A 1031 Exchange is a powerful tax-deferral strategy that allows real estate investors to reinvest proceeds from the sale of an investment property into another qualifying property, deferring associated taxes and preserving wealth. While many investors are familiar with the basic benefits of 1031 Exchanges, fewer fully understand their role in estate planning and passive investment opportunities like Delaware Statutory Trusts (DSTs). In this blog, we’ll explore how 1031 Exchanges can be strategically used to build and preserve wealth across generations, optimize estate planning, and provide investors with passive real estate options. Additionally, we’ll cover key considerations for Registered Investment Advisors guiding clients through the 1031 Exchange process, including tax implications, compliance requirements, and investment alternatives.

Estate Planning

https://www.accruit.com/blog/1031-tax-deferred-exchanges-important-esta… planning is an essential consideration for many, particularly those with large real estate holdings. One of the key benefits of a 1031 Exchange in this context is its potential to help preserve wealth across generations.

Stepped-Up Basis Upon Inheritance

By using a 1031 Exchange during their lifetime, individuals can continue to defer taxes, thereby allowing them to build a larger estate that will benefit from a stepped-up basis when transferred to heirs upon death. Essentially, the exchange allows Exchangers to grow their wealth, pass it down, and defer taxes on gains, sometimes indefinitely, that they would have incurred by selling the property outright. It is important to note that the stepped-up basis applies to property acquired through a 1031 Exchange that is still held at the time of the property owner’s death.

When an individual passes away, their heirs receive inherited real estate at the fair market value as of the date of the prior owner’s death. Typically, this means that the heirs received the property with a stepped-up basis, rather than the basis of the previous owner. For individuals who have held property for many years, this adjustment can significantly reduce tax liabilities if the property is later sold by the heirs.

Wealth Preservation

For individuals with significant real estate investments, a 1031 Exchange provides a powerful tool for preserving wealth without having to liquidate assets and pay taxes on gains and depreciation recapture. Exchangers have the ability to reinvest the full proceeds from the sale of their Relinquished Property into other qualifying property, deferring tax liabilities that would otherwise reduce the amount of capital available for reinvestment.

Without a 1031 Exchange, investors face a combination of taxes that could significantly devalue their proceeds:

https://www.accruit.com/blog/what-are-capital-gains”>Federal Capital Gains Tax: 15-20%

https://www.accruit.com/blog/what-depreciation-recapture-tax”>Depreciat… Recapture Tax: 25%

https://www.accruit.com/blog/1031-exchanges-state-tax-law-consideration… Income Tax: If applicable, up to 13.3%

https://www.accruit.com/blog/what-net-investment-income-tax”>Net Investment Income Tax: If applicable, 3.8%

These taxes typically total between 25 – 35% of the proceeds, depending on an individual’s situation. For example, if the Relinquished Property is sold for $1,000,000 with an adjusted basis of $400,000 and $200,000 in prior depreciation, their total gain is $600,000. Without a 1031 Exchange, the investor could lose nearly $200,000 of their proceeds to the aforementioned taxes. In contrast, utilizing an exchange allows the full $1,000,000 to be reinvested, preserving a significantly larger portion of wealth.

Strategic Use for Family Trusts

For individuals looking to pass their real estate holdings to future generations through family trusts, 1031 Exchanges can help optimize the timing of asset transfers that are deemed necessary due to market issues or other circumstances that arise over time. As opposed to a taxable sale of a property no longer wanted, trusts can use 1031 Exchanges to reposition or diversify their holdings as often as necessary, thus deferring taxes, enhancing the real estate portfolio and possibly allow the estate to receive a stepped-up basis when the estate is passed down to beneficiaries.

Exploring Passive Investment Opportunities

While 1031 Exchanges are often associated with active real estate management, passive real estate investments are becoming increasingly popular among many investors. This is where Delaware Statutory Trusts (DSTs) come in as a powerful option. DSTs allow investors to participate in the ownership of professionally managed, commercial grade property without the need for active management.

Delaware Statutory Trusts

A https://www.accruit.com/blog/delaware-statutory-trusts-1031-exchange-in… Statutory Trust is a legally recognized trust that holds title to investment property. Investors in a DST receive beneficial ownership interests and share in the income and potential appreciation from the property. DSTs are structured to qualify as like-kind properties for a 1031 Exchange, making them an attractive option for clients looking for a more hands-off approach to real estate investment. (

Benefits for Investors

DSTs offer several benefits that can align with investor goals:

Passive Management: Since DSTs are managed by professional real estate operators, investors don’t have to worry about the day-to-day management of the property. This is ideal for those who want the benefits of real estate investment without the time commitment.

Diversification: DSTs allow investors to pool their capital with others to invest in larger, institutional-grade properties, such as commercial real estate or apartment complexes, which may be out of reach for individual investors.

Stable Income: Many DSTs invest in income-producing properties, offering potential for regular cash flow through rental income. This can be a stable, predictable addition to an investment portfolio.

Key Considerations for Registered Investment Advisors When Advising Clients on 1031 Exchanges

Registered Investment Advisors (RIAs) and other financial advisors help individuals and companies manage their finances and make investments based on their financial goals including stocks, bonds, retirement accounts, etc. Their responsibilities include providing investment strategies, asset management, and comprehensive financial planning.

Real estate holdings represent a largely untapped area of overall wealth with over $6.4 Trillion held within investment property by US households age 55 and over. Furthermore, 90% of these investors identify as unadvised or under-advised on tax deferral strategies for their real estate investments, such as 1031 Exchanges.

Many real estate investors fail to utilize 1031 Exchanges for tax deferral because they lack awareness of reinvestment options including passive real estate investments such as Delaware Statutory Trusts (DSTs). This creates an opportunity for advisors to establish themselves as a total wealth solution discussing not just traditional investment options, but alternative investment options including real estate.

Discussing real estate and incorporating 1031 Exchanges into a client’s wealth strategy can greatly enhance their portfolio, helping clients preserve and grow their wealth while offering advisors the chance to serve as a comprehensive financial guide.

For RIAs advising clients on 1031 Exchanges, understanding the rules, deadlines, and tax implications is essential to facilitating a seamless transaction. Below are critical points to keep in mind:

Strict Deadlines and Timelines

For a 1031 Exchange to qualify, clients must identify Replacement Property(ies) within 45 days of selling the Relinquished Property and close the purchase within a total of 180 days after the sale. Keeping track of these strict deadlines is crucial to ensuring the exchange goes smoothly and tax benefits are preserved.

The Role of a Qualified Intermediary (QI)

A https://www.accruit.com/blog/what-qualified-intermediary”>Qualified Intermediary (QI) is required to facilitate the 1031 Exchange process. The QI holds the proceeds from the sale of the Relinquished Property and ensures that the exchange is conducted according to IRS rules. It’s important to work with a reputable QI, such as Accruit, who has experience in handling these types of transactions.

State Taxes

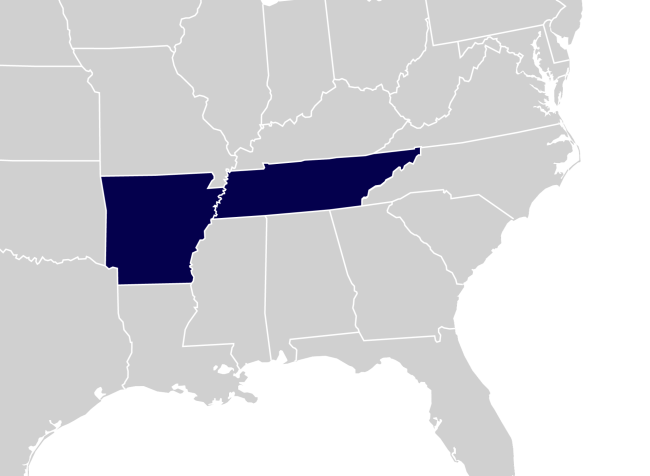

While the IRS allows 1031 Exchanges, some states, such as https://www.accruit.com/blog/commercial-real-estate-transactions-and-10…;, have their own rules and tax treatments for such exchanges. Be sure to consider any state-level tax implications when advising clients, as these can vary.

Depreciation and Recapture

While 1031 Exchanges allow tax deferral, they do not eliminate depreciation recapture taxes. Clients who have depreciated the property over time may face recapture taxes on the depreciation deductions they’ve taken when they sell the property. Understanding the impact of depreciation and recapture is key to providing sound advice.

Utilizing 1031 Exchanges in investment strategies can offer significant benefits for estate planning, wealth preservation, and passive investing. By understanding tax implications, timelines, and the role of QIs, investment advisors can help clients make informed decisions that align with their financial goals. Whether aiming to defer taxes, diversify investments, or secure a legacy for future generations, leveraging 1031 Exchanges can be a powerful tool in a well-rounded investment approach.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.