While financial benefits of a 1031 Exchange are experienced within the 180-day exchange period, there are additional, compounding benefits that are not readily visible at the completion of your exchange.

Let’s take a look at the long-term benefits of utilizing a 1031 Exchange for your qualifying real estate transaction.

Suzy Investor owns a retail center she has been renting out over the past 20 years. She has taken annual depreciation deductions of $10,256 since 1990, reducing her tax basis to $244,880. She decides to sell the retail center at market value of $1,250,000, and rid herself of management responsibility by reinvesting into a passive investment opportunity, such as a DST.

Without leveraging a 1031 Exchange, Suzy will incur the following tax liability, leaving her only $942,400 to reinvest.

federal capital gains tax (20%): $153,000

depreciation recapture tax (25%): $51,280

state capital gains (5% varies by state): $38,250

net investment income tax (3.8%): $29,070

Total Tax Liability: $271,600

Reinvestment Total Without a 1031 exchange: $942,400 ($1,250,000 – $271,600)

However, should Suzy engage a Qualified Intermediary prior to the sale of her retail center and structure her transaction as a 1031 Exchange, she will defer all levels of tax above and have the total $1.25 Million to reinvest.

The immediate benefit is obvious; Suzy has an additional $271,600 to reinvest. The less obvious benefit is how that additional amount compounds over the proceeding years. With Suzy utilizing a 1031 Exchange and reinvesting the full $1.25 million, at a 7% compounded rate of return over the next 10 years she will have earned nearly double the investment for a total of $2.45 Million.

Without a 1031 Exchange, the reinvestment amount of just $942,400 after 10 years at the same compounding rate of return, only earns $1.85 Million, roughly only $500,000 more than her original reinvestment amount with the use of a 1031 Exchange. That equates to $600,000 less over 10 years should a 1031 Exchange not be utilized.

Utilizing a 1031 Exchange not only provides investors with immediate benefits, it continues to produce returns on investment in the future.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.

Blog

-

The Compounding Benefits of a 1031 Exchange

-

IRS Announces Tax Relief for Georgia Taxpayers Impacted by Idalia

Due to Idalia, the IRS has issued Tax Relief for 28 counties within Georgia.

The Disaster Date is August 30th (GA). The General postponement date is February 15, 2024.

The Disaster Date is listed above. Note that some disasters occur on a single date; others, such as flooding, occur over a period of days and the Disaster Date above is preceded by beginning or began.

Currently, 28 counties within Georgia including: Appling, Atkinson, Bacon, Berrien, Brantley, Brooks, Bulloch, Camden, Candler, Charlton, Clinch, Coffee, Colquitt, Cook, Echols, Emanuel, Glynn, Jeff Davis, Jenkins, Lanier, Lowndes, Pierce, Screven, Tattnall, Thomas, Tift, Ware and Wayne counties qualify. Individuals and households that reside or have a business in these counties qualify for tax relief, but any area added later to the disaster area will also qualify.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers). -

IRS Announces Tax Relief for Georgia Taxpayers Impacted by Idalia

Due to Idalia, the IRS has issued Tax Relief for 28 counties within Georgia.

The Disaster Date is August 30th (GA). The General postponement date is February 15, 2024.

The Disaster Date is listed above. Note that some disasters occur on a single date; others, such as flooding, occur over a period of days and the Disaster Date above is preceded by beginning or began.

Currently, 28 counties within Georgia including: Appling, Atkinson, Bacon, Berrien, Brantley, Brooks, Bulloch, Camden, Candler, Charlton, Clinch, Coffee, Colquitt, Cook, Echols, Emanuel, Glynn, Jeff Davis, Jenkins, Lanier, Lowndes, Pierce, Screven, Tattnall, Thomas, Tift, Ware and Wayne counties qualify. Individuals and households that reside or have a business in these counties qualify for tax relief, but any area added later to the disaster area will also qualify.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers). -

IRS Announces Tax Relief for Georgia Taxpayers Impacted by Idalia

Due to Idalia, the IRS has issued Tax Relief for 28 counties within Georgia.

The Disaster Date is August 30th (GA). The General postponement date is February 15, 2024.

The Disaster Date is listed above. Note that some disasters occur on a single date; others, such as flooding, occur over a period of days and the Disaster Date above is preceded by beginning or began.

Currently, 28 counties within Georgia including: Appling, Atkinson, Bacon, Berrien, Brantley, Brooks, Bulloch, Camden, Candler, Charlton, Clinch, Coffee, Colquitt, Cook, Echols, Emanuel, Glynn, Jeff Davis, Jenkins, Lanier, Lowndes, Pierce, Screven, Tattnall, Thomas, Tift, Ware and Wayne counties qualify. Individuals and households that reside or have a business in these counties qualify for tax relief, but any area added later to the disaster area will also qualify.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers). -

Accruit Technologies Successfully Implements 1031 Exchange Software Exchange Manager Pro(SM) for Asset Preservation, Inc.

Denver, CO, September 12, 2023 – Accruit Technologies, anhttps://inspirafinancial.com/”> Inspira Financial solution, announced today the successful implementation of Exchange Manager ProSM, patented 1031 exchange software, for Asset Preservation, Inc. (API), a national Qualified Intermediary of publicly-traded parent company Stewart Information Services Corp (NYSE: STC).

Exchange Manager ProSM standardizes the 1031 Exchange workflow through embedded controls to track deadlines, automated document creation and distribution, electronic signatures, and data consolidation, resulting in 30% improved efficiencies and increased client satisfaction. In June of 2023, Accruit Technologies successfully completed a System and Organization SOC 2 Type II audit achieving compliance with the industry leading standards for customer data and security.

“We established an initiative that would allow advancements in technology to improve our company’s customer experience. A significant part of this initiative was the implementation of Exchange Manager ProSM,” said API President Javier Vande Steeg. “Exchange Manager ProSM has greatly improved our efficiencies in both our exchange management practice and our document preparation. Accruit Technologies is responsive and works tirelessly to deliver an outstanding solution. Their team of analysts and developers are knowledgeable, not only of their technical field, but also of the 1031 exchange rules and process. We’re very excited to see how Exchange Manager ProSM will continue to improve our customers’ experience.”

“The integration of Exchange Manager ProSM into Asset Preservation’s operations is a large milestone for Accruit Technologies,” stated Accruit President Brent Abrahm. “Javier and his team support our vision of revolutionizing the way the real estate industry manages 1031 Exchanges. We are honored to work with one of the largest and most well-respected Qualified Intermediaries in the industry, and we look forward to our SaaS offering impacting their customers’ experience through operational efficiencies moving forward.”

About Accruit Technologies

Accruit Technologies, an Inspira Financial solution, developed Exchange Manager ProSM, a proprietary, cloud-based SaaS application that makes administering 1031 Exchanges safe, secure, and simple. Accruit Technologies achieved SOC 2 Type II compliance with industry leading standards for customer data security. -

Accruit Technologies Successfully Implements 1031 Exchange Software Exchange Manager Pro(SM) for Asset Preservation, Inc.

Denver, CO, September 12, 2023 – Accruit Technologies, anhttps://inspirafinancial.com/”> Inspira Financial solution, announced today the successful implementation of Exchange Manager ProSM, patented 1031 exchange software, for Asset Preservation, Inc. (API), a national Qualified Intermediary of publicly-traded parent company Stewart Information Services Corp (NYSE: STC).

Exchange Manager ProSM standardizes the 1031 Exchange workflow through embedded controls to track deadlines, automated document creation and distribution, electronic signatures, and data consolidation, resulting in 30% improved efficiencies and increased client satisfaction. In June of 2023, Accruit Technologies successfully completed a System and Organization SOC 2 Type II audit achieving compliance with the industry leading standards for customer data and security.

“We established an initiative that would allow advancements in technology to improve our company’s customer experience. A significant part of this initiative was the implementation of Exchange Manager ProSM,” said API President Javier Vande Steeg. “Exchange Manager ProSM has greatly improved our efficiencies in both our exchange management practice and our document preparation. Accruit Technologies is responsive and works tirelessly to deliver an outstanding solution. Their team of analysts and developers are knowledgeable, not only of their technical field, but also of the 1031 exchange rules and process. We’re very excited to see how Exchange Manager ProSM will continue to improve our customers’ experience.”

“The integration of Exchange Manager ProSM into Asset Preservation’s operations is a large milestone for Accruit Technologies,” stated Accruit President Brent Abrahm. “Javier and his team support our vision of revolutionizing the way the real estate industry manages 1031 Exchanges. We are honored to work with one of the largest and most well-respected Qualified Intermediaries in the industry, and we look forward to our SaaS offering impacting their customers’ experience through operational efficiencies moving forward.”

About Accruit Technologies

Accruit Technologies, an Inspira Financial solution, developed Exchange Manager ProSM, a proprietary, cloud-based SaaS application that makes administering 1031 Exchanges safe, secure, and simple. Accruit Technologies achieved SOC 2 Type II compliance with industry leading standards for customer data security. -

Accruit Technologies Successfully Implements 1031 Exchange Software Exchange Manager Pro(SM) for Asset Preservation, Inc.

Denver, CO, September 12, 2023 – Accruit Technologies, anhttps://inspirafinancial.com/”> Inspira Financial solution, announced today the successful implementation of Exchange Manager ProSM, patented 1031 exchange software, for Asset Preservation, Inc. (API), a national Qualified Intermediary of publicly-traded parent company Stewart Information Services Corp (NYSE: STC).

Exchange Manager ProSM standardizes the 1031 Exchange workflow through embedded controls to track deadlines, automated document creation and distribution, electronic signatures, and data consolidation, resulting in 30% improved efficiencies and increased client satisfaction. In June of 2023, Accruit Technologies successfully completed a System and Organization SOC 2 Type II audit achieving compliance with the industry leading standards for customer data and security.

“We established an initiative that would allow advancements in technology to improve our company’s customer experience. A significant part of this initiative was the implementation of Exchange Manager ProSM,” said API President Javier Vande Steeg. “Exchange Manager ProSM has greatly improved our efficiencies in both our exchange management practice and our document preparation. Accruit Technologies is responsive and works tirelessly to deliver an outstanding solution. Their team of analysts and developers are knowledgeable, not only of their technical field, but also of the 1031 exchange rules and process. We’re very excited to see how Exchange Manager ProSM will continue to improve our customers’ experience.”

“The integration of Exchange Manager ProSM into Asset Preservation’s operations is a large milestone for Accruit Technologies,” stated Accruit President Brent Abrahm. “Javier and his team support our vision of revolutionizing the way the real estate industry manages 1031 Exchanges. We are honored to work with one of the largest and most well-respected Qualified Intermediaries in the industry, and we look forward to our SaaS offering impacting their customers’ experience through operational efficiencies moving forward.”

About Accruit Technologies

Accruit Technologies, an Inspira Financial solution, developed Exchange Manager ProSM, a proprietary, cloud-based SaaS application that makes administering 1031 Exchanges safe, secure, and simple. Accruit Technologies achieved SOC 2 Type II compliance with industry leading standards for customer data security. -

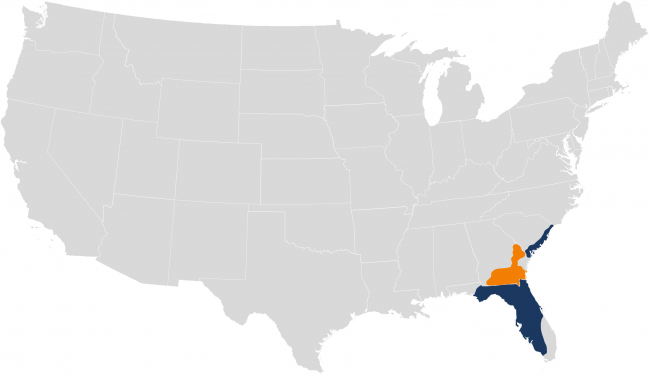

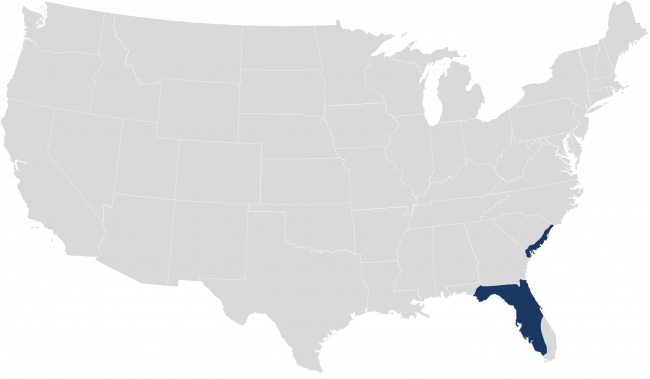

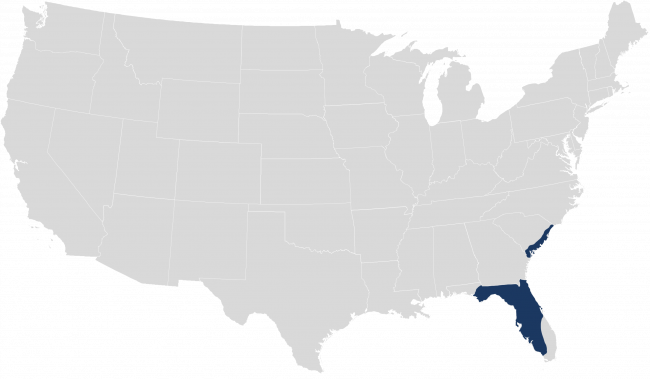

IRS Announces Tax Relief for Victims of Hurricane Idalia for Florida and South Carolina

Due to Hurricane Idalia, the IRS has issues Tax Relief for several counties in Florida and all counties within South Carolina.

The Disaster Date is August 27th (FL) and August 29th (SC). The General postponement date is February 15, 2024.

The Disaster Date is listed above. Note that some disasters occur on a single date; others, such as flooding, occur over a period of days and the Disaster Date above is preceded by beginning or began.

Currently, 46 of Florida’s 67 counties and all 46 counties of South Carolina qualify. Individuals and households that reside or have a business in these counties qualify for tax relief, but any area added later to the disaster area will also qualify.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers).Visit for full details on the tax relief in South Carolina.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

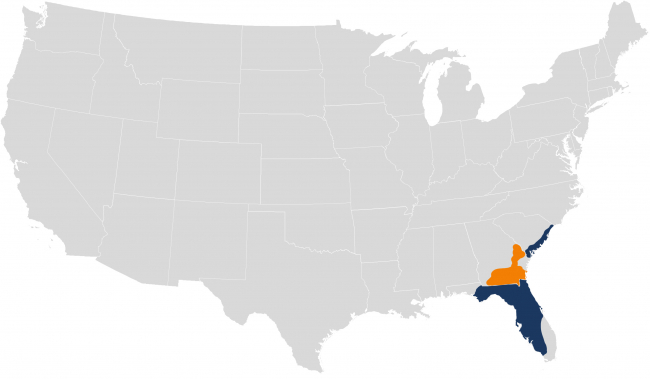

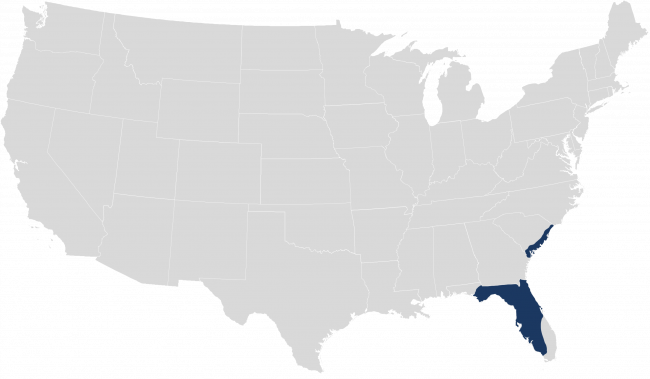

IRS Announces Tax Relief for Victims of Hurricane Idalia for Florida and South Carolina

Due to Hurricane Idalia, the IRS has issues Tax Relief for several counties in Florida and all counties within South Carolina.

The Disaster Date is August 27th (FL) and August 29th (SC). The General postponement date is February 15, 2024.

The Disaster Date is listed above. Note that some disasters occur on a single date; others, such as flooding, occur over a period of days and the Disaster Date above is preceded by beginning or began.

Currently, 46 of Florida’s 67 counties and all 46 counties of South Carolina qualify. Individuals and households that reside or have a business in these counties qualify for tax relief, but any area added later to the disaster area will also qualify.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers).Visit for full details on the tax relief in South Carolina.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice. -

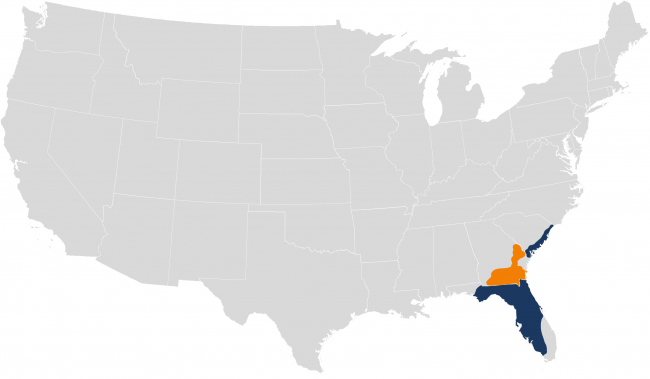

IRS Announces Tax Relief for Victims of Hurricane Idalia for Florida and South Carolina

Due to Hurricane Idalia, the IRS has issues Tax Relief for several counties in Florida and all counties within South Carolina.

The Disaster Date is August 27th (FL) and August 29th (SC). The General postponement date is February 15, 2024.

The Disaster Date is listed above. Note that some disasters occur on a single date; others, such as flooding, occur over a period of days and the Disaster Date above is preceded by beginning or began.

Currently, 46 of Florida’s 67 counties and all 46 counties of South Carolina qualify. Individuals and households that reside or have a business in these counties qualify for tax relief, but any area added later to the disaster area will also qualify.

An “Affected Taxpayer” includes individuals who live, and businesses whose principal place of business is located in, the Covered Disaster Area. Affected Taxpayers are entitled to relief regardless of where the relinquished property or replacement property is located. Affected Taxpayers may choose either the General Postponement relief under Section 6 OR the Alternative relief under Section 17 of Rev. Proc. 2018-58. Taxpayers who do not meet the definition of Affected Taxpayers do not qualify for Section 6 General Postponement relief.

Option One: General Postponement under Section 6 of Rev. Proc. 2018-58 (Affected Taxpayers only). Any 45-day deadline or 180-day deadline (for either a forward or reverse exchange) that falls on or after the Disaster Date above is postponed to the General Postponement Date. The General Postponement applies regardless of the date the Relinquished Property was transferred (or the parked property acquired by the EAT) and is available to Affected Taxpayers regardless of whether their exchange began before or after the Disaster Date.

Option Two: Section 17 Alternative (Available to (1) Affected Taxpayers and (2) other taxpayers who have difficulty meeting the exchange deadlines because of the disaster. See Rev. Proc. 2018-58, Section 17 for conditions constituting “difficulty”). Option Two is only available if the relinquished property was transferred (or the parked property was acquired by the EAT) on or before the Disaster Date. Any 45-day or 180-day deadline that falls on or after the Disaster Date is extended to THE LONGER OF: (1) 120 days from such deadline; OR (2) the General Postponement Date. Note the date may not be extended beyond one year or the due date (including extensions) of the tax return for the year of the disposition of the relinquished property (typically, if an extension was filed, 9/15 for corporations and partnerships and 10/15 for other taxpayers).Visit for full details on the tax relief in South Carolina.

The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax or compliance advice. Accruit performs the duties of a Qualified Intermediary, and as such does not offer or sell investments or provide investment, legal, or tax advice.