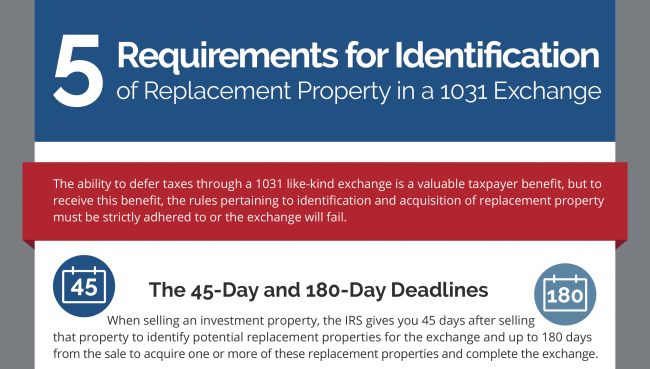

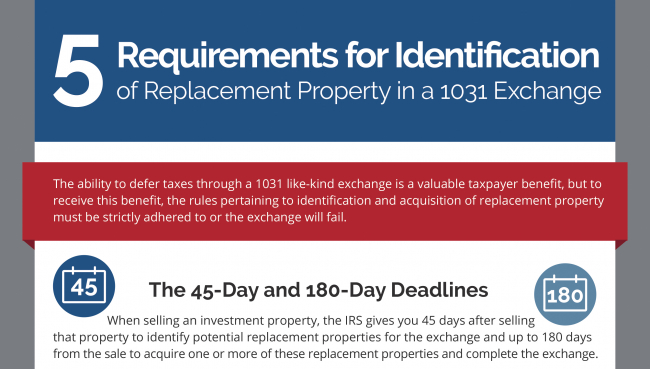

The ability to defer taxes through a 1031 like-kind exchange is a valuable taxpayer benefit, but to receive this benefit, the rules pertaining to identification and acquisition of replacement property must be strictly adhered to or the exchange will fail.

This infographic describes the deadlines and rules for identification of 1031 replacement property:

· The 45-day and 180-day deadlines

· The 3-property rule

· The 200% rule

· The 95% rule

View the full infographic or click the image below.

Blog

-

Infographic: Requirements for Identification of Replacement Property in a 1031 Exchange

-

Infographic: Requirements for Identification of Replacement Property in a 1031 Exchange

The ability to defer taxes through a 1031 like-kind exchange is a valuable taxpayer benefit, but to receive this benefit, the rules pertaining to identification and acquisition of replacement property must be strictly adhered to or the exchange will fail.

This infographic describes the deadlines and rules for identification of 1031 replacement property:

· The 45-day and 180-day deadlines

· The 3-property rule

· The 200% rule

· The 95% rule

View the full infographic or click the image below.

-

How to Calculate Your Potential Tax Benefits with a 1031 Exchange

If you are selling an investment or business use property, you should consider a 1031 exchange. Generally speaking, a 1031 exchange allows you to defer capital gains tax at the federal and state level, depreciation recapture tax, and net investment income tax when you sell an investment or business use real estate and reinvest those proceeds into another business or investment use property. If that isn’t compelling enough, wait until you see your potential benefits by calculating your various tax totals and deferral potential.

How to Calculate Capital Gains Tax

Many people ask, how is Capital Gains Calculated, the Capital Gains Tax Calculation is as follows: Sales Price – the TOTAL of Original purchase price (cost basis) + improvements to the property + selling expenses = Total Capital Gains

Federal Capital Gains Tax = Total Capital Gains multiplied either 15% or 20% depending on your annual household Income. Currently for persons married filing jointly the 20% rate would begin on income of $517,001. Remember the sale of the property itself is considered part of the income.

State Capital Gains Tax = Total Capital Gains multiplied by your State Capital Gain Tax Rate which varies by state. -

How to Calculate Your Potential Tax Benefits with a 1031 Exchange

If you are selling an investment or business use property, you should consider a 1031 exchange. Generally speaking, a 1031 exchange allows you to defer capital gains tax at the federal and state level, depreciation recapture tax, and net investment income tax when you sell an investment or business use real estate and reinvest those proceeds into another business or investment use property. If that isn’t compelling enough, wait until you see your potential benefits by calculating your various tax totals and deferral potential.

How to Calculate Capital Gains Tax

Many people ask, how is Capital Gains Calculated, the Capital Gains Tax Calculation is as follows: Sales Price – the TOTAL of Original purchase price (cost basis) + improvements to the property + selling expenses = Total Capital Gains

Federal Capital Gains Tax = Total Capital Gains multiplied either 15% or 20% depending on your annual household Income. Currently for persons married filing jointly the 20% rate would begin on income of $517,001. Remember the sale of the property itself is considered part of the income.

State Capital Gains Tax = Total Capital Gains multiplied by your State Capital Gain Tax Rate which varies by state. -

How to Calculate Your Potential Tax Benefits with a 1031 Exchange

If you are selling an investment or business use property, you should consider a 1031 exchange. Generally speaking, a 1031 exchange allows you to defer capital gains tax at the federal and state level, depreciation recapture tax, and net investment income tax when you sell an investment or business use real estate and reinvest those proceeds into another business or investment use property. If that isn’t compelling enough, wait until you see your potential benefits by calculating your various tax totals and deferral potential.

How to Calculate Capital Gains Tax

Many people ask, how is Capital Gains Calculated, the Capital Gains Tax Calculation is as follows: Sales Price – the TOTAL of Original purchase price (cost basis) + improvements to the property + selling expenses = Total Capital Gains

Federal Capital Gains Tax = Total Capital Gains multiplied either 15% or 20% depending on your annual household Income. Currently for persons married filing jointly the 20% rate would begin on income of $517,001. Remember the sale of the property itself is considered part of the income.

State Capital Gains Tax = Total Capital Gains multiplied by your State Capital Gain Tax Rate which varies by state. -

Case Study: A Property Improvement Exchange of Real Estate

The Facts

On August 1, 2014, we received a call from the exchange department of a national banking association. She had a client for whom she was facilitating a conventional exchange of real estate. The exchange account had been opened on July 21, 2014, and the net proceeds from the sale of the relinquished property located in Bellmore, New York were $1,075,000. The client intended to acquire a replacement property in Massapequa, New York for $640,000. If nothing further was done the client would be trading substantially down in value and would be realizing little or no tax deferral from the exchange. Since the replacement property required significant improvements, we suggested to the client that a build-to-suit, or improvement exchange, may be advantageous, as it would potentially allow her client to defer some, if not all, of the gain that would otherwise be recognized.

The Problem

Under IRS rules, once a taxpayer takes legal ownership of the replacement property any additional expenditures used to make improvements to the property do not count towards its value in the exchange. Real estate exchanges have to involve disposing of and acquiring “like-kind” real estate. When a taxpayer sells relinquished real estate and acquires replacement real estate, any improvements made thereafter are considered payment for labor and materials. Labor and materials are not like-kind to the sale of real estate. Unable to include the cost of improvements to the replacement property, many taxpayers are unable to make exchanges for property of equal or greater value.

The Solution

The IRS issued Revenue Procedure 2000-37 in part to accommodate the need for inclusion of improvement costs in the value of replacement property. Under the Revenue Procedure, an independent third party may take title to the replacement property in the taxpayer’s stead and make the desired improvements on the taxpayer’s behalf. Build-to-suit exchanges refer to exchanges in which improvements are made on a vacant parcel of property, whereas property improvement exchanges refer to exchanges in which improvements are made to an existing structure on a parcel of real estate. The procedures for facilitating a build-to-suit and property improvement exchanges are identical.

When the exchange company services a routine exchange, it acts as a qualified intermediary or QI. When an exchange company services a property improvement, or build-to-suit exchange, it is acting as an exchange accommodation titleholder or EAT. The EAT takes title to the new property and parks, or holds, that title until the earliest of the following:180 days from when the relinquished property is sold

The improvements are completed

180 days from when the replacement property was parked by the EATThe client entered into a property improvement exchange with an EAT and directed the QI to send funds periodically to the EAT, which were used to purchase the Massapequa property and to improve it according to the client’s instructions. Before any payments were made to any party, written confirmation by the client was obtained to make sure he was satisfied regarding the particular piece of work. When the balances held by the EAT declined, instructions were given to the QI to send more funds to the EAT.

Over the course of the transaction more than ten persons and companies were paid by the EAT for services related to the improvements. By the time 180 days had elapsed from the sale of the relinquished property, most of the improvements were completed. The client had $39,000 left in the forward exchange account and only that sum was subject to capital gains taxes. This allowed this taxpayer to defer taxes on the $396,000 used for the improvements.

The Result

The client’s old property had a zero basis. Had the client only purchased the replacement property for $640,000, he would have faced taxes on the remaining amount of $435,000. At an approximate rate of 40%, this would have cost him $174,000. By completing a property improvement exchange, he was able to improve the replacement property while deferring most of the tax that would otherwise be payable.

Updated 5/17/2022. -

Case Study: A Property Improvement Exchange of Real Estate

The Facts

On August 1, 2014, we received a call from the exchange department of a national banking association. She had a client for whom she was facilitating a conventional exchange of real estate. The exchange account had been opened on July 21, 2014, and the net proceeds from the sale of the relinquished property located in Bellmore, New York were $1,075,000. The client intended to acquire a replacement property in Massapequa, New York for $640,000. If nothing further was done the client would be trading substantially down in value and would be realizing little or no tax deferral from the exchange. Since the replacement property required significant improvements, we suggested to the client that a build-to-suit, or improvement exchange, may be advantageous, as it would potentially allow her client to defer some, if not all, of the gain that would otherwise be recognized.

The Problem

Under IRS rules, once a taxpayer takes legal ownership of the replacement property any additional expenditures used to make improvements to the property do not count towards its value in the exchange. Real estate exchanges have to involve disposing of and acquiring “like-kind” real estate. When a taxpayer sells relinquished real estate and acquires replacement real estate, any improvements made thereafter are considered payment for labor and materials. Labor and materials are not like-kind to the sale of real estate. Unable to include the cost of improvements to the replacement property, many taxpayers are unable to make exchanges for property of equal or greater value.

The Solution

The IRS issued Revenue Procedure 2000-37 in part to accommodate the need for inclusion of improvement costs in the value of replacement property. Under the Revenue Procedure, an independent third party may take title to the replacement property in the taxpayer’s stead and make the desired improvements on the taxpayer’s behalf. Build-to-suit exchanges refer to exchanges in which improvements are made on a vacant parcel of property, whereas property improvement exchanges refer to exchanges in which improvements are made to an existing structure on a parcel of real estate. The procedures for facilitating a build-to-suit and property improvement exchanges are identical.

When the exchange company services a routine exchange, it acts as a qualified intermediary or QI. When an exchange company services a property improvement, or build-to-suit exchange, it is acting as an exchange accommodation titleholder or EAT. The EAT takes title to the new property and parks, or holds, that title until the earliest of the following:180 days from when the relinquished property is sold

The improvements are completed

180 days from when the replacement property was parked by the EATThe client entered into a property improvement exchange with an EAT and directed the QI to send funds periodically to the EAT, which were used to purchase the Massapequa property and to improve it according to the client’s instructions. Before any payments were made to any party, written confirmation by the client was obtained to make sure he was satisfied regarding the particular piece of work. When the balances held by the EAT declined, instructions were given to the QI to send more funds to the EAT.

Over the course of the transaction more than ten persons and companies were paid by the EAT for services related to the improvements. By the time 180 days had elapsed from the sale of the relinquished property, most of the improvements were completed. The client had $39,000 left in the forward exchange account and only that sum was subject to capital gains taxes. This allowed this taxpayer to defer taxes on the $396,000 used for the improvements.

The Result

The client’s old property had a zero basis. Had the client only purchased the replacement property for $640,000, he would have faced taxes on the remaining amount of $435,000. At an approximate rate of 40%, this would have cost him $174,000. By completing a property improvement exchange, he was able to improve the replacement property while deferring most of the tax that would otherwise be payable.

Updated 5/17/2022. -

Case Study: A Property Improvement Exchange of Real Estate

The Facts

On August 1, 2014, we received a call from the exchange department of a national banking association. She had a client for whom she was facilitating a conventional exchange of real estate. The exchange account had been opened on July 21, 2014, and the net proceeds from the sale of the relinquished property located in Bellmore, New York were $1,075,000. The client intended to acquire a replacement property in Massapequa, New York for $640,000. If nothing further was done the client would be trading substantially down in value and would be realizing little or no tax deferral from the exchange. Since the replacement property required significant improvements, we suggested to the client that a build-to-suit, or improvement exchange, may be advantageous, as it would potentially allow her client to defer some, if not all, of the gain that would otherwise be recognized.

The Problem

Under IRS rules, once a taxpayer takes legal ownership of the replacement property any additional expenditures used to make improvements to the property do not count towards its value in the exchange. Real estate exchanges have to involve disposing of and acquiring “like-kind” real estate. When a taxpayer sells relinquished real estate and acquires replacement real estate, any improvements made thereafter are considered payment for labor and materials. Labor and materials are not like-kind to the sale of real estate. Unable to include the cost of improvements to the replacement property, many taxpayers are unable to make exchanges for property of equal or greater value.

The Solution

The IRS issued Revenue Procedure 2000-37 in part to accommodate the need for inclusion of improvement costs in the value of replacement property. Under the Revenue Procedure, an independent third party may take title to the replacement property in the taxpayer’s stead and make the desired improvements on the taxpayer’s behalf. Build-to-suit exchanges refer to exchanges in which improvements are made on a vacant parcel of property, whereas property improvement exchanges refer to exchanges in which improvements are made to an existing structure on a parcel of real estate. The procedures for facilitating a build-to-suit and property improvement exchanges are identical.

When the exchange company services a routine exchange, it acts as a qualified intermediary or QI. When an exchange company services a property improvement, or build-to-suit exchange, it is acting as an exchange accommodation titleholder or EAT. The EAT takes title to the new property and parks, or holds, that title until the earliest of the following:180 days from when the relinquished property is sold

The improvements are completed

180 days from when the replacement property was parked by the EATThe client entered into a property improvement exchange with an EAT and directed the QI to send funds periodically to the EAT, which were used to purchase the Massapequa property and to improve it according to the client’s instructions. Before any payments were made to any party, written confirmation by the client was obtained to make sure he was satisfied regarding the particular piece of work. When the balances held by the EAT declined, instructions were given to the QI to send more funds to the EAT.

Over the course of the transaction more than ten persons and companies were paid by the EAT for services related to the improvements. By the time 180 days had elapsed from the sale of the relinquished property, most of the improvements were completed. The client had $39,000 left in the forward exchange account and only that sum was subject to capital gains taxes. This allowed this taxpayer to defer taxes on the $396,000 used for the improvements.

The Result

The client’s old property had a zero basis. Had the client only purchased the replacement property for $640,000, he would have faced taxes on the remaining amount of $435,000. At an approximate rate of 40%, this would have cost him $174,000. By completing a property improvement exchange, he was able to improve the replacement property while deferring most of the tax that would otherwise be payable.

Updated 5/17/2022. -

Leading Qualified Intermediary, Accruit, Grows Their Footprint with New Hires in Montana and Florida

DENVER, CO, May 12, 2022 – Accruit, recently welcomed Jonathan Barge, J.D. to their team of staff attorneys. Jonathan joins Accruit after nearly 20 years in public service in the United States Air Force and as a law enforcement officer for the Bozeman, Montana Police Department. Additionally, Accruit welcomed Brad Dugger, a licensed REALTOR®, with over 10 years’ experience in the Real Estate Industry to the internal sales team, after his most recent role as Lead National Agent Development Trainer at Realogy Title Group.

Jonathan is an active member of the Montana State Bar Association, his legal experience, client-focused practice, and background in public service makes him a valuable addition to the Accruit team of staff attorneys. “What an opportunity,” said Barge. “This position allows me to work side-by-side Accruit’s renowned subject matter expert and Managing Director, Max Hansen. I’m already seeing tangible results in applying this in-house training to advise Accruit clientele and their fiduciaries on both complex and straightforward exchange transactions. I’m very excited to develop in this new role and grow Accruit’s presence in the Northwest Rocky Mountain region.”

Brad has an extensive background throughout the Real Estate Industry. From being a licensed REALTOR® to developing and instructing industry leading Continued Education (CE) courses to thousands of agents nationwide, including topics such as 1031 exchanges. Brad’s vast knowledge will be a great addition to business development at Accruit. “I cannot wait to hit the ground running. I look forward to utilizing the relationships I have within the real estate industry both in Florida and the greater United States to help investors defer capital gains and other taxes on their investment properties,” stated Brad.

“We couldn’t be more excited to grow our footprint in Montana, and the Rocky Mountain Region as a whole, as well as within Florida and other Southern states with the addition of both Jonathan and Brad,” stated Steve Holtkamp, Executive Vice President of Accruit.

About Accruit

Accruit is a leading independent, national Qualified Intermediary with over 20 years in the 1031 exchange industry, providing 1031 exchange service across all 50 states and specializing in all types of exchanges from forward, reverse, built-to-suit/improvement to non-safe harbor exchanges. Through its’ patented, 1031 exchange workflow technology, Exchange Manager ProSM, Accruit is proud to offer clients best in class customer service -

Leading Qualified Intermediary, Accruit, Grows Their Footprint with New Hires in Montana and Florida

DENVER, CO, May 12, 2022 – Accruit, recently welcomed Jonathan Barge, J.D. to their team of staff attorneys. Jonathan joins Accruit after nearly 20 years in public service in the United States Air Force and as a law enforcement officer for the Bozeman, Montana Police Department. Additionally, Accruit welcomed Brad Dugger, a licensed REALTOR®, with over 10 years’ experience in the Real Estate Industry to the internal sales team, after his most recent role as Lead National Agent Development Trainer at Realogy Title Group.

Jonathan is an active member of the Montana State Bar Association, his legal experience, client-focused practice, and background in public service makes him a valuable addition to the Accruit team of staff attorneys. “What an opportunity,” said Barge. “This position allows me to work side-by-side Accruit’s renowned subject matter expert and Managing Director, Max Hansen. I’m already seeing tangible results in applying this in-house training to advise Accruit clientele and their fiduciaries on both complex and straightforward exchange transactions. I’m very excited to develop in this new role and grow Accruit’s presence in the Northwest Rocky Mountain region.”

Brad has an extensive background throughout the Real Estate Industry. From being a licensed REALTOR® to developing and instructing industry leading Continued Education (CE) courses to thousands of agents nationwide, including topics such as 1031 exchanges. Brad’s vast knowledge will be a great addition to business development at Accruit. “I cannot wait to hit the ground running. I look forward to utilizing the relationships I have within the real estate industry both in Florida and the greater United States to help investors defer capital gains and other taxes on their investment properties,” stated Brad.

“We couldn’t be more excited to grow our footprint in Montana, and the Rocky Mountain Region as a whole, as well as within Florida and other Southern states with the addition of both Jonathan and Brad,” stated Steve Holtkamp, Executive Vice President of Accruit.

About Accruit

Accruit is a leading independent, national Qualified Intermediary with over 20 years in the 1031 exchange industry, providing 1031 exchange service across all 50 states and specializing in all types of exchanges from forward, reverse, built-to-suit/improvement to non-safe harbor exchanges. Through its’ patented, 1031 exchange workflow technology, Exchange Manager ProSM, Accruit is proud to offer clients best in class customer service