, rather than day 180 which would fall after April 15th. To take full advantage of the 180-day exchange period, you will need tohttps://www.accruit.com/blog/what-happens-if-1031-exchange-spans-two-ta…; file an extension for your 2024 taxes. Keep in mind that for individuals in Maine and Massachusetts, the tax filing deadline is April 17th, 2025. Other states, such as Delaware, Iowa, Louisiana, and Virginia may have differing deadlines for filing state tax returns. By filing an extension, you can utilize the entire 180-day period to complete your exchange without the pressure of an imminent tax return deadline.

By reviewing and implementing these tax strategies now, you can significantly reduce your 2024 tax burden and set yourself up for financial success in the coming year. Always consult with a tax professional to personalize your strategy and ensure you’re making the most of available opportunities.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

End-of-Year Tax Considerations for 2024

Maximize Retirement Contributions

One of the easiest ways to lower taxable income is by contributing to retirement accounts like a 401(k) or IRA. For 2024, the contribution limits for 401(k)s are $23,000, with an additional $7,500 catch-up contribution allowed for those 50 or older. Maxing out 401(k) contributions not only boosts retirement savings but also reduces taxable income, as contributions are made pre-tax. Contributions to traditional IRAs are also tax-deductible, with a maximum limit of $7,000, with an additional $1,000 catch-up contribution for individuals 50 or older. Contributions to a Roth IRA are not tax-deductible, but they grow tax-free and allow for qualified withdrawals in retirement. Individuals who are self-employed can contribute to a SEP IRA or Solo 401(k), with limits based on earnings. For SEP IRAs, you can contribute up to 25% of your income, with a maximum of $69,000 for 2024. These contributions can reduce your taxable income and grow tax-deferred until retirement. Maxing out retirement contributions before the year closes out can save you current or long-term taxes as well as ensure long-term financial security.

Harvest Investment Losses

Tax-loss harvesting is another useful strategy to consider before year-end. Tax-loss harvesting is the strategic sale of assets at a loss to offset capital gains taxes owed from selling profitable assets. It’s often used to reduce short-term capital gains, which are taxed at higher rates than long-term gains. Investors typically employ this tactic at the end of the year to minimize taxes by selling investments that have decreased in value to claim a credit against their gains. For 2024, up to $3,000 of net losses can be used to offset ordinary income, with any remaining losses carried over to future years. With this, it is important to not only be aware that selling an asset at a loss disrupts the balance of a portfolio, but to avoid a wash-sale scenario.

The Wash-Sale Rule

The wash-sale rule is an IRS regulation that disallows a tax deduction on an asset sold at a loss if the same or a “substantially identical” asset is repurchased within 30 days before or after the sale. This rule prevents investors from selling assets just to claim a tax benefit and quickly buying them back. In a wash sale, the loss is not deductible but added to the cost basis of the new purchase. Violating the rule can lead to fines or trading restrictions.

Take Advantage of Expiring Tax Provisions

Certain tax provisions are set to expire at the end of 2024 and could provide one-time benefits that won’t be available in future tax years, possibly yielding significant savings. For example, the temporary provision for bonus depreciation for businesses is set to change in 2025. In 2024, eligible businesses can deduct up to 80% of the cost of qualified assets, like equipment and machinery, in the year they are put into use. However, this rate will decrease to 60% next year, so it’s important to make purchases or invest in qualifying assets before December 31 to benefit from the higher deduction. Additionally, the expanded Child Tax Credit, which was temporarily raised to $3,600 per child under 6 and $3,000 for children aged 6 to 17 under previous COVID-19 relief laws, may return to lower amounts unless extended by Congress. Eligible families should make sure they claim the full credit available for 2024. Other expiring tax benefits may involve temporary deductions, credits, or incentives introduced through recent legislation, such as tax credits for energy-efficient home improvements, including solar panel installations. Some of these provisions are specific to certain years or projects, so reviewing any applicable expiring credits, such as those for residential energy efficiency upgrades, can help you maximize savings before the end of year.

Review Your Tax Withholding and Estimated Payments

Lastly, it’s important to review your tax withholding or estimated tax payments to avoid underpayment penalties. If you’ve experienced significant income changes in 2024, adjusting your withholding now can prevent surprises when you file your return.

Start by checking your paycheck and W-4 form to ensure your withholding aligns with your tax obligations. If you’ve had too much withheld, adjusting your W-4 now can increase your take-home pay. If you’ve withheld too little, you may owe taxes when filing and face penalties. For self-employed individuals or those with additional income, review your estimated tax payments. Ensure you’ve made sufficient quarterly payments, especially if your income has fluctuated. Adjusting your remaining estimated payments can help avoid underpayment penalties.

1031 Exchanges and Real Estate Tax Considerations

If you’re in the real estate sector or thinking about selling investment property, consider using a 1031 Exchange to defer capital gains taxes. A 1031 Exchange allows you to reinvest proceeds from the sale of real estate into a new property without immediately paying taxes associated with the real estate transaction. This is particularly useful if you’re selling at year-end but don’t want to realize the gain in 2024. For more on how to structure a 1031 Exchange, consult a Qualified Intermediary like Accruit.

For investors who are on the fence about selling property in Q4 or delaying listing the property until Q1 2025, https://www.accruit.com/blog/1031-exchange-tax-straddling-2023″>1031 tax straddling could be a compelling reason to list the property now rather than waiting until 2025. If a 1031 Exchange spans multiple tax years, i.e. is started in 2024, but the 180-day exchange period extends into 2025, and the Exchanger fails to identify or acquire Replacement Property, the Exchanger may still be able to defer capital gains taxes until the 2025 tax due date under IRS Installment Sale rules (Section 453). This provides flexibility in managing tax obligations, even in failed exchanges.

Conducting a 1031 Exchange in Q4 can provide flexibility. If the exchange fails due to missed deadlines, any returned funds become taxable in 2024. However, the default reporting allows for the deferral of capital gains payment on the sale of the Relinquished Property until the 2025 taxes are due, which coincides with the deadline for filing individual 2025 tax returns. By combining Section 1031 with Section 453, Exchangers can report exchange funds as income in the year received rather than the year of the sale, which provides a potential benefit for those considering a Q4 sale.

An additional consideration for 1031 Exchanges started in Q4 of 2024 is to ensure you get the full 180-day exchange period. Specifically for 1031 Exchanges started after October 18th, it is important to plan your tax filing accordingly. The exchange deadline would be the individuals tax return due date, which is April 15th, rather than day 180 which would fall after April 15th. To take full advantage of the 180-day exchange period, you will need tohttps://www.accruit.com/blog/what-happens-if-1031-exchange-spans-two-ta…; file an extension for your 2024 taxes. Keep in mind that for individuals in Maine and Massachusetts, the tax filing deadline is April 17th, 2025. Other states, such as Delaware, Iowa, Louisiana, and Virginia may have differing deadlines for filing state tax returns. By filing an extension, you can utilize the entire 180-day period to complete your exchange without the pressure of an imminent tax return deadline.

By reviewing and implementing these tax strategies now, you can significantly reduce your 2024 tax burden and set yourself up for financial success in the coming year. Always consult with a tax professional to personalize your strategy and ensure you’re making the most of available opportunities.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

End-of-Year Tax Considerations for 2024

Maximize Retirement Contributions

One of the easiest ways to lower taxable income is by contributing to retirement accounts like a 401(k) or IRA. For 2024, the contribution limits for 401(k)s are $23,000, with an additional $7,500 catch-up contribution allowed for those 50 or older. Maxing out 401(k) contributions not only boosts retirement savings but also reduces taxable income, as contributions are made pre-tax. Contributions to traditional IRAs are also tax-deductible, with a maximum limit of $7,000, with an additional $1,000 catch-up contribution for individuals 50 or older. Contributions to a Roth IRA are not tax-deductible, but they grow tax-free and allow for qualified withdrawals in retirement. Individuals who are self-employed can contribute to a SEP IRA or Solo 401(k), with limits based on earnings. For SEP IRAs, you can contribute up to 25% of your income, with a maximum of $69,000 for 2024. These contributions can reduce your taxable income and grow tax-deferred until retirement. Maxing out retirement contributions before the year closes out can save you current or long-term taxes as well as ensure long-term financial security.

Harvest Investment Losses

Tax-loss harvesting is another useful strategy to consider before year-end. Tax-loss harvesting is the strategic sale of assets at a loss to offset capital gains taxes owed from selling profitable assets. It’s often used to reduce short-term capital gains, which are taxed at higher rates than long-term gains. Investors typically employ this tactic at the end of the year to minimize taxes by selling investments that have decreased in value to claim a credit against their gains. For 2024, up to $3,000 of net losses can be used to offset ordinary income, with any remaining losses carried over to future years. With this, it is important to not only be aware that selling an asset at a loss disrupts the balance of a portfolio, but to avoid a wash-sale scenario.

The Wash-Sale Rule

The wash-sale rule is an IRS regulation that disallows a tax deduction on an asset sold at a loss if the same or a “substantially identical” asset is repurchased within 30 days before or after the sale. This rule prevents investors from selling assets just to claim a tax benefit and quickly buying them back. In a wash sale, the loss is not deductible but added to the cost basis of the new purchase. Violating the rule can lead to fines or trading restrictions.

Take Advantage of Expiring Tax Provisions

Certain tax provisions are set to expire at the end of 2024 and could provide one-time benefits that won’t be available in future tax years, possibly yielding significant savings. For example, the temporary provision for bonus depreciation for businesses is set to change in 2025. In 2024, eligible businesses can deduct up to 80% of the cost of qualified assets, like equipment and machinery, in the year they are put into use. However, this rate will decrease to 60% next year, so it’s important to make purchases or invest in qualifying assets before December 31 to benefit from the higher deduction. Additionally, the expanded Child Tax Credit, which was temporarily raised to $3,600 per child under 6 and $3,000 for children aged 6 to 17 under previous COVID-19 relief laws, may return to lower amounts unless extended by Congress. Eligible families should make sure they claim the full credit available for 2024. Other expiring tax benefits may involve temporary deductions, credits, or incentives introduced through recent legislation, such as tax credits for energy-efficient home improvements, including solar panel installations. Some of these provisions are specific to certain years or projects, so reviewing any applicable expiring credits, such as those for residential energy efficiency upgrades, can help you maximize savings before the end of year.

Review Your Tax Withholding and Estimated Payments

Lastly, it’s important to review your tax withholding or estimated tax payments to avoid underpayment penalties. If you’ve experienced significant income changes in 2024, adjusting your withholding now can prevent surprises when you file your return.

Start by checking your paycheck and W-4 form to ensure your withholding aligns with your tax obligations. If you’ve had too much withheld, adjusting your W-4 now can increase your take-home pay. If you’ve withheld too little, you may owe taxes when filing and face penalties. For self-employed individuals or those with additional income, review your estimated tax payments. Ensure you’ve made sufficient quarterly payments, especially if your income has fluctuated. Adjusting your remaining estimated payments can help avoid underpayment penalties.

1031 Exchanges and Real Estate Tax Considerations

If you’re in the real estate sector or thinking about selling investment property, consider using a 1031 Exchange to defer capital gains taxes. A 1031 Exchange allows you to reinvest proceeds from the sale of real estate into a new property without immediately paying taxes associated with the real estate transaction. This is particularly useful if you’re selling at year-end but don’t want to realize the gain in 2024. For more on how to structure a 1031 Exchange, consult a Qualified Intermediary like Accruit.

For investors who are on the fence about selling property in Q4 or delaying listing the property until Q1 2025, https://www.accruit.com/blog/1031-exchange-tax-straddling-2023″>1031 tax straddling could be a compelling reason to list the property now rather than waiting until 2025. If a 1031 Exchange spans multiple tax years, i.e. is started in 2024, but the 180-day exchange period extends into 2025, and the Exchanger fails to identify or acquire Replacement Property, the Exchanger may still be able to defer capital gains taxes until the 2025 tax due date under IRS Installment Sale rules (Section 453). This provides flexibility in managing tax obligations, even in failed exchanges.

Conducting a 1031 Exchange in Q4 can provide flexibility. If the exchange fails due to missed deadlines, any returned funds become taxable in 2024. However, the default reporting allows for the deferral of capital gains payment on the sale of the Relinquished Property until the 2025 taxes are due, which coincides with the deadline for filing individual 2025 tax returns. By combining Section 1031 with Section 453, Exchangers can report exchange funds as income in the year received rather than the year of the sale, which provides a potential benefit for those considering a Q4 sale.

An additional consideration for 1031 Exchanges started in Q4 of 2024 is to ensure you get the full 180-day exchange period. Specifically for 1031 Exchanges started after October 18th, it is important to plan your tax filing accordingly. The exchange deadline would be the individuals tax return due date, which is April 15th, rather than day 180 which would fall after April 15th. To take full advantage of the 180-day exchange period, you will need tohttps://www.accruit.com/blog/what-happens-if-1031-exchange-spans-two-ta…; file an extension for your 2024 taxes. Keep in mind that for individuals in Maine and Massachusetts, the tax filing deadline is April 17th, 2025. Other states, such as Delaware, Iowa, Louisiana, and Virginia may have differing deadlines for filing state tax returns. By filing an extension, you can utilize the entire 180-day period to complete your exchange without the pressure of an imminent tax return deadline.

By reviewing and implementing these tax strategies now, you can significantly reduce your 2024 tax burden and set yourself up for financial success in the coming year. Always consult with a tax professional to personalize your strategy and ensure you’re making the most of available opportunities.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Video: Can You 1031 Into a REIT?

Common questions we receive from Exchangers include, “Is it possible to 1031 Exchange into a REIT”, “Do QIs facilitate a 721 Exchange?”, and “What is the process if I ultimately want to reinvest my 1031 exchange funds into a REIT?”

This educational video breaks down the steps involved when an Exchanger’s end goal is to invest their 1031 exchange funds into a REIT. Steps include utilizing a Delaware Statutory Trust (DST) as Replacement Property in a 1031 Exchange, a holding period of the DST interest, then using a 721 UPREIT to swap the interest in the DST for Operating Partnership (OP) units in a REIT.

Watch this video below to better understand the process, as well as this this article, -

Video: Can You 1031 Into a REIT?

Common questions we receive from Exchangers include, “Is it possible to 1031 Exchange into a REIT”, “Do QIs facilitate a 721 Exchange?”, and “What is the process if I ultimately want to reinvest my 1031 exchange funds into a REIT?”

This educational video breaks down the steps involved when an Exchanger’s end goal is to invest their 1031 exchange funds into a REIT. Steps include utilizing a Delaware Statutory Trust (DST) as Replacement Property in a 1031 Exchange, a holding period of the DST interest, then using a 721 UPREIT to swap the interest in the DST for Operating Partnership (OP) units in a REIT.

Watch this video below to better understand the process, as well as this this article, -

Video: Can You 1031 Into a REIT?

Common questions we receive from Exchangers include, “Is it possible to 1031 Exchange into a REIT”, “Do QIs facilitate a 721 Exchange?”, and “What is the process if I ultimately want to reinvest my 1031 exchange funds into a REIT?”

This educational video breaks down the steps involved when an Exchanger’s end goal is to invest their 1031 exchange funds into a REIT. Steps include utilizing a Delaware Statutory Trust (DST) as Replacement Property in a 1031 Exchange, a holding period of the DST interest, then using a 721 UPREIT to swap the interest in the DST for Operating Partnership (OP) units in a REIT.

Watch this video below to better understand the process, as well as this this article, -

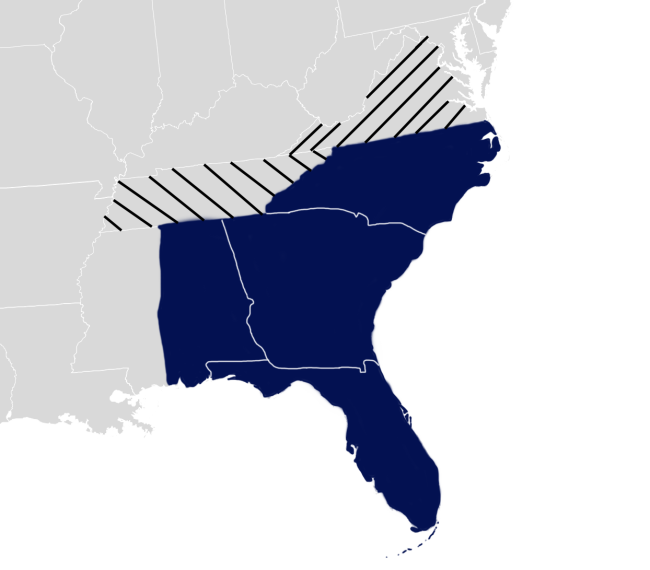

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

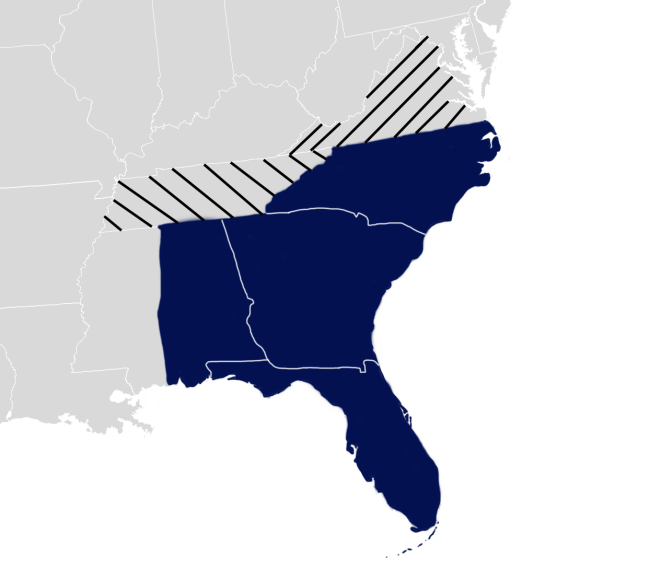

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

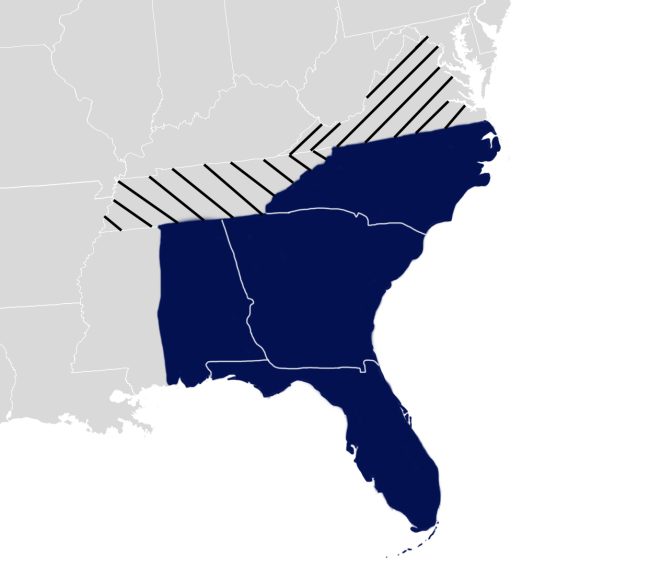

IRS Announces Tax Relief for Taxpayers in Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia Impacted by Hurricanes Milton and Helene

Due to Hurricanes Milton and Helene, the IRS has issued Tax Relief for Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia.

Affected Taxpayers have until May 1, 2025, to make tax payments and file for various individual and business tax returns.

Currently, all individuals and households that reside in or have a business within Florida, Alabama, Georgia, North Carolina, South Carolina, and counties in Tennessee and Virginia qualify for tax relief. Any area added to the disaster area at a later time will also qualify for tax relief.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is in the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58nt under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other Taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other Taxpayers).

https://www.irs.gov/newsroom/irs-help-available-to-victims-of-hurricane… for full details on the tax relief.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.