A 1031 exchange is a powerful tool that can help investors defer taxes when they sell one investment property and buy another. However, there are some common mistakes that investors make during the process that can cost them time and money. In this article, we will discuss some of the most common mistakes to avoid in a 1031 exchange.

Mistake #1: Not understanding the 1031 Exchange timeline

The IRS has specific rules and timelines that must be followed in a 1031 exchange. Investors have 45 days from the sale of their relinquished property to identify potential replacement properties and 180 days to complete the purchase of one or more of those identified replacement properties. Failure to meet these deadlines will result in the disqualification of the 1031 exchange, meaning that the investor will be responsible for paying taxes on any capital gains realized from the sale of the relinquished property.

Mistake #2: Not using a 1031 Exchange Qualified Intermediary

A Qualified Intermediary (QI) is a third-party facilitator that through a series of assignments acts as the party to complete the exchange with the Exchanger. By virtue of these assignments, title to the Relinquished Party passes through the QI to the Buyer, and title to the Replacement Property passes through the QI to the Exchanger. Title does not actually vest in the QI, saving a legal step, and in many states, additional transfer taxes. The QI ensures a valid 1031 exchange by properly structuring the exchange per IRC 1031, preparing all necessary exchange documents, and monitoring the exchange to ensure continued compliance throughout the process. Failure to use a QI can result in missteps causing the disqualification of the exchange and the loss of tax deferral benefits.

Mistake #3: Not properly identifying replacement property

Investors must follow strict identification rules when selecting replacement properties in a 1031 exchange. They must identify potential replacement properties within 45 days of the sale of their relinquished property, and they must follow one of three identification rules: the Three-Property Rule, the 200% Rule, or the 95% Rule. (These rules are discussed in more detail here: [insert blog link]) Failure to properly identify replacement properties can result in the disqualification of the exchange.

Mistake #4: Mixing personal and business property

A 1031 exchange is only applicable to investment or business property. It cannot be used for personal property, such as a primary residence. Mixing personal and business property can result in the disqualification of the exchange, unless great care is exercised in structuring the exchange.

Mistake #5: Not consulting with a tax professional

The rules and regulations surrounding a 1031 exchange can be complex and confusing. It is important to consult with a tax professional who is familiar with the intricacies of the process to ensure that all requirements are met and mistakes are avoided. Failure to consult with a tax professional can result in costly errors and the loss of tax deferral benefits.

In conclusion, a 1031 exchange can be an effective way to defer taxes on investment properties. However, it is important to understand the rules and requirements of the process in order to avoid common mistakes that will result in the disqualification of the exchange. By working with a Qualified Intermediary and consulting with a tax professional, investors can ensure a successful 1031 exchange and maximize their tax deferral benefits.

Blog

-

Common Mistakes to Avoid in a 1031 Exchange

-

Common Mistakes to Avoid in a 1031 Exchange

A 1031 exchange is a powerful tool that can help investors defer taxes when they sell one investment property and buy another. However, there are some common mistakes that investors make during the process that can cost them time and money. In this article, we will discuss some of the most common mistakes to avoid in a 1031 exchange.

Mistake #1: Not understanding the 1031 Exchange timeline

The IRS has specific rules and timelines that must be followed in a 1031 exchange. Investors have 45 days from the sale of their relinquished property to identify potential replacement properties and 180 days to complete the purchase of one or more of those identified replacement properties. Failure to meet these deadlines will result in the disqualification of the 1031 exchange, meaning that the investor will be responsible for paying taxes on any capital gains realized from the sale of the relinquished property.

Mistake #2: Not using a 1031 Exchange Qualified Intermediary

A Qualified Intermediary (QI) is a third-party facilitator that through a series of assignments acts as the party to complete the exchange with the Exchanger. By virtue of these assignments, title to the Relinquished Party passes through the QI to the Buyer, and title to the Replacement Property passes through the QI to the Exchanger. Title does not actually vest in the QI, saving a legal step, and in many states, additional transfer taxes. The QI ensures a valid 1031 exchange by properly structuring the exchange per IRC 1031, preparing all necessary exchange documents, and monitoring the exchange to ensure continued compliance throughout the process. Failure to use a QI can result in missteps causing the disqualification of the exchange and the loss of tax deferral benefits.

Mistake #3: Not properly identifying replacement property

Investors must follow strict identification rules when selecting replacement properties in a 1031 exchange. They must identify potential replacement properties within 45 days of the sale of their relinquished property, and they must follow one of three identification rules: the Three-Property Rule, the 200% Rule, or the 95% Rule. (These rules are discussed in more detail here: [insert blog link]) Failure to properly identify replacement properties can result in the disqualification of the exchange.

Mistake #4: Mixing personal and business property

A 1031 exchange is only applicable to investment or business property. It cannot be used for personal property, such as a primary residence. Mixing personal and business property can result in the disqualification of the exchange, unless great care is exercised in structuring the exchange.

Mistake #5: Not consulting with a tax professional

The rules and regulations surrounding a 1031 exchange can be complex and confusing. It is important to consult with a tax professional who is familiar with the intricacies of the process to ensure that all requirements are met and mistakes are avoided. Failure to consult with a tax professional can result in costly errors and the loss of tax deferral benefits.

In conclusion, a 1031 exchange can be an effective way to defer taxes on investment properties. However, it is important to understand the rules and requirements of the process in order to avoid common mistakes that will result in the disqualification of the exchange. By working with a Qualified Intermediary and consulting with a tax professional, investors can ensure a successful 1031 exchange and maximize their tax deferral benefits. -

Accruit Accelerates Growth and Opportunities for Clients with Strategic Sale to Inspira Financial

DENVER, Co. – (May, 4, 2023) – On April 19, 2023, Accruit announced a successful acquisition by alternative asset investments, including real estate, making the company and its existing clients a great fit for Accruit’s real estate 1031 exchange services.

“As we looked at how to best serve our current clients and grow our business, finding a company with strategic, like-minded values and service, which we found in Inspira Financial, was the right move,” said Brent Abrahm, CEO and Founder of Accruit. “This acquisition isn’t about slowing down, it’s about accelerating our growth and opportunities, and extending our reach to over 5 million potential clients.”

As a 1031 exchange Qualified Intermediary and a technology solution provider, Accruit holds a unique position in the marketplace, making it an attractive extension of the solutions Inspira Financial currently offers clients. Accruit’s patented 1031 exchange workflow technology, Exchange Manager ProSM, streamlines the 1031 exchange process through embedded controls, automated notifications, custom exchange agreement and document creation, and digital execution via electronic signatures, making it simple and efficient.

“Being part of Inspira Financial allows Accruit to exponentially expand our footprint and provide exceptional service to more people looking to maximize their financial wellbeing,” said Steven Holtkamp, Managing Director, and CFO of Accruit.

About Accruit Holdings

Accruit Holdings boasts over 20 years in the 1031 exchange industry. Through our leading independent, national Qualified Intermediary, we provide 1031 exchange services across the U.S. and specialize in all types of exchanges from forward, reverse, and build-to-suit/improvement, to specialty “non-safe harbor” reverse exchanges. We revolutionize the industry through our patented 1031 exchange workflow software by offering both SaaS and back-office solutions to the real estate marketplace.

About Inspira Financial

Inspira Financial solves important business challenges through innovative financial wellness solutions that help people plan, save and invest. With clients holding more than $55 billion in assets under custody, we are committed to using our decades of expertise and strong partnership with the financial community to empower employers, advisors and institutions to help people achieve short-term and long-term financial security. Learn more about -

Accruit Accelerates Growth and Opportunities for Clients with Strategic Sale to Inspira Financial

DENVER, Co. – (May, 4, 2023) – On April 19, 2023, Accruit announced a successful acquisition by alternative asset investments, including real estate, making the company and its existing clients a great fit for Accruit’s real estate 1031 exchange services.

“As we looked at how to best serve our current clients and grow our business, finding a company with strategic, like-minded values and service, which we found in Inspira Financial, was the right move,” said Brent Abrahm, CEO and Founder of Accruit. “This acquisition isn’t about slowing down, it’s about accelerating our growth and opportunities, and extending our reach to over 5 million potential clients.”

As a 1031 exchange Qualified Intermediary and a technology solution provider, Accruit holds a unique position in the marketplace, making it an attractive extension of the solutions Inspira Financial currently offers clients. Accruit’s patented 1031 exchange workflow technology, Exchange Manager ProSM, streamlines the 1031 exchange process through embedded controls, automated notifications, custom exchange agreement and document creation, and digital execution via electronic signatures, making it simple and efficient.

“Being part of Inspira Financial allows Accruit to exponentially expand our footprint and provide exceptional service to more people looking to maximize their financial wellbeing,” said Steven Holtkamp, Managing Director, and CFO of Accruit.

About Accruit Holdings

Accruit Holdings boasts over 20 years in the 1031 exchange industry. Through our leading independent, national Qualified Intermediary, we provide 1031 exchange services across the U.S. and specialize in all types of exchanges from forward, reverse, and build-to-suit/improvement, to specialty “non-safe harbor” reverse exchanges. We revolutionize the industry through our patented 1031 exchange workflow software by offering both SaaS and back-office solutions to the real estate marketplace.

About Inspira Financial

Inspira Financial solves important business challenges through innovative financial wellness solutions that help people plan, save and invest. With clients holding more than $55 billion in assets under custody, we are committed to using our decades of expertise and strong partnership with the financial community to empower employers, advisors and institutions to help people achieve short-term and long-term financial security. Learn more about -

Accruit Accelerates Growth and Opportunities for Clients with Strategic Sale to Inspira Financial

DENVER, Co. – (May, 4, 2023) – On April 19, 2023, Accruit announced a successful acquisition by alternative asset investments, including real estate, making the company and its existing clients a great fit for Accruit’s real estate 1031 exchange services.

“As we looked at how to best serve our current clients and grow our business, finding a company with strategic, like-minded values and service, which we found in Inspira Financial, was the right move,” said Brent Abrahm, CEO and Founder of Accruit. “This acquisition isn’t about slowing down, it’s about accelerating our growth and opportunities, and extending our reach to over 5 million potential clients.”

As a 1031 exchange Qualified Intermediary and a technology solution provider, Accruit holds a unique position in the marketplace, making it an attractive extension of the solutions Inspira Financial currently offers clients. Accruit’s patented 1031 exchange workflow technology, Exchange Manager ProSM, streamlines the 1031 exchange process through embedded controls, automated notifications, custom exchange agreement and document creation, and digital execution via electronic signatures, making it simple and efficient.

“Being part of Inspira Financial allows Accruit to exponentially expand our footprint and provide exceptional service to more people looking to maximize their financial wellbeing,” said Steven Holtkamp, Managing Director, and CFO of Accruit.

About Accruit Holdings

Accruit Holdings boasts over 20 years in the 1031 exchange industry. Through our leading independent, national Qualified Intermediary, we provide 1031 exchange services across the U.S. and specialize in all types of exchanges from forward, reverse, and build-to-suit/improvement, to specialty “non-safe harbor” reverse exchanges. We revolutionize the industry through our patented 1031 exchange workflow software by offering both SaaS and back-office solutions to the real estate marketplace.

About Inspira Financial

Inspira Financial solves important business challenges through innovative financial wellness solutions that help people plan, save and invest. With clients holding more than $55 billion in assets under custody, we are committed to using our decades of expertise and strong partnership with the financial community to empower employers, advisors and institutions to help people achieve short-term and long-term financial security. Learn more about -

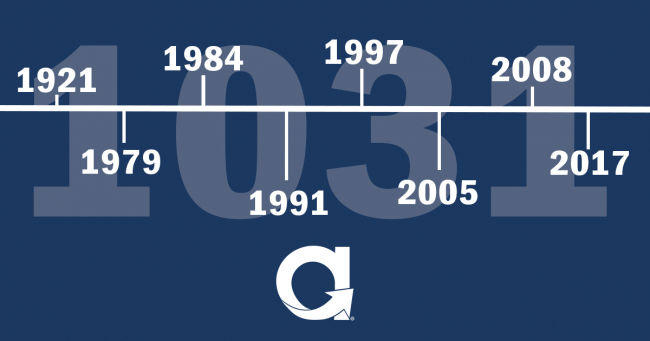

How the 1031 Exchange Process has Evolved Over Time

The 1031 Exchange has been a popular tax strategy for real estate investors for over a century, but its history and evolution are often overlooked. By understanding how this tax strategy has developed and changed over time, investors can make more informed decisions about their investments and take advantage of the benefits associated with a 1031 Exchange.

Originally established as part of the Revenue Act of 1921, 1031 Exchanges were designed to encourage investment and growth in the real estate market. The basic idea behind the exchanges was simple; by allowing investors to exchange one property for another without incurring capital gains, or other related taxes, the government could incentivize investors to keep their money in real estate and continue investing in new properties.

Over the years, the rules and regulations governing 1031 Exchanges have changed in response to new economic and political realities. For example, in 1979, the 9th US Circuit Court of Appeals approved “delayed exchanges” in the Starker case, which allowed investors to sell their property before acquiring a replacement property, therefore eliminated the requirement for a simultaneous exchange. The case involved not only the first non-simultaneously structured exchange but provided for a five-year time frame for Starker to receive his replacement property. In direct response to the open-ended period, in 1984, Congress codified the 45 and 180-day restrictions presented in Starker {Sec. 1031(a)(3)}, and prohibited exchanges of partnership interests {Sec. 1031(a)(2)(D)}. These narrower time frames provided a nexus between the sale and purchase.

In 1991, Section 1031 Regulations were issued, outlining four “Safe Harbors” including: how the exchange funds could be held so that the Taxpayer was not in constructive receipt; allowing funds to be put into a Trust or Escrow; the use of a Qualified Intermediary which took the place of the buyer in connection with the Taxpayers intent to exchange and; allowing the Taxpayer to earn interest on their funds, which previously was not allowed because that would be considered in “constructive receipt” of the funds.

In 1997, the Taxpayer Relief Act introduced a provision stating that domestic property and foreign property are not considered like-kind. This means that real estate investors could no longer exchange their domestic properties for foreign ones or vice versa using a 1031 exchange. However, the act did not change the rules around like-kind exchanges for properties within the United States. This clarification helped to ensure that investors could continue to use 1031 exchanges as a powerful tax strategy for domestic real estate investments. It also remained possible to exchange one foreign property for another foreign property.

In 2005, the IRS issued Revenue Procedure 2005-14, which provided guidance for combining Section 121 and Section 1031, which has implications for (a) rental property converted to primary residence, and (b) primary residence converted to rental property.

In 2008, the IRS issued Revenue Procedure 2008-16 which provided addition guidance and restrictions on vacation/second homes. The restrictions included the requirement that the Relinquished Property be held for investment for at least 24 months immediately preceding the exchange, and within each of the 12-months the property must have been rented out at fair market value for at least 14 days, and the owners personal use could not exceed 14 days or 10% of the total time the property was rented out. The same restrictions were put place for the Replacement Property.

More recently, the Tax Cuts and Jobs Act of 2017 made significant changes to the 1031 Exchange process, eliminating the ability to use 1031 Exchanges for personal property and limiting its use to real estate investments. The act also introduced new restrictions on the types of properties that could be exchanged, including stricter requirements for vacation homes and other non-primary residences.

Despite these changes, the core idea behind the 1031 exchange process remains the same, to incentivize real estate investment and promote growth in the real estate market. Whether you’re a seasoned investor or just getting started in the world of real estate, understanding the history and evolution of 1031 Exchanges is essential to making informed decisions about your investments and maximizing the benefits of this powerful tax strategy. -

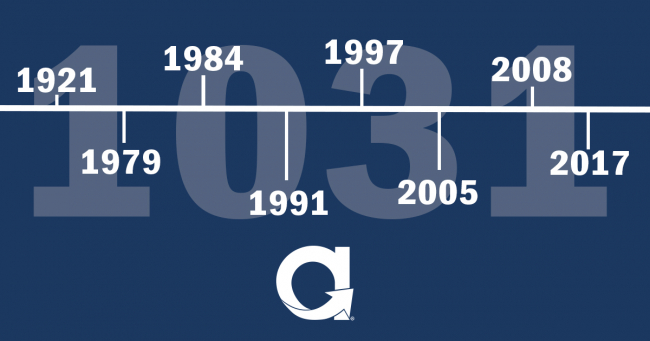

How the 1031 Exchange Process has Evolved Over Time

The 1031 Exchange has been a popular tax strategy for real estate investors for over a century, but its history and evolution are often overlooked. By understanding how this tax strategy has developed and changed over time, investors can make more informed decisions about their investments and take advantage of the benefits associated with a 1031 Exchange.

Originally established as part of the Revenue Act of 1921, 1031 Exchanges were designed to encourage investment and growth in the real estate market. The basic idea behind the exchanges was simple; by allowing investors to exchange one property for another without incurring capital gains, or other related taxes, the government could incentivize investors to keep their money in real estate and continue investing in new properties.

Over the years, the rules and regulations governing 1031 Exchanges have changed in response to new economic and political realities. For example, in 1979, the 9th US Circuit Court of Appeals approved “delayed exchanges” in the Starker case, which allowed investors to sell their property before acquiring a replacement property, therefore eliminated the requirement for a simultaneous exchange. The case involved not only the first non-simultaneously structured exchange but provided for a five-year time frame for Starker to receive his replacement property. In direct response to the open-ended period, in 1984, Congress codified the 45 and 180-day restrictions presented in Starker {Sec. 1031(a)(3)}, and prohibited exchanges of partnership interests {Sec. 1031(a)(2)(D)}. These narrower time frames provided a nexus between the sale and purchase.

In 1991, Section 1031 Regulations were issued, outlining four “Safe Harbors” including: how the exchange funds could be held so that the Taxpayer was not in constructive receipt; allowing funds to be put into a Trust or Escrow; the use of a Qualified Intermediary which took the place of the buyer in connection with the Taxpayers intent to exchange and; allowing the Taxpayer to earn interest on their funds, which previously was not allowed because that would be considered in “constructive receipt” of the funds.

In 1997, the Taxpayer Relief Act introduced a provision stating that domestic property and foreign property are not considered like-kind. This means that real estate investors could no longer exchange their domestic properties for foreign ones or vice versa using a 1031 exchange. However, the act did not change the rules around like-kind exchanges for properties within the United States. This clarification helped to ensure that investors could continue to use 1031 exchanges as a powerful tax strategy for domestic real estate investments. It also remained possible to exchange one foreign property for another foreign property.

In 2005, the IRS issued Revenue Procedure 2005-14, which provided guidance for combining Section 121 and Section 1031, which has implications for (a) rental property converted to primary residence, and (b) primary residence converted to rental property.

In 2008, the IRS issued Revenue Procedure 2008-16 which provided addition guidance and restrictions on vacation/second homes. The restrictions included the requirement that the Relinquished Property be held for investment for at least 24 months immediately preceding the exchange, and within each of the 12-months the property must have been rented out at fair market value for at least 14 days, and the owners personal use could not exceed 14 days or 10% of the total time the property was rented out. The same restrictions were put place for the Replacement Property.

More recently, the Tax Cuts and Jobs Act of 2017 made significant changes to the 1031 Exchange process, eliminating the ability to use 1031 Exchanges for personal property and limiting its use to real estate investments. The act also introduced new restrictions on the types of properties that could be exchanged, including stricter requirements for vacation homes and other non-primary residences.

Despite these changes, the core idea behind the 1031 exchange process remains the same, to incentivize real estate investment and promote growth in the real estate market. Whether you’re a seasoned investor or just getting started in the world of real estate, understanding the history and evolution of 1031 Exchanges is essential to making informed decisions about your investments and maximizing the benefits of this powerful tax strategy. -

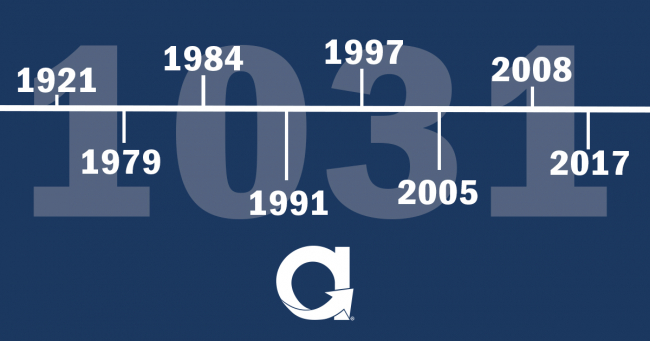

How the 1031 Exchange Process has Evolved Over Time

The 1031 Exchange has been a popular tax strategy for real estate investors for over a century, but its history and evolution are often overlooked. By understanding how this tax strategy has developed and changed over time, investors can make more informed decisions about their investments and take advantage of the benefits associated with a 1031 Exchange.

Originally established as part of the Revenue Act of 1921, 1031 Exchanges were designed to encourage investment and growth in the real estate market. The basic idea behind the exchanges was simple; by allowing investors to exchange one property for another without incurring capital gains, or other related taxes, the government could incentivize investors to keep their money in real estate and continue investing in new properties.

Over the years, the rules and regulations governing 1031 Exchanges have changed in response to new economic and political realities. For example, in 1979, the 9th US Circuit Court of Appeals approved “delayed exchanges” in the Starker case, which allowed investors to sell their property before acquiring a replacement property, therefore eliminated the requirement for a simultaneous exchange. The case involved not only the first non-simultaneously structured exchange but provided for a five-year time frame for Starker to receive his replacement property. In direct response to the open-ended period, in 1984, Congress codified the 45 and 180-day restrictions presented in Starker {Sec. 1031(a)(3)}, and prohibited exchanges of partnership interests {Sec. 1031(a)(2)(D)}. These narrower time frames provided a nexus between the sale and purchase.

In 1991, Section 1031 Regulations were issued, outlining four “Safe Harbors” including: how the exchange funds could be held so that the Taxpayer was not in constructive receipt; allowing funds to be put into a Trust or Escrow; the use of a Qualified Intermediary which took the place of the buyer in connection with the Taxpayers intent to exchange and; allowing the Taxpayer to earn interest on their funds, which previously was not allowed because that would be considered in “constructive receipt” of the funds.

In 1997, the Taxpayer Relief Act introduced a provision stating that domestic property and foreign property are not considered like-kind. This means that real estate investors could no longer exchange their domestic properties for foreign ones or vice versa using a 1031 exchange. However, the act did not change the rules around like-kind exchanges for properties within the United States. This clarification helped to ensure that investors could continue to use 1031 exchanges as a powerful tax strategy for domestic real estate investments. It also remained possible to exchange one foreign property for another foreign property.

In 2005, the IRS issued Revenue Procedure 2005-14, which provided guidance for combining Section 121 and Section 1031, which has implications for (a) rental property converted to primary residence, and (b) primary residence converted to rental property.

In 2008, the IRS issued Revenue Procedure 2008-16 which provided addition guidance and restrictions on vacation/second homes. The restrictions included the requirement that the Relinquished Property be held for investment for at least 24 months immediately preceding the exchange, and within each of the 12-months the property must have been rented out at fair market value for at least 14 days, and the owners personal use could not exceed 14 days or 10% of the total time the property was rented out. The same restrictions were put place for the Replacement Property.

More recently, the Tax Cuts and Jobs Act of 2017 made significant changes to the 1031 Exchange process, eliminating the ability to use 1031 Exchanges for personal property and limiting its use to real estate investments. The act also introduced new restrictions on the types of properties that could be exchanged, including stricter requirements for vacation homes and other non-primary residences.

Despite these changes, the core idea behind the 1031 exchange process remains the same, to incentivize real estate investment and promote growth in the real estate market. Whether you’re a seasoned investor or just getting started in the world of real estate, understanding the history and evolution of 1031 Exchanges is essential to making informed decisions about your investments and maximizing the benefits of this powerful tax strategy. -

FAQs on the Same Taxpayer Requirement in a 1031 Exchange

The Same Taxpayer Requirement is simple in practice when you are dealing with individuals, i.e. John Smith holds title to the Relinquished Property and therefore John Smith must hold title to the acquired Replacement Property as John Smith. The “Same Taxpayer” requirement is less obvious when different types of entities are involved in the 1031 Exchange, such as multi-member LLCs, S-Corps, etc.

Below are answers to some commonly asked questions regarding the “Same Taxpayer” requirement.

Q: For a husband and wife owned property, if they own property as Tenants-in-Common (TIC) can they take title to the replacement property in just one of their names?

A: Not unless the spouses live in a community property state where title in just one would still be considered owned by both. In all other situations they should take title in both names.

Q: If a husband sells an investment property under his name, can he put the title of the Replacement Property in both his and his wife’s name?

A: This is not advisable since it does not meet the Same Taxpayer requirement. However, in a few years when the exchange is “old and cold” it would be acceptable to add the spouse. Q: If 123 Main LLC sells Relinquished Property through a 1031 exchange and 123 Main LLC buys the Replacement Property, but 2 years later they quitclaim it to 456 New LLC (same members) – is there a problem with IRS? A: Two separate LLCs, even with the same members, are not considered the Same Taxpayer. But generally, changes in the ownership structure are possible after a period of two years or more. This is not codified but rather the general belief of commentators.

Q: If the single member LLC has filed an election at their outset to be taxed as an S-Corp, does that S-Corp election defeat the disregarded entity flexibility so that the owner of the LLC now cannot acquire the Replacement Property in their individual name? Meaning, does that disregarded entity that elected to be taxed as an S-Corp now HAVE to acquire the Replacement Property in the name of their LLC instead of their individual name?

A: Yes, as to the first question. Generally, holding real estate investments in corporations, including S-Corps, can cause unexpected issues when trying to change the entity and are not considered the best way to hold real estate. An LLC does not cause any such issues. As to the second question, yes. Keep in mind that S-Corp is not disregarded, rather its tax reporting can be done on the shareholder’s personal return. So, any replacement property would have to be owned by S-Corp, either directly or as the single member of a new LLC.

Q: Can a single member LLC sell the Relinquished Property and a different single member LLC acquire Replacement Property if the member is the same on both LLCs?

A: That is a good question and one that comes up constantly. The answer is yes, since the single member LLCs are tax disregarded, you would look at the member to determine if the Same Taxpayer requirement is met. This is very common when a taxpayer is selling a property held by one LLC but would prefer eliminating potential claims and matters that would remain should the replacement property be put back into the original LLC. A fresh LLC would prevent that.

Q: Can a Same Taxpayer add a third party to the acquired Replacement Property, as long as all of the Relinquished Property proceeds end up being used?

A: Yes and no, it depends upon the structure. If the taxpayer alone owns the relinquished property, a new two person partnership or LLC would not result in maintaining the same taxpayer. However, if the two parties held the ownership as tenants in common, that would be fine. Keep in mind that a tenancy in common in an exchange context should consider a TIC Agreement per Rev. Proc. 2002-22. Also remember that the Same Taxpayer must exchange equal or up in equity and value, so the price of this new property would need to be substantially higher.

Q: What other different title holding options would continue to constitute the same taxpayer to a person holding title individually?

A: Any tax disregarded entity. This would include such things as a new single member LLC, Revocable Living Trust, Illinois Land Trust, Tenant-in-Common, or as a beneficiary of a Delaware Statutory Trust (DST).

Read our additional blog, The Same Taxpayer Requirement in a 1031 Exchange, for a more detailed explanation on the requirements and for specific examples of way to hold title, etc. -

FAQs on the Same Taxpayer Requirement in a 1031 Exchange

The Same Taxpayer Requirement is simple in practice when you are dealing with individuals, i.e. John Smith holds title to the Relinquished Property and therefore John Smith must hold title to the acquired Replacement Property as John Smith. The “Same Taxpayer” requirement is less obvious when different types of entities are involved in the 1031 Exchange, such as multi-member LLCs, S-Corps, etc.

Below are answers to some commonly asked questions regarding the “Same Taxpayer” requirement.

Q: For a husband and wife owned property, if they own property as Tenants-in-Common (TIC) can they take title to the replacement property in just one of their names?

A: Not unless the spouses live in a community property state where title in just one would still be considered owned by both. In all other situations they should take title in both names.

Q: If a husband sells an investment property under his name, can he put the title of the Replacement Property in both his and his wife’s name?

A: This is not advisable since it does not meet the Same Taxpayer requirement. However, in a few years when the exchange is “old and cold” it would be acceptable to add the spouse. Q: If 123 Main LLC sells Relinquished Property through a 1031 exchange and 123 Main LLC buys the Replacement Property, but 2 years later they quitclaim it to 456 New LLC (same members) – is there a problem with IRS? A: Two separate LLCs, even with the same members, are not considered the Same Taxpayer. But generally, changes in the ownership structure are possible after a period of two years or more. This is not codified but rather the general belief of commentators.

Q: If the single member LLC has filed an election at their outset to be taxed as an S-Corp, does that S-Corp election defeat the disregarded entity flexibility so that the owner of the LLC now cannot acquire the Replacement Property in their individual name? Meaning, does that disregarded entity that elected to be taxed as an S-Corp now HAVE to acquire the Replacement Property in the name of their LLC instead of their individual name?

A: Yes, as to the first question. Generally, holding real estate investments in corporations, including S-Corps, can cause unexpected issues when trying to change the entity and are not considered the best way to hold real estate. An LLC does not cause any such issues. As to the second question, yes. Keep in mind that S-Corp is not disregarded, rather its tax reporting can be done on the shareholder’s personal return. So, any replacement property would have to be owned by S-Corp, either directly or as the single member of a new LLC.

Q: Can a single member LLC sell the Relinquished Property and a different single member LLC acquire Replacement Property if the member is the same on both LLCs?

A: That is a good question and one that comes up constantly. The answer is yes, since the single member LLCs are tax disregarded, you would look at the member to determine if the Same Taxpayer requirement is met. This is very common when a taxpayer is selling a property held by one LLC but would prefer eliminating potential claims and matters that would remain should the replacement property be put back into the original LLC. A fresh LLC would prevent that.

Q: Can a Same Taxpayer add a third party to the acquired Replacement Property, as long as all of the Relinquished Property proceeds end up being used?

A: Yes and no, it depends upon the structure. If the taxpayer alone owns the relinquished property, a new two person partnership or LLC would not result in maintaining the same taxpayer. However, if the two parties held the ownership as tenants in common, that would be fine. Keep in mind that a tenancy in common in an exchange context should consider a TIC Agreement per Rev. Proc. 2002-22. Also remember that the Same Taxpayer must exchange equal or up in equity and value, so the price of this new property would need to be substantially higher.

Q: What other different title holding options would continue to constitute the same taxpayer to a person holding title individually?

A: Any tax disregarded entity. This would include such things as a new single member LLC, Revocable Living Trust, Illinois Land Trust, Tenant-in-Common, or as a beneficiary of a Delaware Statutory Trust (DST).

Read our additional blog, The Same Taxpayer Requirement in a 1031 Exchange, for a more detailed explanation on the requirements and for specific examples of way to hold title, etc.