It’s tax time – individuals and businesses are collecting their various 2023 tax documents, receipts, etc. to get their 2023 tax returns filed by their corresponding due dates. For any Exchangers having started or completed a 1031 Exchange in 2023 there are some specific reporting requirements for their 2023 tax return.

2024 Tax Filing: Reporting a 1031 Exchange

A successful 1031 Exchange allows for the deferral of capital gains, depreciation recapture, state, and net investment income taxes, yet there are still tax filing obligations for the Exchanger to ensure the 1031 Exchange is properly recognized and documented for the IRS.

If a 1031 Exchange was completed in 2023, the Exchanger must submit a Form 8824 along with their 2023 tax return.

If a 1031 Exchange was started in 2023, but not completed by the end of 2023, the Exchanger must file a Form 6252 to provide the IRS with information related to their receipt of the 1099 showing the sale of Relinquished Property in 2023. In other words, without further tax filing, the Service would be expecting that tax reporting related to the 1099 to be reflected on the 2023 tax return.

If a 1031 Exchange was started in 2022, but failed, or was completed with “boot” in 2023 the default reporting is to report the exchange transaction in the second year (2023). However, if an Exchanger had losses in the first year (2022), they may have elected to treat the exchange as though it took place in first year to offset the taxable event with the losses.

1031 Exchange Specific 2023 Tax Return Due Dates

Below are the specific dates that a 1031 Exchange should be reported based on the type of entity that completed the 1031 Exchange.

Reminder: For 1031 Exchange started in the fourth quarter of 2023, specifically after October 18, 2023, if you will need the full 180-day exchange period for your 1031 exchange, your 1031 exchange period will end on your tax due date, April 15, 2024, unless you file an extension on your 2023 taxes. (Taxpayers who live in Maine or Massachusetts have until April 17, 2024 to file their Federal returns. Some states – including Delaware, Iowa, Louisiana, and Virginia – have different deadlines for filing state tax returns.)

March

March 15, 2024: Partnerships and S corporations, must file a 2023 calendar year return (Form 1065) and provide each partner with a copy of their Schedule K-1 (Form 1065) and if applicable Scheduled K-3. If needed, file Form 7004 for an automatic 6-month extension to file the return.

If a partnership or S corporation engaged in a 1031 Exchange, this is the due date by which they must file one of the above-mentioned items pertaining to the exchange.

April

April 15, 2024: Most Individuals, living and working in the US, must file their 2023 tax return, Form 1040 or 1040-SR and pay any tax due. If you want an automatic 6-month extension, file a Form 4868, and pay what you estimate you will owe to avoid any penalties and interest.

April 15, 2024: Corporations, must file a 2023 calendar year income tax return (Form 1120) and pay any tax due. To file an automatic 6-month extension file Form 7004 and deposit what you estimate you owe in taxes to avoid any penalties and interest.

If an Individual or Corporation engaged in a 1031 Exchange this is the date by which they must report the exchange to the IRS.

April 17, 2024: Individuals living in Maine or Massachusetts, must file their 2023 tax return, per the above.

Due Dates for Extensions

September

September 15, 2024: Partnerships and S corporations, if you requested a timely 6-month extension back on March 15, 2024, you must now file your 2023 calendar year return, Form 1065, and pay any difference in tax owed from the payment you made back in March.

October

October 15, 2024: Due date for Individual and Corporations that filed an extension back in April, they must now file their 2023 Tax Return.

For a comprehensive list of dates associated with filing taxes in 2024, visit the

Blog

-

2024 Tax Day: Key Dates and Factors Involving 1031 Exchanges

-

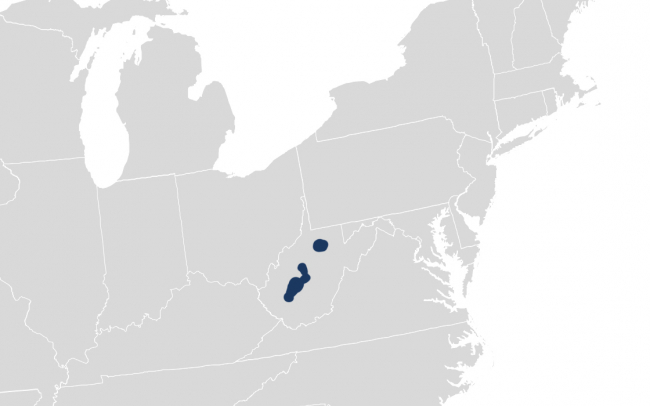

IRS Announces Tax Relief for West Virginia Taxpayers Impacted by Severe Storms

IRS has issued Tax Relief for parts of West Virginia impacted by severe storms, flooding, landslides, and mudslides that began August 28, 2023.

The General postponement date is June 17, 2024.

Individuals that reside or have businesses within Boone, Calhoun, Clay, Harrison, and Kanawha counties qualify for tax relief as this time.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers). -

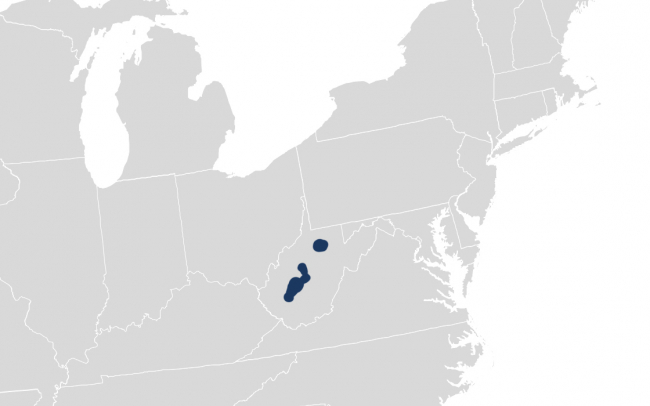

IRS Announces Tax Relief for West Virginia Taxpayers Impacted by Severe Storms

IRS has issued Tax Relief for parts of West Virginia impacted by severe storms, flooding, landslides, and mudslides that began August 28, 2023.

The General postponement date is June 17, 2024.

Individuals that reside or have businesses within Boone, Calhoun, Clay, Harrison, and Kanawha counties qualify for tax relief as this time.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers). -

IRS Announces Tax Relief for West Virginia Taxpayers Impacted by Severe Storms

IRS has issued Tax Relief for parts of West Virginia impacted by severe storms, flooding, landslides, and mudslides that began August 28, 2023.

The General postponement date is June 17, 2024.

Individuals that reside or have businesses within Boone, Calhoun, Clay, Harrison, and Kanawha counties qualify for tax relief as this time.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers). -

Maximizing the Value of Farm and Ranch Operations through 1031 Exchange Tax Deferral

1031 Exchange Eligible Ag Land in America

By definition, all Ag land is eligible for a 1031 exchange. Ag land includes pastureland, cropland, woodland, other land types and any improvements situated on or appurtenances to the land. In 2022, Ag land in the United States totaled 893 million acres, a decrease of 22 million acres from 2012. Total Ag land decreased 14.5 million acres from 2012 to 2017, double the rate of decrease compared to the previous 5-year period in which Ag land decreased 7.5 million acres from 2007 to 2012.

With an average price per acre over the 10-year span of $1348/acre, that equates to a total of $29.6 Billion dollars in sales of Ag land that would have been eligible for a 1031 exchange and which would have resulted in a conservative $11.8 Billion in tax deferrals based on the four levels of tax deferral associated with a 1031 exchange.

What is happening to Ag Land?

There are a variety of factors contributing to the decrease in Ag land over the last decade. Some of the most common reasons landowners are selling Ag land include:The Aging Producer/Landowner: 82% of principal operators of Ag land are 55+ years old and 38% of all Ag land is intended to be sold within the next 5-years.

Encroaching Development: The main drivers of land conversion in the last decade were low-density residential areas, urban developments, and energy production.

Increased Conservation Efforts: In 2021, the America the Beautiful initiative was introduced to conserve 30% of American land by 2030.Regardless of the reason or motivation, a profit from the sale of land creates a likely sizeable taxable event for the landowner. A 1031 exchange provides tax deferral to the landowners of Ag land upon the sale, which is often indefinite if the property is held until death and passed onto heirs.

The Future of Ag Land in America

In the coming years, the transfer of Ag land will continue. According to the 2014 Tenure, Ownership and Transition of Agricultural Land Survey conducted by the USDA, 38% of principal Ag land operators intend to sell their land, which equates to roughly $236.3 Billion dollars in 1031 exchange Value, and approximately $94.5 Billion in associated taxes due without a 1031 exchange.

From 2015 to 2023 a total of 27.3 million total acres were protected through state PACE (Purchase of Agricultural Conservation Easement) programs alone, with an average annual increase of 4%. If historical trends remain consistent, that is an estimated 3.6 million acres will enter Conservation Easements in 2024 through state PACE programs alone. With the 2023 average price per acre of pastureland at $1760, that is roughly $2.2 Billion in potential exchange value for land entered into Conservation Easements. It is important to note that most conveyances of Conservations Easements for Ag land by landowners will allow the sale price of the Conservation Easements to be used to acquire other real property interests in a 1031 exchange.Finally, the development of land will continue to impact agribusiness property into the future. From 2001 to 2016, 2,000 acres per day of Ag land was lost or developed. If that trend continues by 2040 an additional 18.4 million acres of Ag land will be converted into urban and rural developments triggering taxable events for the property owners of the Ag land sold. 1031 exchanges provide owners of Ag land the ability to make the right decisions for the future of their land without the tax consequences of the real estate transaction.

Unique Considerations for Agribusiness Property in a 1031 Exchange

While tax deferral with a 1031 exchange is not unique to agribusiness land, there are some unique considerations for owners of agribusiness property to be aware of to ensure they are getting the fullest extent of tax deferral possible under IRC Section 1031.

Improvements to Land

Additional guidance was provided in the 2020 Treasury Regulations regarding what can be eligible for 1031 exchange treatment outside of the traditional view of real property. The regulations state that to be part of real property, improvements to land must be permanently affixed. Affixation is considered permanent if it is reasonably expected to last indefinitely based on all the facts and circumstances. Ask the following questions to help determine whether the improvement qualifies as real property:How is it affixed to the real property?

Was it designed to be removed or remain in place?

What damage would removal cause to the improvement or real estate?

What time and expense would be associated with removal?

Is it documented by a fixture filing under state law?Some common agribusiness examples of improvements to land that qualify for 1031 exchange treatment include:

Center pivot irrigation systems

Fencing and livestock handling facilities

Wells, water lines and other water developments

Septic systems

Streambank preservation and erosion control structures

Foundations

Shops and Outbuildings including grain storage facilitiesIntangible Real Property Interests

Similar to improvements to land, there are additional interests that are deemed as real property for 1031 exchange purposes and as a result an Exchanger can receive tax deferral for transactions involving the specific interests.

Some of the most common types of like-kind intangible real property associated with agribusiness real estate transaction include:Perpetual Easements: Some of the most popular easements include Conservation Easements, Drainage Easements, Pipelines, Solar, Wind, and Billboards;

Water and ditch rights and oil, gas and mineral rights;

Leases and Permits: Federal or state grazing permits, special land use permits for cell tower or wind and solar farmsThere are many additional like-kind real property interests that are eligible for 1031 exchange treatment, as well.

Mixed-Use Properties

It is not uncommon for an agribusiness property to be mixed-used, meaning that while a portion of it is used for business or investment use, the remainder might be used for personal use, such as a primary residence. For example, a 100-acre plot that includes 95 acres of farmland and 5 acres which includes a primary residence.

Since only business or investment use property qualifies for a 1031 exchange, the personal use portion of a mixed-use property must be excluded from the total 1031 exchange value. Section 121 does however allow the property owner to exclude up to $250,000 (or $500,000 if married and filing jointly) on the gain of the sale of a primary residence which could provide full or partial tax deferral on the primary residence portion of the transaction. A 1031 exchange could be used for the remainder property achieving full tax deferral.

In conclusion, Agribusiness land will continue to be the subject of real estate transactions for a variety of reasons and without the proper knowledge and education, landowners could be subject to paying upwards of 40% of their land sale proceeds in taxes without a 1031 exchange.

It is important for a landowner to understand all of their options prior to entering into a real estate transaction and our dedicated team of 1031 Exchange Land experts are available to educate and consult Agribusiness property owners to help them maximize the value of their land, that in many cases, has been passed on generation to generation.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Sources:

Farmland Information Center -

Maximizing the Value of Farm and Ranch Operations through 1031 Exchange Tax Deferral

1031 Exchange Eligible Ag Land in America

By definition, all Ag land is eligible for a 1031 exchange. Ag land includes pastureland, cropland, woodland, other land types and any improvements situated on or appurtenances to the land. In 2022, Ag land in the United States totaled 893 million acres, a decrease of 22 million acres from 2012. Total Ag land decreased 14.5 million acres from 2012 to 2017, double the rate of decrease compared to the previous 5-year period in which Ag land decreased 7.5 million acres from 2007 to 2012.

With an average price per acre over the 10-year span of $1348/acre, that equates to a total of $29.6 Billion dollars in sales of Ag land that would have been eligible for a 1031 exchange and which would have resulted in a conservative $11.8 Billion in tax deferrals based on the four levels of tax deferral associated with a 1031 exchange.

What is happening to Ag Land?

There are a variety of factors contributing to the decrease in Ag land over the last decade. Some of the most common reasons landowners are selling Ag land include:The Aging Producer/Landowner: 82% of principal operators of Ag land are 55+ years old and 38% of all Ag land is intended to be sold within the next 5-years.

Encroaching Development: The main drivers of land conversion in the last decade were low-density residential areas, urban developments, and energy production.

Increased Conservation Efforts: In 2021, the America the Beautiful initiative was introduced to conserve 30% of American land by 2030.Regardless of the reason or motivation, a profit from the sale of land creates a likely sizeable taxable event for the landowner. A 1031 exchange provides tax deferral to the landowners of Ag land upon the sale, which is often indefinite if the property is held until death and passed onto heirs.

The Future of Ag Land in America

In the coming years, the transfer of Ag land will continue. According to the 2014 Tenure, Ownership and Transition of Agricultural Land Survey conducted by the USDA, 38% of principal Ag land operators intend to sell their land, which equates to roughly $236.3 Billion dollars in 1031 exchange Value, and approximately $94.5 Billion in associated taxes due without a 1031 exchange.

From 2015 to 2023 a total of 27.3 million total acres were protected through state PACE (Purchase of Agricultural Conservation Easement) programs alone, with an average annual increase of 4%. If historical trends remain consistent, that is an estimated 3.6 million acres will enter Conservation Easements in 2024 through state PACE programs alone. With the 2023 average price per acre of pastureland at $1760, that is roughly $2.2 Billion in potential exchange value for land entered into Conservation Easements. It is important to note that most conveyances of Conservations Easements for Ag land by landowners will allow the sale price of the Conservation Easements to be used to acquire other real property interests in a 1031 exchange.Finally, the development of land will continue to impact agribusiness property into the future. From 2001 to 2016, 2,000 acres per day of Ag land was lost or developed. If that trend continues by 2040 an additional 18.4 million acres of Ag land will be converted into urban and rural developments triggering taxable events for the property owners of the Ag land sold. 1031 exchanges provide owners of Ag land the ability to make the right decisions for the future of their land without the tax consequences of the real estate transaction.

Unique Considerations for Agribusiness Property in a 1031 Exchange

While tax deferral with a 1031 exchange is not unique to agribusiness land, there are some unique considerations for owners of agribusiness property to be aware of to ensure they are getting the fullest extent of tax deferral possible under IRC Section 1031.

Improvements to Land

Additional guidance was provided in the 2020 Treasury Regulations regarding what can be eligible for 1031 exchange treatment outside of the traditional view of real property. The regulations state that to be part of real property, improvements to land must be permanently affixed. Affixation is considered permanent if it is reasonably expected to last indefinitely based on all the facts and circumstances. Ask the following questions to help determine whether the improvement qualifies as real property:How is it affixed to the real property?

Was it designed to be removed or remain in place?

What damage would removal cause to the improvement or real estate?

What time and expense would be associated with removal?

Is it documented by a fixture filing under state law?Some common agribusiness examples of improvements to land that qualify for 1031 exchange treatment include:

Center pivot irrigation systems

Fencing and livestock handling facilities

Wells, water lines and other water developments

Septic systems

Streambank preservation and erosion control structures

Foundations

Shops and Outbuildings including grain storage facilitiesIntangible Real Property Interests

Similar to improvements to land, there are additional interests that are deemed as real property for 1031 exchange purposes and as a result an Exchanger can receive tax deferral for transactions involving the specific interests.

Some of the most common types of like-kind intangible real property associated with agribusiness real estate transaction include:Perpetual Easements: Some of the most popular easements include Conservation Easements, Drainage Easements, Pipelines, Solar, Wind, and Billboards;

Water and ditch rights and oil, gas and mineral rights;

Leases and Permits: Federal or state grazing permits, special land use permits for cell tower or wind and solar farmsThere are many additional like-kind real property interests that are eligible for 1031 exchange treatment, as well.

Mixed-Use Properties

It is not uncommon for an agribusiness property to be mixed-used, meaning that while a portion of it is used for business or investment use, the remainder might be used for personal use, such as a primary residence. For example, a 100-acre plot that includes 95 acres of farmland and 5 acres which includes a primary residence.

Since only business or investment use property qualifies for a 1031 exchange, the personal use portion of a mixed-use property must be excluded from the total 1031 exchange value. Section 121 does however allow the property owner to exclude up to $250,000 (or $500,000 if married and filing jointly) on the gain of the sale of a primary residence which could provide full or partial tax deferral on the primary residence portion of the transaction. A 1031 exchange could be used for the remainder property achieving full tax deferral.

In conclusion, Agribusiness land will continue to be the subject of real estate transactions for a variety of reasons and without the proper knowledge and education, landowners could be subject to paying upwards of 40% of their land sale proceeds in taxes without a 1031 exchange.

It is important for a landowner to understand all of their options prior to entering into a real estate transaction and our dedicated team of 1031 Exchange Land experts are available to educate and consult Agribusiness property owners to help them maximize the value of their land, that in many cases, has been passed on generation to generation.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Sources:

Farmland Information Center -

Maximizing the Value of Farm and Ranch Operations through 1031 Exchange Tax Deferral

1031 Exchange Eligible Ag Land in America

By definition, all Ag land is eligible for a 1031 exchange. Ag land includes pastureland, cropland, woodland, other land types and any improvements situated on or appurtenances to the land. In 2022, Ag land in the United States totaled 893 million acres, a decrease of 22 million acres from 2012. Total Ag land decreased 14.5 million acres from 2012 to 2017, double the rate of decrease compared to the previous 5-year period in which Ag land decreased 7.5 million acres from 2007 to 2012.

With an average price per acre over the 10-year span of $1348/acre, that equates to a total of $29.6 Billion dollars in sales of Ag land that would have been eligible for a 1031 exchange and which would have resulted in a conservative $11.8 Billion in tax deferrals based on the four levels of tax deferral associated with a 1031 exchange.

What is happening to Ag Land?

There are a variety of factors contributing to the decrease in Ag land over the last decade. Some of the most common reasons landowners are selling Ag land include:The Aging Producer/Landowner: 82% of principal operators of Ag land are 55+ years old and 38% of all Ag land is intended to be sold within the next 5-years.

Encroaching Development: The main drivers of land conversion in the last decade were low-density residential areas, urban developments, and energy production.

Increased Conservation Efforts: In 2021, the America the Beautiful initiative was introduced to conserve 30% of American land by 2030.Regardless of the reason or motivation, a profit from the sale of land creates a likely sizeable taxable event for the landowner. A 1031 exchange provides tax deferral to the landowners of Ag land upon the sale, which is often indefinite if the property is held until death and passed onto heirs.

The Future of Ag Land in America

In the coming years, the transfer of Ag land will continue. According to the 2014 Tenure, Ownership and Transition of Agricultural Land Survey conducted by the USDA, 38% of principal Ag land operators intend to sell their land, which equates to roughly $236.3 Billion dollars in 1031 exchange Value, and approximately $94.5 Billion in associated taxes due without a 1031 exchange.

From 2015 to 2023 a total of 27.3 million total acres were protected through state PACE (Purchase of Agricultural Conservation Easement) programs alone, with an average annual increase of 4%. If historical trends remain consistent, that is an estimated 3.6 million acres will enter Conservation Easements in 2024 through state PACE programs alone. With the 2023 average price per acre of pastureland at $1760, that is roughly $2.2 Billion in potential exchange value for land entered into Conservation Easements. It is important to note that most conveyances of Conservations Easements for Ag land by landowners will allow the sale price of the Conservation Easements to be used to acquire other real property interests in a 1031 exchange.Finally, the development of land will continue to impact agribusiness property into the future. From 2001 to 2016, 2,000 acres per day of Ag land was lost or developed. If that trend continues by 2040 an additional 18.4 million acres of Ag land will be converted into urban and rural developments triggering taxable events for the property owners of the Ag land sold. 1031 exchanges provide owners of Ag land the ability to make the right decisions for the future of their land without the tax consequences of the real estate transaction.

Unique Considerations for Agribusiness Property in a 1031 Exchange

While tax deferral with a 1031 exchange is not unique to agribusiness land, there are some unique considerations for owners of agribusiness property to be aware of to ensure they are getting the fullest extent of tax deferral possible under IRC Section 1031.

Improvements to Land

Additional guidance was provided in the 2020 Treasury Regulations regarding what can be eligible for 1031 exchange treatment outside of the traditional view of real property. The regulations state that to be part of real property, improvements to land must be permanently affixed. Affixation is considered permanent if it is reasonably expected to last indefinitely based on all the facts and circumstances. Ask the following questions to help determine whether the improvement qualifies as real property:How is it affixed to the real property?

Was it designed to be removed or remain in place?

What damage would removal cause to the improvement or real estate?

What time and expense would be associated with removal?

Is it documented by a fixture filing under state law?Some common agribusiness examples of improvements to land that qualify for 1031 exchange treatment include:

Center pivot irrigation systems

Fencing and livestock handling facilities

Wells, water lines and other water developments

Septic systems

Streambank preservation and erosion control structures

Foundations

Shops and Outbuildings including grain storage facilitiesIntangible Real Property Interests

Similar to improvements to land, there are additional interests that are deemed as real property for 1031 exchange purposes and as a result an Exchanger can receive tax deferral for transactions involving the specific interests.

Some of the most common types of like-kind intangible real property associated with agribusiness real estate transaction include:Perpetual Easements: Some of the most popular easements include Conservation Easements, Drainage Easements, Pipelines, Solar, Wind, and Billboards;

Water and ditch rights and oil, gas and mineral rights;

Leases and Permits: Federal or state grazing permits, special land use permits for cell tower or wind and solar farmsThere are many additional like-kind real property interests that are eligible for 1031 exchange treatment, as well.

Mixed-Use Properties

It is not uncommon for an agribusiness property to be mixed-used, meaning that while a portion of it is used for business or investment use, the remainder might be used for personal use, such as a primary residence. For example, a 100-acre plot that includes 95 acres of farmland and 5 acres which includes a primary residence.

Since only business or investment use property qualifies for a 1031 exchange, the personal use portion of a mixed-use property must be excluded from the total 1031 exchange value. Section 121 does however allow the property owner to exclude up to $250,000 (or $500,000 if married and filing jointly) on the gain of the sale of a primary residence which could provide full or partial tax deferral on the primary residence portion of the transaction. A 1031 exchange could be used for the remainder property achieving full tax deferral.

In conclusion, Agribusiness land will continue to be the subject of real estate transactions for a variety of reasons and without the proper knowledge and education, landowners could be subject to paying upwards of 40% of their land sale proceeds in taxes without a 1031 exchange.

It is important for a landowner to understand all of their options prior to entering into a real estate transaction and our dedicated team of 1031 Exchange Land experts are available to educate and consult Agribusiness property owners to help them maximize the value of their land, that in many cases, has been passed on generation to generation.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Sources:

Farmland Information Center -

Can You 1031 Exchange Into a REIT?

Review of 1031 Exchange Requirements

First, we must review the requirements set forth within IRS Code §1031. Although the nature of the REIT asset is real estate, the investor receives shares in the REIT which is treated as owning under a partnership and that is not compatible with IRS Code §1031 which effectively requires a more direct interest such as a deeded interest in real estate. So, without more, a real estate investor or business property owner cannot trade directly from the property into a REIT through a 1031 Exchange. However, if investment in a REIT is the ultimate goal, a property owner can accomplish such by first completing a 1031 Exchange into a DST and then completing a 721 UPREIT Exchange from the DST into a REIT, though careful consideration and planning are critical to the success of this process.

Tax Deferred Transaction into REIT

For real estate investors looking to move from a property into a REIT, one possible way to accomplish the movement with taxes deferred is via IRS Code §721, known as a 721 Exchange. REITs often hold the real estate assets in an Umbrella Partnership Real Estate Investment Trust, referred to as an “UPREIT.” If a property owner happens to own a significant piece of property that might meet the criteria of the type of property that a particular UPREIT owns in its investment portfolio, the REIT might be willing to acquire the property using a 721 Exchange for an equal value of operating units in the UPREIT operating partnership which can then shortly after be converted to direct shares in the REIT. But as one can imagine, a lot of things have to line up and your average property investor is unlikely to be able to take advantage of this structure due to their property not meeting all criteria set forth by the REIT.

1031 Exchange into a DST Followed by a 721 Transaction into a REIT

Fortunately for the average investor or business property owner who is unable to affect a trade directly with a REIT there is another practical solution utilizing a 1031 Exchange. Specifically, a property owner can use a 1031 Exchange and buy into a Delaware Statutory Trust (DST) as the Replacement Property. Although DSTs are very popular investments across the board for 1031 investors, in this case, the DSTs in questions are ones that are affiliated with the REIT sponsor.

This transaction is begun like any other 1031 Exchange where the Exchanger sells the Relinquished Property to the buyer of choice. The exchange proceeds are then utilized to acquire the DST, which is allowed per §1031 based on the legal structure of a DST interest. The investor is considered to be acquiring a direct interest in real estate, unlike a REIT where the interest being acquired is a partnership interest (and not real estate). As the link above explains in greater detail, the DST share holds a fractional share of one or more properties based on the amount invested, together with other people, but the investor does own his or her real estate interest personally. It is somewhat similar as a REIT, but one qualifies as Replacement Property for a 1031 Exchange and the other does not.

Once the DST interest is held for several years or more, the UPREIT 721 process described above can take place and the property owner can exchange the DST interest for the UPREIT interest via a 721 UPREIT Exchange. Basically, by using the DST, the REIT is able to acquire the property that fits into their REIT portfolio instead of the property originally being sold by the investor. Everyone can have their cake and invest it too.

Many property owners, simply trade into a DST and that is the end of that specific 1031 exchange transaction. From there they can continue to trade into future exchanges out of the DST. But from those interested in an ultimate investment in REIT, they can take the further step.

Considerations of 1031 Exchanges, DSTs and REITS

There are advantages to continuing to do 1031 Exchanges each time a property is sold to continue to defer the taxes that would otherwise become due, which among other things allows the investor to benefit from the time value of money. Additionally, should the investor pass away without having cashed out of their exchange property, the heirs would receive a stepped-up basis and any of the deferred taxes would become non-payable (https://www.accruit.com/blog/video-step-basis-1031-exchange).

REITs too have many benefits, but once the 1031 link is cut via the conversion to the REIT, any subsequent sale of the REIT shares are fully taxable at the basis carried over from the original exchange(s) – further tax deferral is not possible.

As always it is important to discuss tax deferral strategies and options with your CPA, Tax Advisor, or Financial Advisor to ensure you are making the most educated decision and that proper planning is in place.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Can You 1031 Exchange Into a REIT?

Review of 1031 Exchange Requirements

First, we must review the requirements set forth within IRS Code §1031. Although the nature of the REIT asset is real estate, the investor receives shares in the REIT which is treated as owning under a partnership and that is not compatible with IRS Code §1031 which effectively requires a more direct interest such as a deeded interest in real estate. So, without more, a real estate investor or business property owner cannot trade directly from the property into a REIT through a 1031 Exchange. However, if investment in a REIT is the ultimate goal, a property owner can accomplish such by first completing a 1031 Exchange into a DST and then completing a 721 UPREIT Exchange from the DST into a REIT, though careful consideration and planning are critical to the success of this process.

Tax Deferred Transaction into REIT

For real estate investors looking to move from a property into a REIT, one possible way to accomplish the movement with taxes deferred is via IRS Code §721, known as a 721 Exchange. REITs often hold the real estate assets in an Umbrella Partnership Real Estate Investment Trust, referred to as an “UPREIT.” If a property owner happens to own a significant piece of property that might meet the criteria of the type of property that a particular UPREIT owns in its investment portfolio, the REIT might be willing to acquire the property using a 721 Exchange for an equal value of operating units in the UPREIT operating partnership which can then shortly after be converted to direct shares in the REIT. But as one can imagine, a lot of things have to line up and your average property investor is unlikely to be able to take advantage of this structure due to their property not meeting all criteria set forth by the REIT.

1031 Exchange into a DST Followed by a 721 Transaction into a REIT

Fortunately for the average investor or business property owner who is unable to affect a trade directly with a REIT there is another practical solution utilizing a 1031 Exchange. Specifically, a property owner can use a 1031 Exchange and buy into a Delaware Statutory Trust (DST) as the Replacement Property. Although DSTs are very popular investments across the board for 1031 investors, in this case, the DSTs in questions are ones that are affiliated with the REIT sponsor.

This transaction is begun like any other 1031 Exchange where the Exchanger sells the Relinquished Property to the buyer of choice. The exchange proceeds are then utilized to acquire the DST, which is allowed per §1031 based on the legal structure of a DST interest. The investor is considered to be acquiring a direct interest in real estate, unlike a REIT where the interest being acquired is a partnership interest (and not real estate). As the link above explains in greater detail, the DST share holds a fractional share of one or more properties based on the amount invested, together with other people, but the investor does own his or her real estate interest personally. It is somewhat similar as a REIT, but one qualifies as Replacement Property for a 1031 Exchange and the other does not.

Once the DST interest is held for several years or more, the UPREIT 721 process described above can take place and the property owner can exchange the DST interest for the UPREIT interest via a 721 UPREIT Exchange. Basically, by using the DST, the REIT is able to acquire the property that fits into their REIT portfolio instead of the property originally being sold by the investor. Everyone can have their cake and invest it too.

Many property owners, simply trade into a DST and that is the end of that specific 1031 exchange transaction. From there they can continue to trade into future exchanges out of the DST. But from those interested in an ultimate investment in REIT, they can take the further step.

Considerations of 1031 Exchanges, DSTs and REITS

There are advantages to continuing to do 1031 Exchanges each time a property is sold to continue to defer the taxes that would otherwise become due, which among other things allows the investor to benefit from the time value of money. Additionally, should the investor pass away without having cashed out of their exchange property, the heirs would receive a stepped-up basis and any of the deferred taxes would become non-payable (https://www.accruit.com/blog/video-step-basis-1031-exchange).

REITs too have many benefits, but once the 1031 link is cut via the conversion to the REIT, any subsequent sale of the REIT shares are fully taxable at the basis carried over from the original exchange(s) – further tax deferral is not possible.

As always it is important to discuss tax deferral strategies and options with your CPA, Tax Advisor, or Financial Advisor to ensure you are making the most educated decision and that proper planning is in place.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

Can You 1031 Exchange Into a REIT?

Review of 1031 Exchange Requirements

First, we must review the requirements set forth within IRS Code §1031. Although the nature of the REIT asset is real estate, the investor receives shares in the REIT which is treated as owning under a partnership and that is not compatible with IRS Code §1031 which effectively requires a more direct interest such as a deeded interest in real estate. So, without more, a real estate investor or business property owner cannot trade directly from the property into a REIT through a 1031 Exchange. However, if investment in a REIT is the ultimate goal, a property owner can accomplish such by first completing a 1031 Exchange into a DST and then completing a 721 UPREIT Exchange from the DST into a REIT, though careful consideration and planning are critical to the success of this process.

Tax Deferred Transaction into REIT

For real estate investors looking to move from a property into a REIT, one possible way to accomplish the movement with taxes deferred is via IRS Code §721, known as a 721 Exchange. REITs often hold the real estate assets in an Umbrella Partnership Real Estate Investment Trust, referred to as an “UPREIT.” If a property owner happens to own a significant piece of property that might meet the criteria of the type of property that a particular UPREIT owns in its investment portfolio, the REIT might be willing to acquire the property using a 721 Exchange for an equal value of operating units in the UPREIT operating partnership which can then shortly after be converted to direct shares in the REIT. But as one can imagine, a lot of things have to line up and your average property investor is unlikely to be able to take advantage of this structure due to their property not meeting all criteria set forth by the REIT.

1031 Exchange into a DST Followed by a 721 Transaction into a REIT

Fortunately for the average investor or business property owner who is unable to affect a trade directly with a REIT there is another practical solution utilizing a 1031 Exchange. Specifically, a property owner can use a 1031 Exchange and buy into a Delaware Statutory Trust (DST) as the Replacement Property. Although DSTs are very popular investments across the board for 1031 investors, in this case, the DSTs in questions are ones that are affiliated with the REIT sponsor.

This transaction is begun like any other 1031 Exchange where the Exchanger sells the Relinquished Property to the buyer of choice. The exchange proceeds are then utilized to acquire the DST, which is allowed per §1031 based on the legal structure of a DST interest. The investor is considered to be acquiring a direct interest in real estate, unlike a REIT where the interest being acquired is a partnership interest (and not real estate). As the link above explains in greater detail, the DST share holds a fractional share of one or more properties based on the amount invested, together with other people, but the investor does own his or her real estate interest personally. It is somewhat similar as a REIT, but one qualifies as Replacement Property for a 1031 Exchange and the other does not.

Once the DST interest is held for several years or more, the UPREIT 721 process described above can take place and the property owner can exchange the DST interest for the UPREIT interest via a 721 UPREIT Exchange. Basically, by using the DST, the REIT is able to acquire the property that fits into their REIT portfolio instead of the property originally being sold by the investor. Everyone can have their cake and invest it too.

Many property owners, simply trade into a DST and that is the end of that specific 1031 exchange transaction. From there they can continue to trade into future exchanges out of the DST. But from those interested in an ultimate investment in REIT, they can take the further step.

Considerations of 1031 Exchanges, DSTs and REITS

There are advantages to continuing to do 1031 Exchanges each time a property is sold to continue to defer the taxes that would otherwise become due, which among other things allows the investor to benefit from the time value of money. Additionally, should the investor pass away without having cashed out of their exchange property, the heirs would receive a stepped-up basis and any of the deferred taxes would become non-payable (https://www.accruit.com/blog/video-step-basis-1031-exchange).

REITs too have many benefits, but once the 1031 link is cut via the conversion to the REIT, any subsequent sale of the REIT shares are fully taxable at the basis carried over from the original exchange(s) – further tax deferral is not possible.

As always it is important to discuss tax deferral strategies and options with your CPA, Tax Advisor, or Financial Advisor to ensure you are making the most educated decision and that proper planning is in place.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.